Economy

IMF Sees Slowing 2016 and 2017 Global Growth, China Revised Slightly Better

Published:

Last Updated:

The International Monetary Fund (IMF) has issued an update to its World Economic Outlook. Most of the report centers around even slower global growth in gross domestic product (GDP) for 2016. There may be at least some good news here: China’s slowing growth may actually be a tad better than the IMF’s prior views.

The IMF World Economic Outlook for April specifies that the global economy is faltering from what is nothing short of too slow growth that is lasting for far too long.

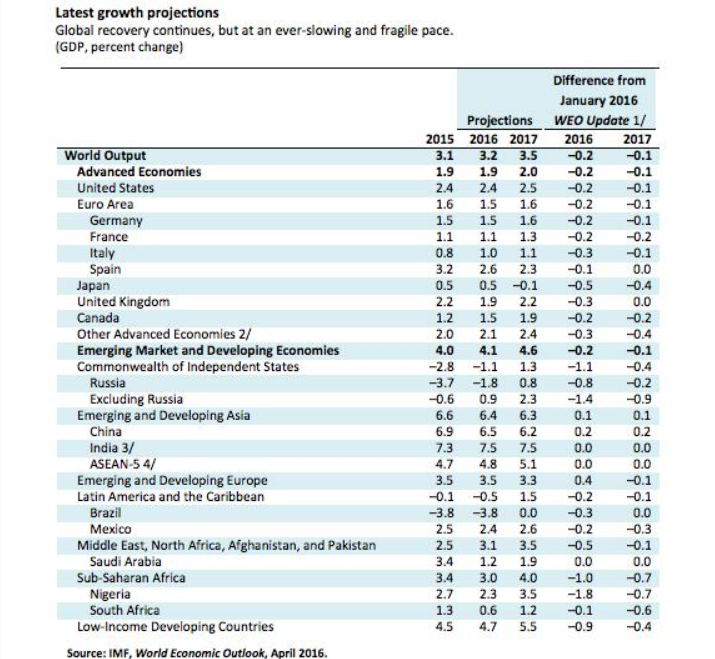

The global growth forecast is now at 3.2% for 2016, with a view of picking up to 3.5% growth in 2017. These are down 0.2% from the January forecast for 2016, and down 0.1% for 2017.

The IMF sees prominent financial risks, geopolitical shocks and political discord all as prevailing themes for 2016. It also is touting a three-pronged approach to address structural, fiscal and monetary measures.

Growth in advanced economies is projected to remain modest at about 2%. The recovery is hampered by weak demand, partly held down by unresolved crisis legacies, as well as unfavorable demographics and low productivity growth.

Growth in the United States is expected to be flat in 2016 at 2.4%, with a modest uptick in 2017. The IMF sees domestic demand being supported by improving government finances and a stronger housing market that help offset the drag on net exports coming from a strong dollar and weaker manufacturing.

China’s modest slowdown is less bad than the view just in January. The IMF sees China still slowing down, but it ratcheted its estimates up 0.2% for each 2016 and 2017. After growth of 6.9% in 2015, the IMF’s slightly higher revised forecast for 2016 is 6.5%, followed by 6.2% growth in 2017. The IMF sees China’s growth continuing to shift away from manufacturing and investment to services and consumption.

European growth is expected, but very weak growth due to low investment, high unemployment and weak balance sheets. GDP growth for 2016 is forecast at 1.5% for 2016 and 1.6% in 2017.

Japan is being hampered by both growth and inflation being weaker than expected, reflecting in particular a sharp fall in private consumption. Growth is projected to remain at 0.5% in 2016, before turning slightly negative to −0.1% in 2017. That 2017 slowdown is as the scheduled increase in the consumption tax rate goes into effect.

The IMF World Economic Outlook said:

Reforms that are coupled with fiscal support will be the most valuable at this juncture, including reducing inefficient taxes on labor and increasing public spending on research and development and active labor market policies (reforms aimed at getting the unemployed back into work, such as job training programs).

In many advanced economies, accommodative monetary policy remains essential to support economic activity and lift inflation expectations. In many emerging market and developing economies, monetary policy must grapple with the impact of weaker currencies on inflation and private sector balance sheets. Exchange rate flexibility, where feasible, should be used to cushion the impact of terms of trade shocks.

Finally, further financial sector strengthening is essential, including to create a context in which monetary, fiscal, and structural policies can be most effective.

The WEO warns that policymakers also need to make contingency plans and design collective measures for a possible future in case downside risks materialize. Cooperation to enhance the global financial safety net and global regulatory regime is also central to a resilient international and financial system.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.