Economy

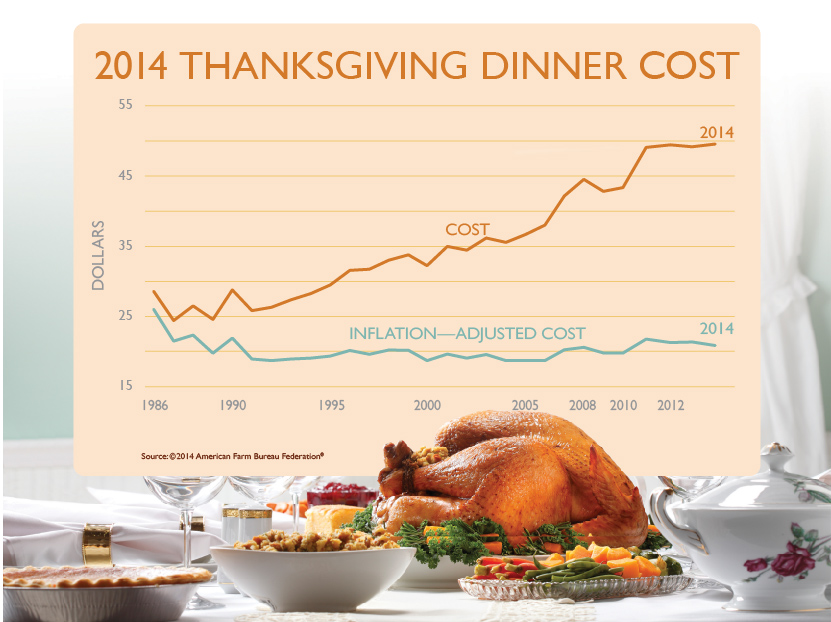

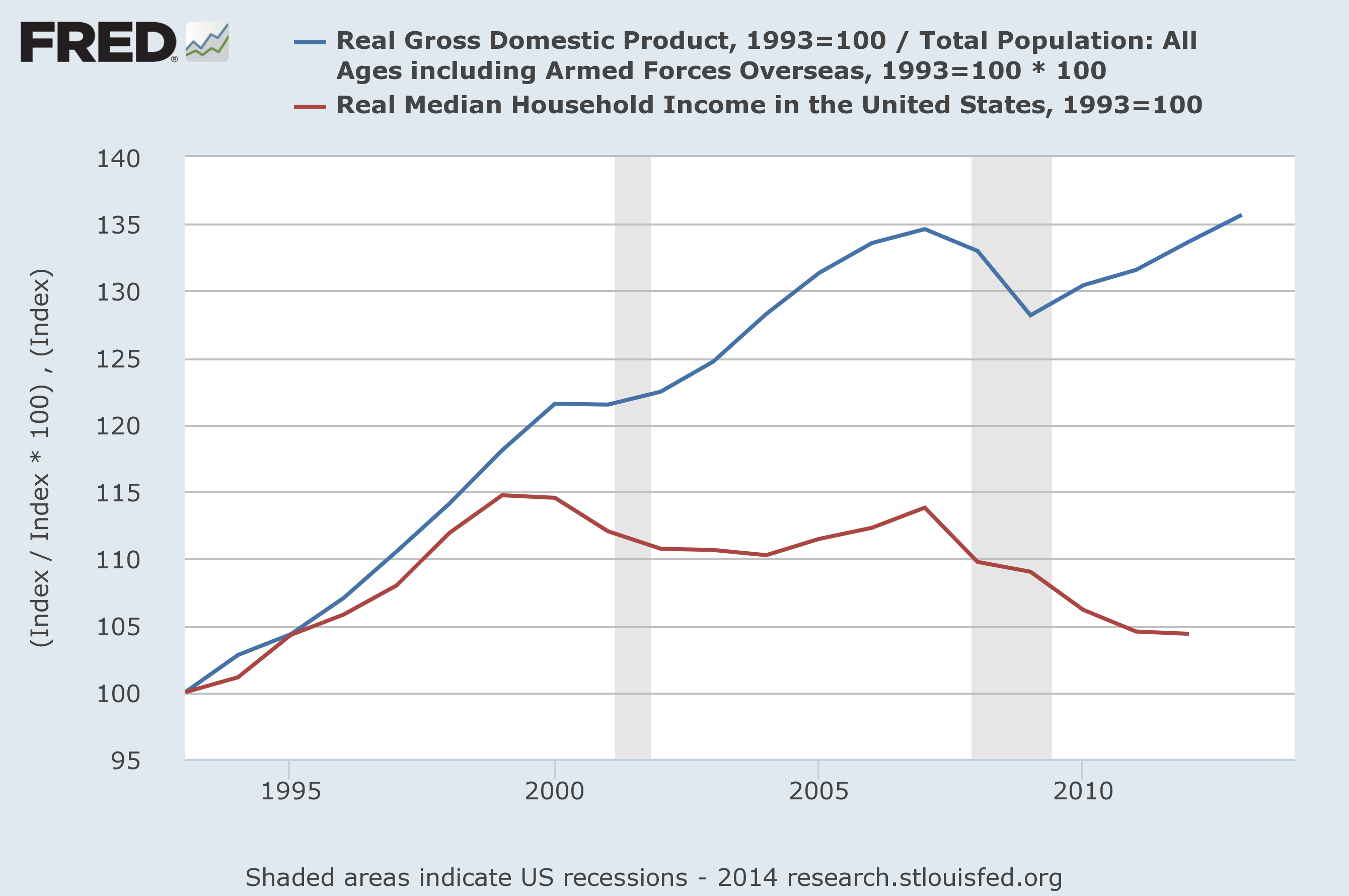

Thanksgiving Dinner Cost Rises Faster Than Family Income

Published:

Last Updated:

According to the American Farm Bureau Federation (AFBF), a 16-pound turkey will cost about $1.35 a pound this year, for a total cost of $21.65, which is 11 cents less than it cost last year. Sweet potatoes and dairy products contribute $0.63 in increased costs, while cubed stuffing, fresh cranberries and pie shells cost $0.28 less than they did a year ago. The AFBF noted, as we did last weekend, that even though turkey production is lower this year and wholesale prices are higher, grocery stores often price turkeys as loss leaders.

Wal-Mart Stores Inc. (NYSE: WMT) did not miss a beat here. The company said Thursday morning that Walmart shoppers could save 34% on the national average cost by purchasing all the items on the AFBF menu at Walmart stores for $32.64. The company said that the items it included are comparable to the AFBF menu items.

Thanksgiving dinner cost more in 2012, according to the Farm Bureau, a total of $49.48 in a year when drought over much of the United States raised prices on a number of traditional holiday foods.

The AFBF survey involved 179 volunteer shoppers who checked prices at grocery stores in 35 states. The Farm Bureau also noted that a ready-to-eat Thanksgiving dinner can be purchased for $50 to $75 from many supermarkets and restaurants.

ALSO READ: Companies That Control the World’s Food

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.