Energy

OPEC Oil Production Cuts vs US Production Growth a Stalemate?

Published:

Last Updated:

The announcement that the Organization of the Petroleum Exporting Countries (OPEC) and its 11 partners are extending their 1.6 million barrel per day production cuts through the first quarter of 2018 set benchmark West Texas Intermediate (WTI) crude oil prices back by about $2 a barrel on Thursday to close below $49 a barrel. Most analysts and traders were expecting the extension, but many were expecting an increase to the level of the cuts. When that didn’t materialize, crude prices dropped.

The stated reason for keeping the 1.6 million barrel reduction is that the cartel and its partners believe that’s enough. A more likely reason is that $50 a barrel is better than a poke in the eye with a sharp stick, which is what might happen if deeper cuts are made.

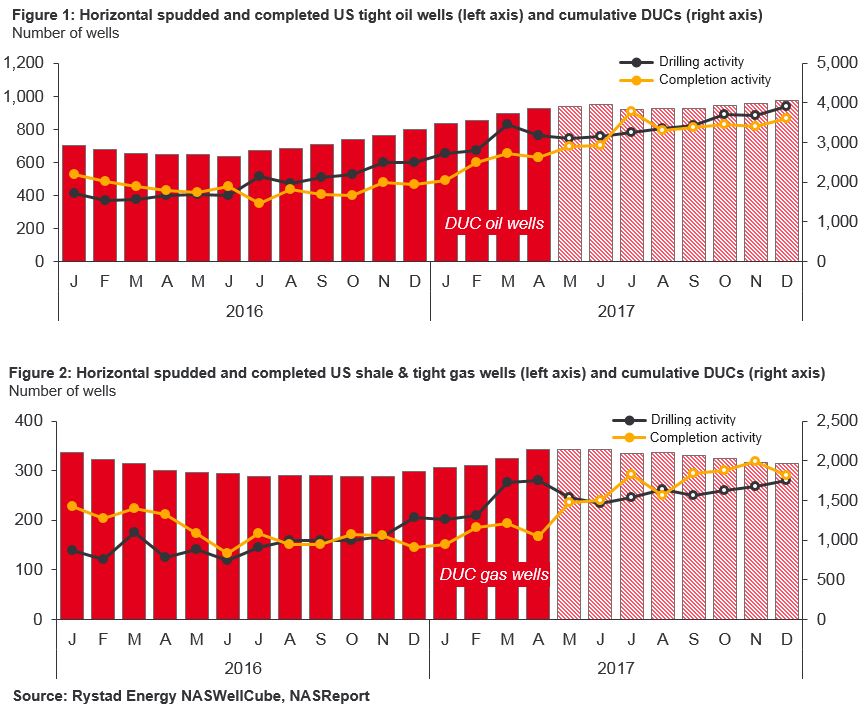

A new report from Rystad Energy shows how the U.S. deck is stacked through the end of this year. New U.S. oil drilling activity has been rising since last June and hit a peak in March at around 800 new wells. At the same time, completed wells totaled about 600 in March. Completions are expected to outnumber newly drilled wells in July and run roughly equal to new drilling for the rest of the year.

That’s important because there were 5,721 drilled, uncompleted (DUC) wells in the Lower 48 states at the end of April, according to the U.S. Energy Information Administration (EIA). A DUC well is just a hole in the ground; a completed well has all the surface equipment attached that allows that hole to produce oil.

The following graphic from Rystad illustrates the relationship of drilled and DUC wells for both tight (shale) oil wells in the top half and drilled and DUC wells for shale and tight gas wells in the bottom half.

In both charts, the solid red bars represent actual DUC oil and gas wells and the cross-hatched bars indicate estimates. The blue line represents drilling activity and the yellow line represents completion activity.

Rystad notes:

[D]rilling activity exhibited an upward trend since mid-2016 for both oil and gas wells, while completion activity was naturally lagging behind drilling, exhibiting relatively flat development through H2 2016. This resulted in a build-up of inventory of drilled uncompleted wells. However, in Q1 2017 we observe that completion activity finally starts to catch up with growth in drilling, driven primarily by a growing number of completions in the Permian Basin and South Texas. … [D]espite further expansion in rig counts, growth in drilling activity is stabilizing due to degrading drilling efficiencies in all major plays.

That last sentence means costs are rising for completion and pressure pumping services, which means that producers can work off some of their DUC backlogs without having to drill more new wells.

The threat to OPEC and its partners is that U.S. crude oil exports have risen by 235,000 barrels a day since last May, reaching a total of more than 525,000 barrels a day last week. The U.S. four-week average for exports has reached 736,000 barrels a day, an 88.6% increase over last year. As the U.S. production increases, more could — and probably will — be exported, and because WTI sells at a discount to Brent, U.S. crude is even more welcome to foreign buyers.

OPEC and its partners can’t afford to let U.S. producers get too much of the global oil trade. The Saudis, Iranians, Kuwaitis and Russians all need the hard currency that their exports provide. As long as that’s the case, it seems unlikely that a cartel-led cut will go much deeper.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.