Economy

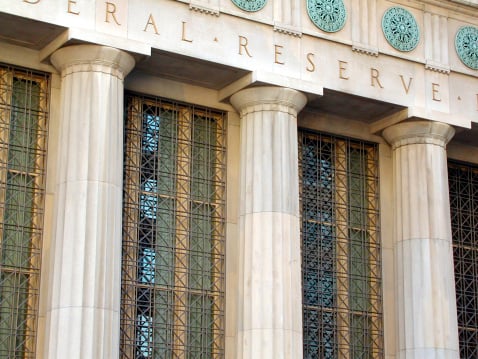

Should the Fed Add Financial Stability to Its Mandates?

Published:

Last Updated:

Minneapolis Fed President Narayana Kocherlakota said Friday in a speech in Boston that whatever the benefits of a third mandate, it “would have substantial costs in terms of adding to policy and economic uncertainty.”

Kocherlakota believes that a mandate of any sort is likely to cause “public uncertainty about the course of policy and the economy” unless it passes three tests:

ALSO READ: The Best and Worst Economies in the World

Regarding the Fed’s mandate to maintain price stability, the FOMC has both set a quantitative object — an inflation rate target of 2% — and outlined that the objective is symmetrical. Kocherlakota said, however, there is no specified time frame for meeting the 2% target:

In my view, the FOMC should consider articulating a benchmark two-year time horizon for returning inflation to the 2 percent goal. Two years is a good choice for a benchmark because monetary policy is generally thought to affect inflation with about a two-year lag.

The Fed’s second mandate (maximum employment) is more difficult quantify and, therefore, carries with it greater uncertainty. Unlike inflation, which is symmetric and can vary a little higher or a little lower than the 2% target, Kocherlakota says, “My interpretation of the employment mandate is that the FOMC should not seek to choke off the creation of jobs in the absence of any inflationary threat.” He then goes on:

[T]he FOMC has not formulated a time horizon for the employment mandate. To summarize, the FOMC has attempted to address the challenging problem of translating the employment mandate into a long-run quantifiable objective. However, it remains ambiguous whether the FOMC views positive and negative deviations from this objective symmetrically. I see this ambiguity about symmetry as being a potentially important source of policy uncertainty, especially in the current environment.

Kocherlakota is “skeptical” of being able to create a mandate for financial stability:

It would be hard to formulate a quantitative metric of long-run financial stability. It would be hard for policymakers to know how to treat deviations from that metric. Finally, the lags associated with the influence of monetary policy on this metric are highly uncertain. These challenges mean that adding a financial stability mandate would likely generate more public uncertainty about policy choices and economic outcomes. In considering whether to add a third mandate, these potentially large costs would have to be weighed against whatever benefits might be identified.

ALSO READ: Cities With the Fastest Growing (and Shrinking) Economies

Earlier Friday morning, Boston Fed President Eric Rosengren, who co-authored a new paper that argues in favor of a financial stability mandate and suggests that Congress may want to add financial stability as an explicit goal of Fed monetary policy, said, “There are reasons to believe that financial stability should be an explicit consideration of monetary policymakers.”

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.