Energy

Is Onshore Drilling for Oil & Gas Set for a Big Comeback?

Published:

Last Updated:

According to last week’s rig count summary from Baker Hughes, there were 502 rigs drilling for oil and gas in the United States last week, down 40% from the 848 active rigs a year ago. Two years ago the total in Texas alone was 905 on September 12 and Baker Hughes counted 1,931 for the country as a whole.

The bulk of the decline came in the onshore segment, most of which was in U.S. tight oil (shale) plays which saw drilling investment fall by 66%. Offshore invest fell by about half as much, 34%.

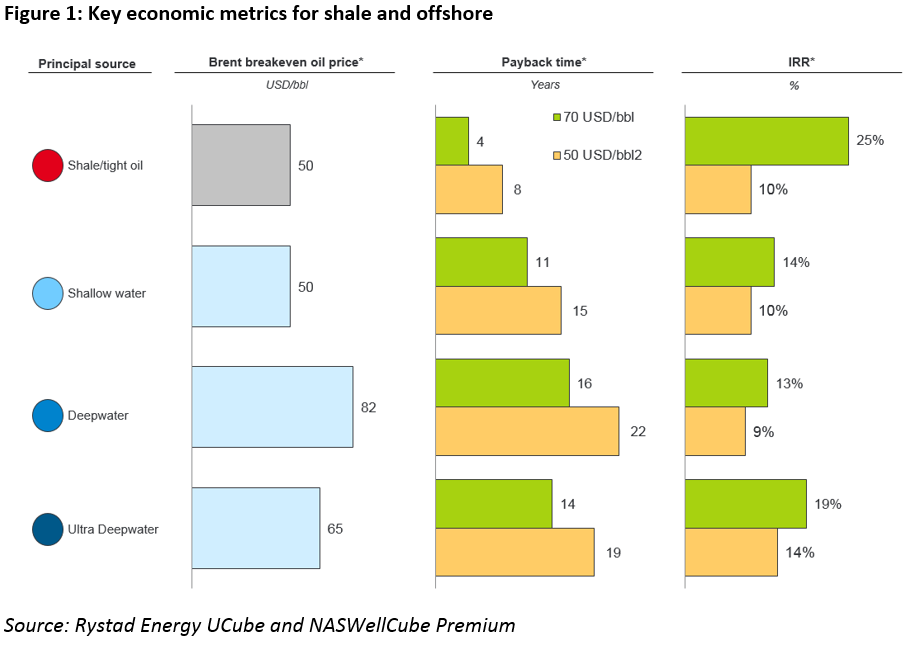

Now that the rig activity has picked up, analysts Rystad Energy expect shale drilling to pick up more quickly than offshore investment for the first time in two years. Onshore unit costs fell more than offshore costs and the break-even price for a barrel of oil produced from shale is now $50 a barrel, equal to the break-even price for shallow water offshore rigs. Deepwater rigs have a break-even cost of $82 a barrel and ultra-deepwater projects post a break-even cost of $65 a barrel.

Although Rystad doesn’t say this, the lowest cost producers in the Permian Basin and a few other shale plays can make a profit at around $30 a barrel by drilling in the so-called sweet spots and using multiple fractures on each lateral. As producers are forced outside the sweet spots, of course, costs will rise because wells will produce less.

The following chart from Rystad shows not only the break-even cost but the payback time and the internal rates of return (IRR) for wells.

Rystad explains its methodology:

Offshore estimates are based on the 30 largest projects within each group expected to be sanctioned in 2016-2025. Shale estimates are based on 2016 well results and costs; going forward, shale breakeven prices are expected to increase as operators drill outside the core areas.

Note especially the payback periods and IRR: payback times are shortest and IRR is highest for onshore shale drilling at $70 a barrel. Even at $50 a barrel shale production’s payback period is the shortest and its IRR is tied for second-best.

Rystad concludes:

The fact that companies can recover investments faster reduces the risk of the source and make it more attractive. As a result, Rystad Energy expects that shale will have the largest growth in investment over the next few years.

That is good news for services providers like Schlumberger, Halliburton, National Oilwell Varco, and the other services companies. It’s bad news for Saudi Arabia, particularly, which admitted in its September report on the market that U.S. production will not fall as far as OPEC had planned in 2016.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.