Energy

Kinder Morgan Maintains 2015 Dividend Outlook Despite Lower Energy Prices

Published:

Last Updated:

Kinder Morgan Inc. (NYSE: KMI) has now announced its post-merger 2015 financial expectations. The news looks great on the surface, in that the post-merger company still expects to declare dividends of $2.00 per share for 2015 with over $500 million of excess coverage. This would be a 16% higher payout than the $1.72 per share budgeted for 2014. Still, the major difference we see here in Wednesday’s post-merger outlook versus the pre-merger outlook is that there is not the stated commitment of 10% dividend growth guidance out to 2020, and the next assumption is that the West Texas Intermediate (WTI) oil price average is now being put at $70. Source: Kinder Morgan Inc.

Source: Kinder Morgan Inc.

Kinder Morgan’s pre-merger forecast included a note that the combined KMI structure would grow that dividend payout by about 10% a year from 2015 to 2020. All in all, it should not be surprising that the longer-term outlook was not included in Wednesday’s forecast, and the wording of a 2015 outlook may simply not be an apples-to-apples assumption change just because the outlook did not mention excess coverage and dividend growth rates out to 2020. Still, it may not go unnoticed by some investors. The August 10 merger announcement had said:

We expect to grow the dividend by approximately 10 percent each year from 2015 through 2020, with excess coverage anticipated to be greater than $2 billion over that same period.

Kinder Morgan’s 2015 growth plan is expected to be driven by continued high demand for North American energy infrastructure. The company said that this includes the transportation and storage of natural gas, natural gas liquids, crude oil and refined products. Growth is also expected to be driven by contributions from the company’s expansion projects across its business units.

ALSO READ: Analyst Top MLP Picks Insulated From Lower Oil Prices

The new outlook still sounds great on the surface, so long as this is not interpreted by investors as a major change in excess dividend coverage and dividend growth. Also, this outlook at least gives us yet another look at the post-merger Kinder Morgan. But what if that new $70 price in WTI crude proves too optimistic? Chairman and CEO Richard Kinder at least has an answer for that potentiality.

The company said that the overwhelming majority of cash generated by Kinder Morgan’s assets is fee based and is not sensitive to commodity prices. In KMI’s CO2 segment, the company hedges the majority of its oil production. Still, the company does have exposure to unhedged volumes, a significant portion of which are natural gas liquids. For 2015, the company expects that every $1 change in the average WTI crude oil price per barrel will impact the CO2 segment by approximately $7 million pre-tax, or roughly 0.086% of KMI’s combined business segments’ anticipated segment earnings before DD&A. Other 2015 projections are as follows:

The outlook noted that KMI’s board of directors will review and approve the 2015 budget at the January board meeting and the budgets will be discussed in detail during the company’s annual analyst meeting on January 28, 2015.

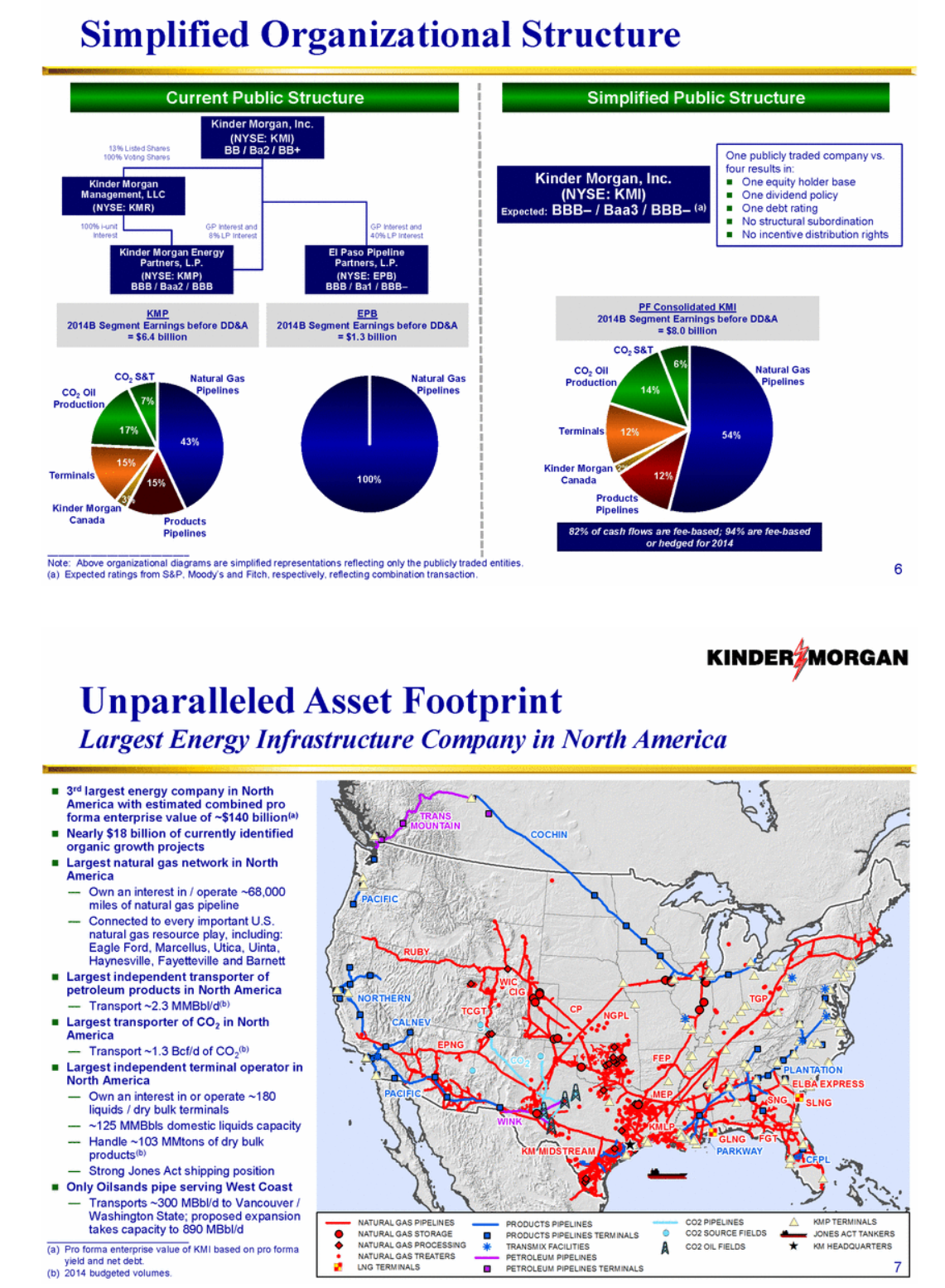

Kinder Morgan is now the largest combined energy infrastructure company in North America, with an interest in or operating roughly 80,000 miles of pipelines and 180 terminals. The company shows that it is the largest midstream and third largest energy company in North America. Its total enterprise value is now represented as being above $125 billion.

Kinder Morgan shares closed up 0.5% at $41.83, within a 52-week range of $30.81 to $42.49 and versus a consensus analyst price target of $44.50. One issue we looked at closely going into this merger was how closed-end funds and ETFs would treat Kinder Morgan after the merger.

ALSO READ: 5 Big Expected DJIA Dividend Hikes Expected Any Day Now

We have included an image of the combined Kinder Morgan entities that was represented by the company as what it would look like after its merger was completed (see below). Richard Kinder said in Wednesday’s forecast:

We believe the recently closed transaction merging the Kinder Morgan companies paves the way for superior growth at KMI for years to come. We anticipate strong growth in 2015 across our pipeline and storage businesses and currently have a backlog of approximately $18 billion in expansion projects and joint venture investments that have a high certainty of completion. We are generating strong growth even though we have revised our projected West Texas Intermediate (WTI) crude oil price to $70 per barrel. As our track record demonstrates, we own and operate a large, diversified portfolio of stable, primarily fee-based energy assets across North America which produce substantial cash flow in virtually all types of market conditions, regardless of commodity prices.

Source: Kinder Morgan SEC Filing

Source: Kinder Morgan SEC Filing

ALSO READ: Will $60 Oil Ruin North Dakota’s Economy?

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.