Boeing Co. (NYSE: BA) reported fourth-quarter and full-year 2017 results before markets opened Wednesday. For the quarter, the aerospace company posted adjusted diluted earnings per share (EPS) of $4.80 on revenues of $25.37 billion. In the same period a year ago, the company reported EPS of $2.47 per share on revenues of $23.29 billion. Fourth-quarter results also compare to consensus estimates for EPS of $2.89 and $24.69 billion in revenues.

For the full year, adjusted EPS came in at $12.04 on revenues of $93.39 billion, compared to 2016 EPS of $7.24 and revenues of $94.57 billion. Analysts were looking for EPS of $10.21 and revenues of $92.55 billion.

The number that matters most to Boeing — and to its shareholders — is operating cash flow, and fourth-quarter cash flow totaled $2.9 billion, up 3% compared to the prior year’s quarter. For the year, cash flow rings in at $13.34 billion, compared with $10.5 billion in 2016. Operating cash flow guidance for the fiscal was raised to $12.5 billion when Boeing reported third-quarter results.

Boeing said that $1.74 in fourth-quarter EPS was the result of recent changes to U.S. tax law.

For the new fiscal year, Boeing guided revenues to $96 billion to $98 billion with adjusted EPS in a range of $13.80 to $14.00. The company said it will adopt two new accounting standards beginning this quarter that will cause it to restate 2017 revenues at $94 billion and adjusted EPS to $12.33. The company also forecast deliveries of new commercial jets at 810 to 815, far above 2017’s record level of 763 deliveries. Operating margin is forecast to rise from 9.4% to more than 11% on its commercial plane sales.

The forecast for 2018 operating cash flow is a staggering $15 billion, a jump of nearly 13%. If that pans out, Boeing will have increased operating cash flow by 43% over the past two years.

Analysts are looking for first-quarter EPS of $2.80 and revenues of $21.79 billion. For the full year, current estimates call for EPS of $11.96 and revenues of $93.45 billion.

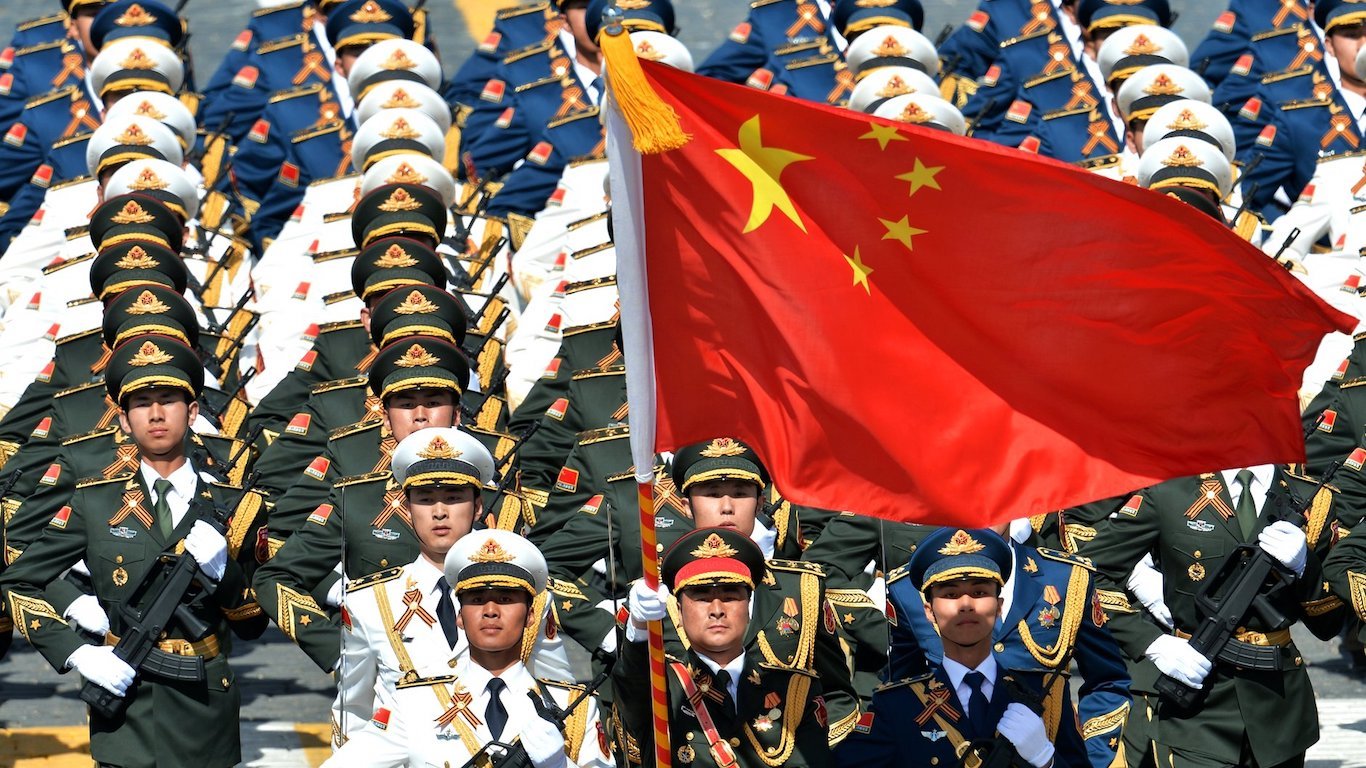

Defense division revenue rose 5%, from $5.28 billion to $5.54 billion and operating earnings rose 6%. The global services and support division’s revenues rose 17% to $4 billion, and operating earnings rose 9% to $617 million.

Boeing’s deferred production costs on the 787 program fell to $25.36 billion, down by $590 million sequentially. Tooling and other non-recurring costs for the program also declined, from $3.33 billion at the end of the third quarter to $3.17 billion.

CEO Dennis Muilenburg said:

Across Boeing our teams delivered a record year of financial and operational performance as they focused on disciplined execution of production and development programs, growing services, and delivering value to customers. That performance enables increased investments in our people and our business, and greater cash return to shareholders.

During the quarter, the company repurchased 6.7 million shares for $1.7 billion and paid $800 million in dividends. For the year, Boeing repurchased 46.1 million shares for $9.2 billion and paid $3.4 billion in dividends. The company raised its dividend by 20% in December and replaced its share buyback program with a new authorization for $18 billion, which the company expects to use over the next 24 to 30 months.

Boeing booked 414 net new orders in the fourth quarter, and the company’s backlog of commercial jets now stands at 5,864, valued at $488 billion at contract (not list) prices.

This is a strong report from the best-performing Dow Jones Industrial stock of last year, and the company’s guidance makes the case for continuing growth in the current year. It’s hard to see how Boeing could have done much better.

The stock traded up about 6.3% at $358.92, just after Wednesday’s opening bell. The 52-week range is $160.82 to $352.23, and the consensus price target as of last night was $351.21.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.