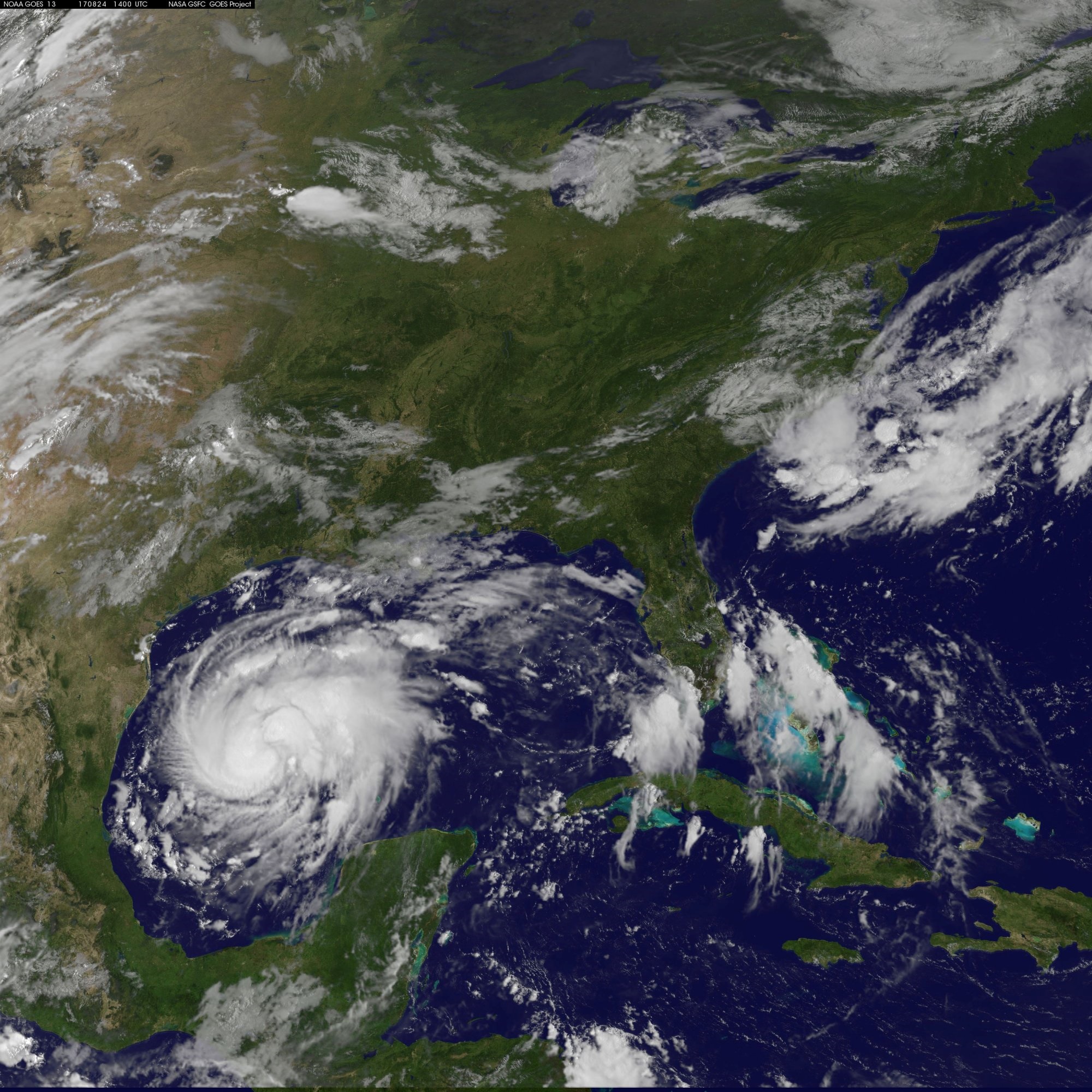

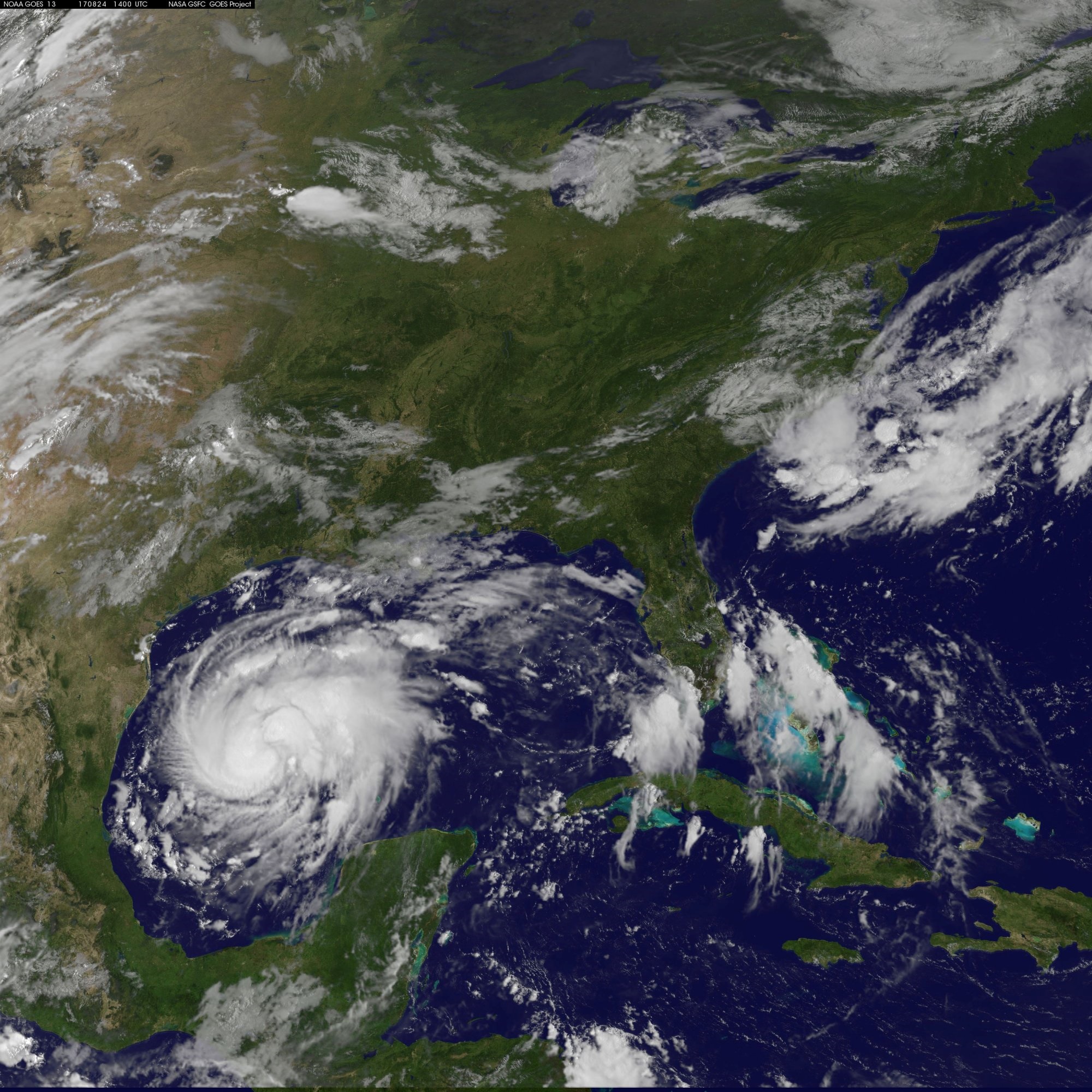

Hurricane Harvey hit the south Texas coast a week ago and the impact on the energy industry has been unusual in many respects. The price of West Texas Intermediate (WTI) crude oil dropped, unusual because when big storms plow through the Gulf of Mexico WTI prices typically run higher.

Harvey was different. The storm’s path detoured around the majority of offshore platforms and headed straight for the refineries in Corpus Christi, then Houston, and finally Beaumont and Port Arthur. As of Friday morning, just over 3 million barrels a day of refining capacity remains idle, according to S&P Global Platts.

If crude prices fell, gasoline prices have climbed. Platts reported Thursday afternoon that the contract price for September reformulated blendstock settled at $2.1399 a gallon, up 25.52 cents a gallon for the day and up more than 50 cents a gallon since last Friday. Largely that’s the result of the shutdown of the Colonial pipeline that normally delivers 1.37 million barrels a day of gasoline from Houston to New Jersey. The pipeline continues to operate, but with the daily supply of refined products down by about a sixth, deliveries are “intermittent and dependent on refinery supply.”

The good news is that refiners are preparing to restart operations. Saudi Aramco’s Motiva refinery in Port Arthur, the largest in the United States with a capacity of 600,000 barrels a day, is “preparing to start up” according to Platts, but there is no timeline yet. Flood waters have to recede before the refinery can be inspected and the restart process begun.

Energy Secretary Rick Perry authorized the release of 1 million barrels of crude to Phillips 66 for the company’s Lake Charles, Louisiana, refinery, which is running normally and had sought the release to offset the decline in deliveries due to weather-related port closures.

More good news is that the ports of Houston, Texas City, Galveston and Freeport have reopened with a few restrictions, according to Platts. The restrictions in Houston are likely to keep most tankers from using the ship channel for the time being. The port of Corpus Christi remains on schedule to reopen Monday.

The past week’s report from the U.S. Energy Information Administration (EIA) on crude oil inventories included only small part of the impact of Harvey. Next week’s EIA report should tell the bigger part of the story. Analysts at RBN Energy have taken a shot at projecting what that EIA report is likely to say. The estimates include very wide ranges of possible effects because Harvey’s impact on the energy industry was so unusual. With that in mind, here’s RBN’s take:

Our preliminary estimates for the U.S. averages for this past week are that crude oil production will be down by [0.8 million barrels per day]to 8.7 [million barrels per day (MMb/d)] reflecting about 1.2 MMb/d of production offline at the peak of the outage (mostly offshore and Eagle Ford). Imports are expected to be down by about 1.1 MMb/d to 6.8 MMb/d due to significant cargo cancellations into the Gulf Coast. Consequently, total supply is projected to be down by 1.9 MMb/d (compared to the previous week) to about 15.5 MMb/d. Refinery-run reductions are projected to peak at about 3.0 MMb/d (up to more than 4.0 MMb/d including Port Arthur/Beaumont outages that did not happen until later in the week). That works out to a decline in refinery runs of about 2.1 MMb/d for the week. Exports are projected to be down to about 0.3 MMb/d, or about 0.6 MMb/d below last week. As a result, total demand is estimated to be lower by about 2.7 MMb/d to 16.0 MMb/d, implying a storage withdrawal of about 3.3 MMbbl.

For more, check out the latest report from Platts and the RBN Energy review of the week’s events and it projections.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.