Apps & Software

Full Microsoft Earnings Preview Expectations (MSFT)

Published:

Last Updated:

Microsoft Corporation (NASDAQ: MSFT) is due to report after the close of trading today and Thomson Reuters has estimates for the DJIA component of $0.68 EPS and $17.25 billion in revenues; next quarter estimates are $0.84 EPS and $21.21 billion in revenue.

Microsoft Corporation (NASDAQ: MSFT) is due to report after the close of trading today and Thomson Reuters has estimates for the DJIA component of $0.68 EPS and $17.25 billion in revenues; next quarter estimates are $0.84 EPS and $21.21 billion in revenue.

Shares are trading under $27.00, its 52-week trading range is $23.65 to $29.46 and analysts have a consensus price target of $31.90. The dividend is now close to 3% but investors are still concerned about the PC market causing a slower upgrade cycle for Windows but there is some hope since Intel offered enough of a PC-market buffer.

Options traders are pricing in a move of up to $0.45 to $0.55 in either direction, an indication of less than 2% based upon the news. Frankly, that could easily be understated if the news is off-expectations.

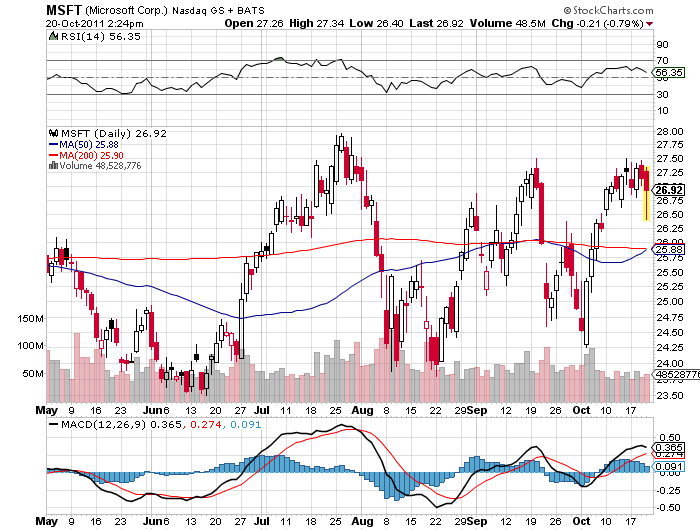

The chart is showing some concern here. While this shows strong support just under $26.00 with the 50-day moving average at $25.88 and the 200-day moving average at $25.90, Microsoft has seen a clear triple-top as you can see on the stockcharts.com stock chart below.

The good news, if the stock goes up the technicians will likely be calling this a breakout move to the upside with a likely challenge of the $28.50 level.

As far as valuation is concerned, Microsoft shares are currently trading at only 9.5-times the $2.85 EPS consensus from Thomson Reuters for the June-2012 fiscal year-end. If you back out the $50+ billion cash from the $225 billion market cap, the stock is even cheaper.

JON C. OGG

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.