Source: Thinkstock

With the unemployment rate at a five-year low, the market for equities at an all-time high and an improving housing market, the signals have all been positive over the past two months. Add in the beginning of the Federal Reserve’s tapering of its asset purchases and a higher-than-expected rise in gross domestic product (GDP), and it is not difficult to see how the economic news has translated into more confidence in the U.S. economy.

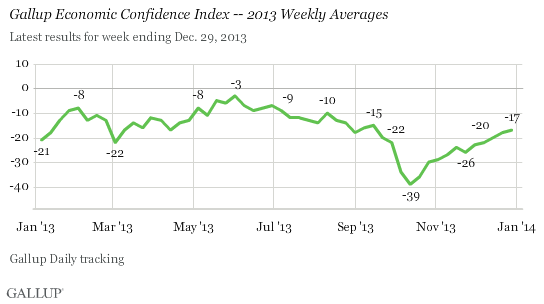

The question, of course, is will it last. Gallup’s survey respondents are skeptical:

Americans are more pessimistic than optimistic about the economy’s outlook, with consumers much more likely to say it is getting worse than getting better (56% vs. 38%, respectively). The resulting net economic outlook score of -18 is significantly improved from the -46 recorded during the shutdown, but substantially below the +4 measured in late May and early June.

On average, though, Americans were more confident in the U.S. economy than they have been in the past five years. The average reading for 2013 was -16, up from -21 in 2012. Not an overwhelming vote of confidence.

While Gallup suggests that further improvement in the unemployment rate and continued GDP growth may be needed to push the index into positive territory in 2014, a more likely requisite could be a rise in wages. GDP and rising stock prices and home values make a lot of headlines, but until consumers see a bump in their paychecks they are unlikely to believe they are getting a lot of benefit from the slowing improving economy. Whether or not 2014 delivers more income to Americans may be the key to economic confidence in the year ahead.

Source: Gallup

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.