Economy

IMF Suggests Bank Reform and Steps to Support Demand in Europe

Published:

Last Updated:

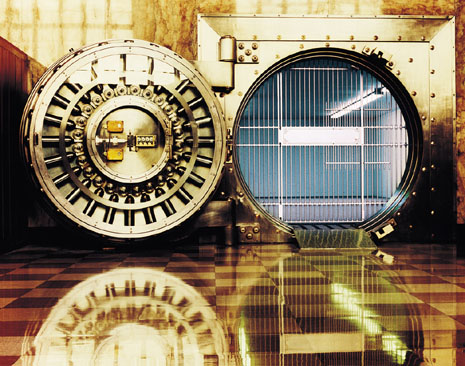

It is a shame that the International Monetary Fund (IMF) can only suggest solutions to the European financial crisis and the devastation of jobs and economic recession that has come in its aftermath. Most of what it supports in its annual assessment of the euro area makes sense. And most of its suggestions have been made before by other organizations and leaders. However, suggestions hardly matter in an environment of political gridlock and the tremendous battle between the forces of austerity and those which favor stimulus. All the while, contraction of gross domestic product (GDP) continues in most nations, and unemployment is in double digits among most of them. Source: Thinkstock

Source: Thinkstock

In its assessment, the IMF offered this advice. Europe needs to do the following:

- Restoring the health of banks’ balance sheets. To raise confidence, a credible assessment of the quality of banks’ assets is needed. Such an assessment would quantify capital needs and should be accompanied by a clear plan on how to meet these needs. Where private capital is insufficient, credible backstops — in some cases, the ESM — will be essential to preserve banks’ ability to continue lending.

- Completing the banking union. This would entail expediting reforms already under way, such as adopting the legislation for the Single Supervisory Mechanism and reaching final agreement on the Bank Resolution and Recovery Directive. It should also involve the introduction of a strong, single resolution mechanism that ensures swift resolution of banks, limiting the overall cost to taxpayers.

- Taking further steps to support demand in the near term. The IMF welcomed the recent introduction of forward guidance and the ECB’s commitment to keep the monetary policy stance accommodative for as long as necessary. The IMF also said that while monetary policy alone cannot address structural banking sector weaknesses, it can provide essential space, with additional conventional and unconventional measures as needed. In addition, fiscal adjustment in euro area countries should be carefully paced to avoid an excessive drag on growth.

- Pushing ahead on structural reforms. Tackling structural gaps — at both the euro area and the national levels — would raise potential growth and promote external adjustment within the euro area. Implementation of the Services Directive could encourage cross-border competition and raise productivity, while national efforts to address labor market weaknesses would boost competitiveness and employment.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.