On Wednesday morning, analysts at Merrill Lynch raised some significant questions about Boeing Co.’s (NYSE: BA) cash flow generation. Noting that the company has assumed that the 787 program will generate $29 billion in cash by the first quarter of 2022, Merrill Lynch’s analysts forecast that cash flow from the 787 by that date will reach just $14 billion, less than half Boeing’s forecast.

For years Boeing has encouraged analysts and investors to judge the company’s financial performance on operating cash flow. Since 2011, Boeing’s cash flow from operations has risen from $4.02 billion to $9.36 billion in 2015, a jump of 133%.

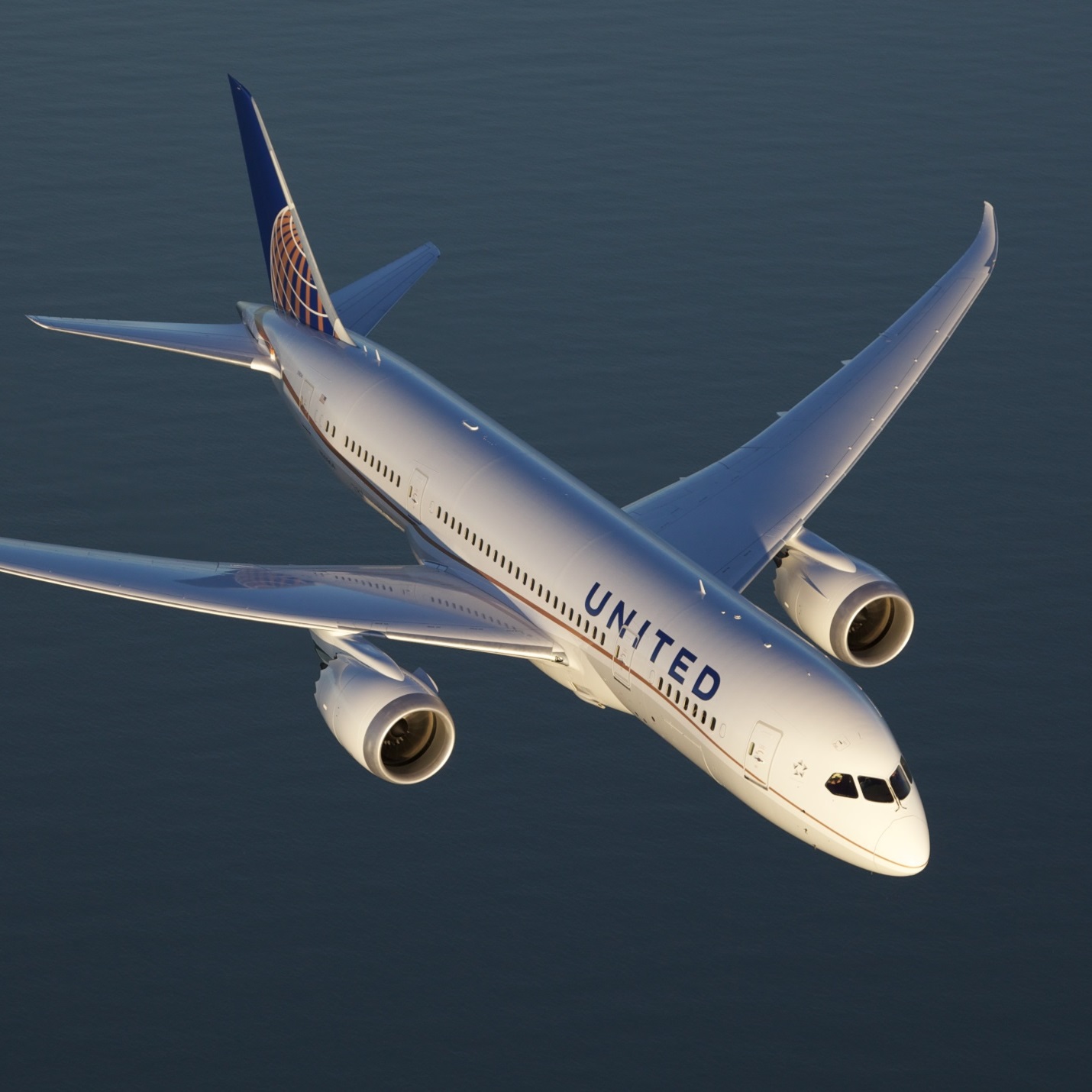

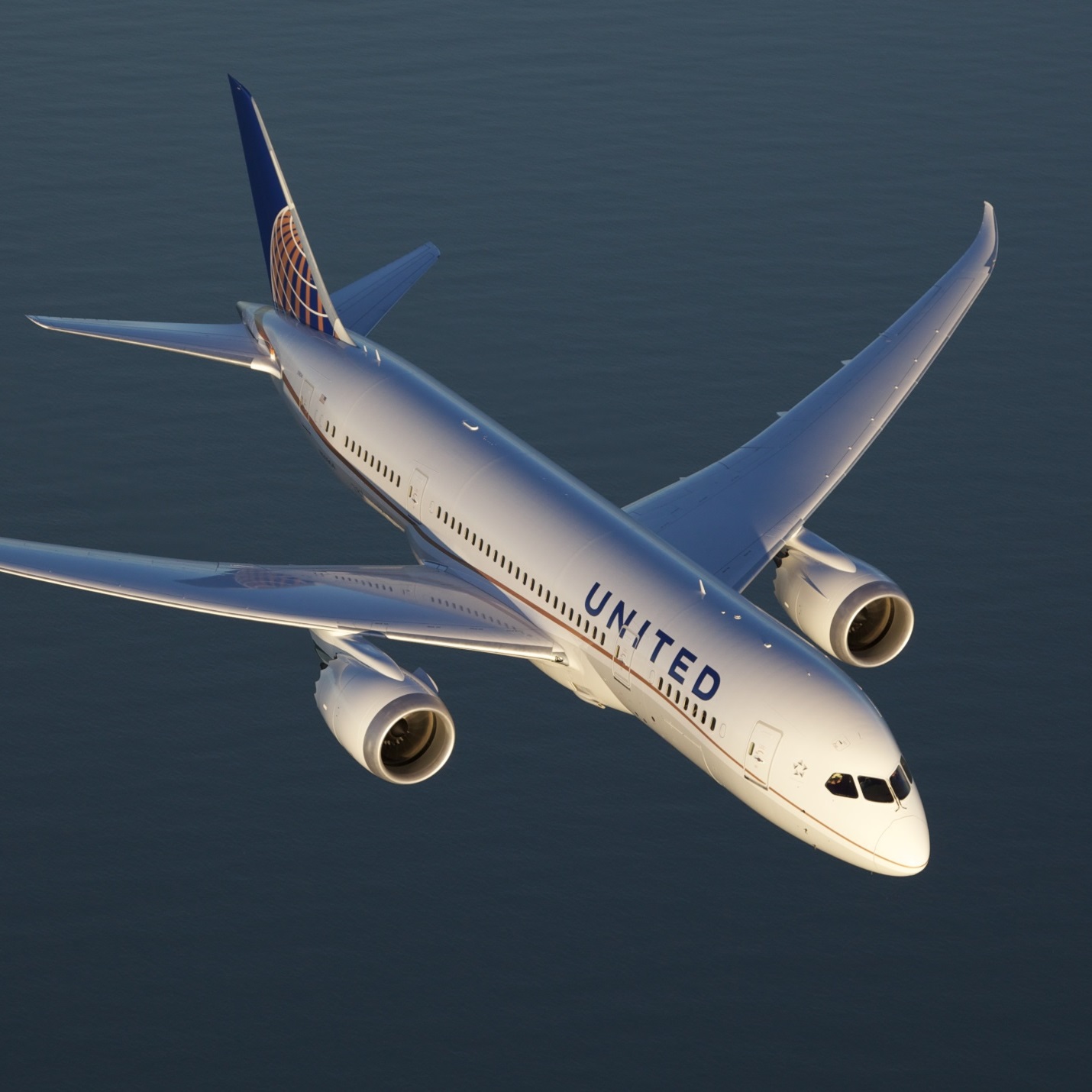

Meanwhile, revenues have risen from $68.7 billion to $96.1 billion and pretax income from $5.39 billion to $7.16 billion, much more modest increases of 40% and 33%, respectively. The company has forecast cash flow of around $10 billion for 2016, primarily due to cost savings on the 787 Dreamliner program.

Here is what Merrill Lynch had to say about Boeing’s $29 billion cash flow forecast:

$30 [million] average unit profit for 787 is unachievable…… As of 4Q15, 787 deferred production costs reached $28.5bn. The current program accounting block for the 787 is 1,300 aircraft. Boeing has already delivered 393 787s as of 1Q16, which leaves 907 undelivered units in the current program accounting block. This means that if Boeing were to burn off the entire 787 deferred production costs in the current accounting block, it would need to generate at least an average unit profit of $30mn for the next 907 787s. In our view, $16mn average unit profit is more achievable.

The 787-8, the smallest of the Dreamliner family of jets, has a list price of $224.6 million, the 787-9 carries a list price of $264.6 million, and the yet-to-be-produced 787-10 lists for $306.1 million. In order to reach its cash flow projections, Boeing would have to lower its cost to build the planes to around $90 million, including engines, according to industry analyst Richard Aboulafia of Teal Group.

In addition to cost savings from last month’s announcement of up to 8,000 job cuts, Merrill Lynch notes that Boeing is squeezing suppliers:

Boeing will likely offset its working capital requirements by squeezing its suppliers and increasing its accounts payable on the balance sheet. [Cost of goods sold] in accounts payable increased before the entry into service of the 777 in 1995 and before the entry into service of the 787 in 2011. We expect Boeing to execute a similar strategy before the entry into service of the 777X in 2020.

At the same time, Boeing is going to ramp production of the 777X, increase production of the 737 and may consider a clean-sheet design for a replacement for the 757, the so-called middle-of-the market aircraft. None of that is cheap and cash will be king.

Merrill Lynch downgraded Boeing’s stock from Neutral to Underperform and set its price objective at $125, an implied 6% downside risk from current levels.

Boeing’s stock traded down about 2.7% Wednesday morning, at $129.13 in a 52-week range of $102.10 to $153.00. The consensus price target is $137.95 from 19 brokers.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.