Source: FinViz.com

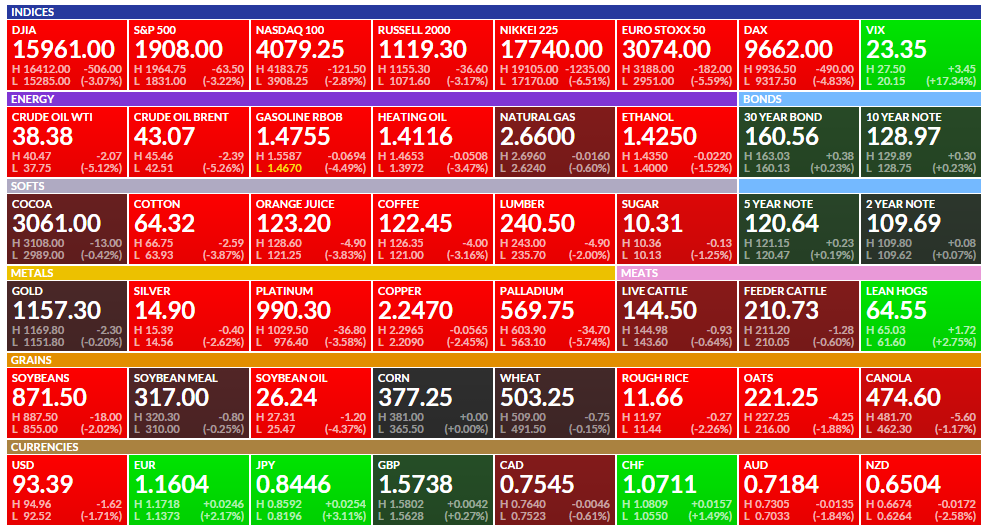

Since May, copper prices have fallen from around $2.90 a pound to about $2.30, a decline of about 21%. Benchmark West Texas Intermediate (WTI) crude oil has dropped from around $60 a barrel to around $40, a drop of a third. Aluminum prices are down about 20%, and iron ore is down about 13% in the same period.

Metals miners have taken a lot of punishment, and in London Monday, big miners like BHP Billiton PLC (NYSE: BHP) and Glencore traded down about 7.5% and 10.5%, respectively.

One very hard hit U.S. mining stock recently has been Freeport-McMoRan Inc. (NYSE: FCX), which posted a new 52-week low Monday morning of $8.17, down about 6.5% from Friday’s closing price. The company’s continuing squabble with the Indonesian government has left it without an export license for its copper production. If the company were stronger financially, that would not be an altogether bad thing, given the price of copper right now, but the company’s long-term debt exploded in 2013, after spending $20 billion on two acquisitions in the oil and gas sector. What looked like a shrewd move at the time has not exactly worked out as planned following the collapse in oil prices.

The three-month copper contract on the London Metal Exchange traded at its lowest level since 2009 Monday morning, at about $2.23 a pound, and lead posted a five-year low of around $0.82 a pound. The devaluation of China’s currency combined with recent poor economic data from the single most important global consumer of metals have added to the impact of low global energy prices to tamp down demand not only in China, but virtually everywhere.

ALSO READ: Where Will Warren Buffett Put Money as Markets Collapse?

Agricultural commodities are faring a little better, but most are no better than unchanged. Corn was flat at $3.77 a bushel, wheat was down less than 1% at $5.03 a bushel, while soybeans were down 2% and feeder cattle down less than 1%.

WTI crude oil traded at less than $39 a barrel, after posting a new 52-week low of $37.75 shortly after the opening bell Monday. Brent crude traded at around $43.40, after posting a new 52-week low of $42.51 in the morning. Brent has not traded at this level in more than six years.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.