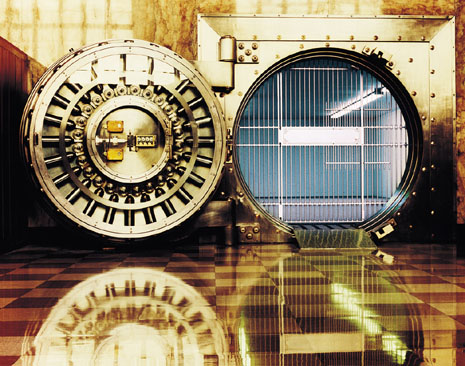

Banking, finance, and taxes

Investment Bank Duff & Phelps Goes Private

Published:

Last Updated:

The offer represents a 19.2% premium over the stock’s closing price on Friday and 27.3% over the its 30-day volume weighted average share price. The merger agreement includes a “go-shop” period beginning immediately and ending on February 8, during which the bank “will actively solicit and potentially receive, evaluate and enter into negotiations with third parties that offer alternative transaction proposals.” The agreement provides for a breakup fee of $6.65 million in the event Duff & Phelps cancels the deal before March 8.

Shares of Duff & Phelps are up 18.5% at $15.47 in premarket trading this morning, in a 52-week range of $11.36 to $16.50. Shares of Carlyle Group are inactive, having closed at $25.85 on Friday, in a post-IPO range of $20.00 to $27.90.

Paul Ausick

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.