Companies and Brands

More Risk Than Meets The Eye in Lululemon, Beyond See-Thru Pants

Published:

Lululemon Athletica Inc. (NASDAQ: LULU) may have a serious problem on its hands. Actually, make that “problems” rather than one problem. New reports of yoga pants being see-thru are making the rounds, as are other notes about quality of the material. Source: lululemon

Source: lululemon

Sterne Agee analyst Sam Poser has said that piling and stitching problems are mounting and that the company has said little about it. He said, “If the product issues are real, then it is unlikely that the company will keep its current multiple. We hope the new Chief Product Officer is as skilled as the company expects.”

Lululemon is getting massive numbers of tweets on Twitter and not in a good way. A Twitter feed for the topic “lululemon” had dozens of tweets in the last hour ending at 3 p.m. EST.

Sam Poser of Sterne Agee is showing that the company may have been bitten by speed after managing to get restocked in most of the LUON pants that had the shear problem within 3 months. He said,

“The speed of the product correction was rewarded by investors. We may be facing a haste makes waste scenario. There are numerous posts on LULU’s website discussing problems with the WunderUnder pant. We must point out that the company as of yet has not responded to the new complaints. Based on those comments, there certainly appears to be an issue. It’s hard to tell if the issue is a product problem or a sizing problem. LULU pants have an athletic fit. In other words, a woman who may normally wear size 6 pants may have to wear size 8 or 10 in a lululemon pant. The company does discuss the sizing on its website, but the delivery of the sizing message appears inconsistent at store level. LULU will certainly face new challenges if the pilling and seam problems are real, but the sizing problem will continue if changes are not made. Let’s be real: generally being told you need a larger size than you thought is not ingratiating.”

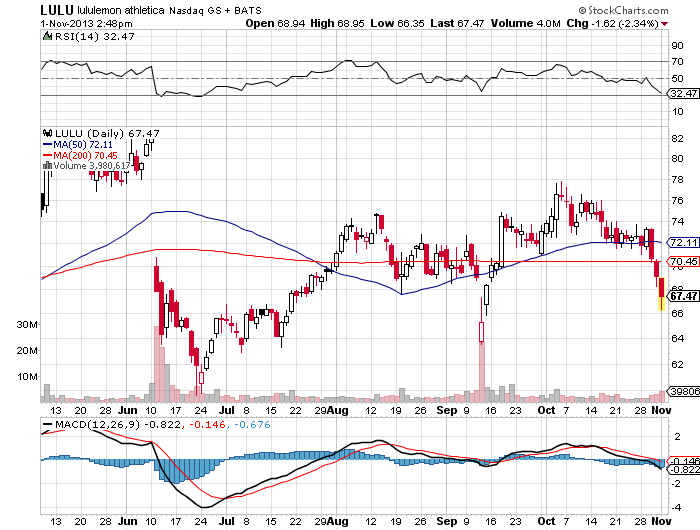

Another issue is that severe chart damage is taking place. If you look at the Stockcharts.com chart (see below), you can see that the last three trading sessions broke under the 50-day moving average (currently at $72.11) and then also broke under the 200-day moving average ($70.45 currently) as the stock is now down close to $67.50. The absolute lows in September were around $64 then around $60 and $61 in summer when the first real problems surfaced.

Having a bad stock chart does not automatically assume that there are product problems because stocks rally or drop for a myriad of reasons. What the chart is signaling though is that all of the recent goodwill could be eroding fast and longer-term issues may be awaiting the stock.

Lululemon shares were down only 2.1% at $67.62 with one hour until the market close on Friday. Unfortunately, its 52-week range is $59.60 to $82.50. If this company truly has another serious product issue on its hands then being a yoga-themed company worth $9.8 billion trading at almost 35-times expected earnings is going to come with more adjustments to the downside.

Source: Stockcharts.com

Source: Stockcharts.com

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.