The Shaky Financial Health of Detroit Residents

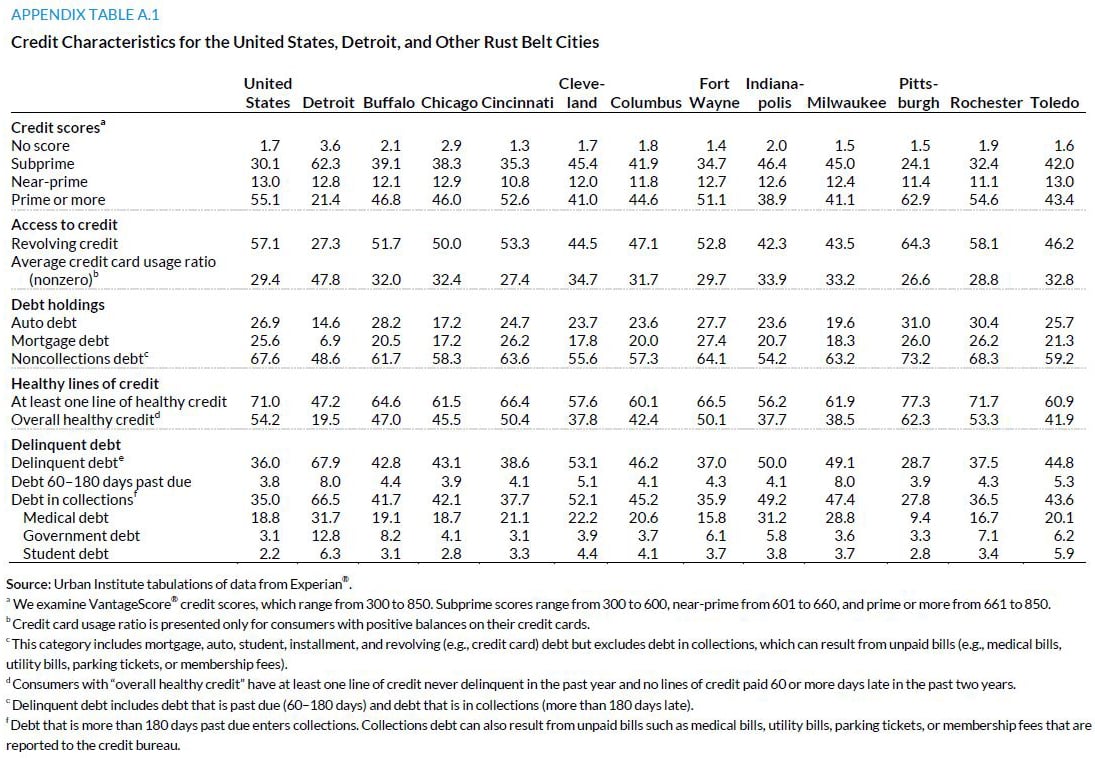

October 13, 2016 by Paul AusickNearly two-thirds of Detroit’s residents have subprime credit. Less than half have at least one healthy line of credit. More than two-thirds have delinquent debt and a shade under two-thirds have debt in collections.

These represent the worst showing among 12 Rust Belt cities included in a recent study by the Urban Institute based on data from Experian.

Prior to the start of the Great Recession in late 2007, the once thriving manufacturing economy of Detroit had already been hit hard by job losses and emigration. That led to falling incomes and declining property tax collections that forced the city to turn to debt financing to meet budget requirements. The city’s homeowners sought subprime home financing, and when that blew up, distressed sales and foreclosures deepened the financial hole residents were in.

The city declared bankruptcy in 2013, and the subsequent recovery has been uneven at best. According to the Urban Institute:

[H]ome equity values have been on the rise and foreclosures have fallen close to pre-crisis levels, but mortgage credit remains extremely scarce. Similarly, job losses have stabilized, but Detroit’s unemployment rate remains highest among the 50 largest cities in the United States.

Here’s a look as some of the statistics the Urban Institute assembled on residents of Detroit compared with the U.S. national average. More data, discussion and definitions are available in the Institute’s report “The Financial Health of Detroit Residents.”

- Subprime or no credit score: Detroit, 65.9%; U.S. average, 31.8%

- Prime or better credit score: Detroit, 21.4%; U.S. average, 55.1%

- Access to revolving credit: Detroit, 27.3%; U.S. average, 57.1%

- Mortgage debt: Detroit, 6.9%; U.S. average, 25.6%

- Overall healthy credit: Detroit, 19.5%; U.S. average, 54.2%

- Delinquent debt: Detroit, 67.9%; U.S. average, 36%

- Debt in collections: Detroit, 66.5%; U.S. average, 35%

The Urban Institute makes a number of recommendations:

Detroit residents who have low credit scores and diminished financial health would benefit from a range of strategies, from structural interventions to city programs aimed directly at building residents’ financial health to steps individual residents can take.

At the structural level, city-led strategies may be important catalysts for improving the long-term financial outlook of Detroit residents. …

[L]ocal government and public-private partnerships can be important mechanisms for improving residents’ financial health. …

Detroit residents can take steps to improve their financial health, either with help from local programs or independent of them. …

When coupled with city-level evidence-based policies and programs that have broader impact on financial health, individual behaviors such as establishing liquid savings, paying debt on time, and limiting usage of available credit can put Detroit’s residents on the path toward better financial health.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.