Health and Healthcare

Oppenheimer Sees Five Biotech Stocks to Buy With Potential 50% Upside, or More

Published:

Last Updated:

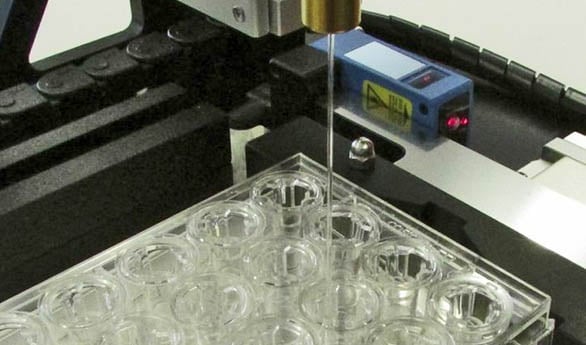

After a tremendous run the past three years, it appears that parts of the biotech sector may be poised for another year of gains in 2014. Many of the firms we cover on Wall Street are stressing stocks that have multiple clinical, regulatory and commercial catalysts for companies in their research universes. The team at Oppenheimer has a list of biotech stocks to buy that feature catalysts that could be game changers. These all have 50% or higher upside to the firm’s price target. Source: Organovo Holdings Inc.

Source: Organovo Holdings Inc.

Like the biotech stocks we recently covered that are trading under $10 with huge potential upside, the Oppenheimer list of names to buy is highlighted by smaller companies with big potential. These stocks are not as secure as their mega-cap counterparts, and not for more conservative portfolios. The top names to buy have big potential catalysts in 2014 that could move the stocks much higher. We have picked the stocks with the biggest upside potential to the Oppenheimer price targets.

Celldex Therapeutics Inc. (NASDAQ: CLDX) focuses on developing therapeutic antibodies, antibody drug conjugates, immune system modulators and vaccines. Investors are interested in Celldex because of the unmet need therapies the company is developing. Celldex is working on drug indications that include therapies for glioblastoma, breast cancer, dense deposit disease and lymphoma. A recent secondary stock offering helped shore up the company coffers. The company is expected to update its CDX-1135 drug status next month, which could be a huge catalyst. The Oppenheimer price target is set at $40. The Thomson/First Call estimate is in line at $39. Celldex closed Monday at $22.33. A move to the target would be a 65% gain for shareholders.

Immunomedics Inc. (NASDAQ: IMMU) shares jumped last week when the company announced that it won approval for two new U.S. patents. One of the patents relates to Immunomedics’ proprietary technology for targeted delivery of its SN-38 antibody-drug conjugate to tumors. It is an important win for the company. Two drugs based on SN-38 are currently in phase II clinical studies. Early results from those studies are expected in the second quarter of 2014. The Oppenheimer price target for the stock is $8, and the consensus is posted at $7.50. Immunomedics closed Monday at $4.80. A move to the target would represent a 65% gain.

Keryx Biopharmaceuticals Inc. (NASDAQ: KERX) was one of the top performing biotech stocks last year, and it may be poised to repeat the performance in 2014. The excitement stems from the success in meeting primary and secondary endpoints in phase III trials for Zerenex. The company has filed a new drug application for the drug with the U.S. Food and Drug Administration (FDA) and expects an answer by June of this year. The Oppenheimer price target for the stock is $20, and the consensus is even higher at $22. Keryx closed Monday at $12.16. A move to either target would be a gain of well over 50%.

Merrimack Pharmaceuticals Inc. (NASDAQ: MACK) will present at the prestigious J.P. Morgan Healthcare Conference in San Francisco in the middle of this month. The stock was hammered in November of last year, and six different insiders have been collectively acquiring more than 500,000 shares, at prices ranging from $3.70 to $4.80. Its top drug is MM-398m which has shown to treat pancreatic cancer in phase III trials. Fully one-quarter of patients using the drug have survived, which is a high percentage when you consider that late-stage pancreatic cancer is almost always quickly lethal. The Oppenheimer price target is $8.50, and the consensus target is at $9. Merrimack closed Monday at $5.81. A move to either target would be a 50% or greater gain.

Protalix Bio Therapeutics Inc. (NYSE: PLX) is developing novel biologics for autoimmune diseases, bioterrorism antidotes, and oral enzyme replacement therapies, as well as several biosimilars. While the joint venture drug with Pfizer, the oral ERT PRX-112, could absolutely revolutionize treatment for Gaucher disease, the company has an excellent biomanufacturing platform that could attract numerous potential partners or even an acquisition. The Oppenheimer price target for the stock is $7, and the consensus is at $5.50. Protalix closed Monday at $3.85. A move to the target would be a gain of 77%.

As we have stated before, these stocks are only for very speculative accounts. While small cap biotech names can show explosive growth, they have also been known to go to zero if their drugs are a failure. That said, some of the Oppenheimer stocks to buy have gone a long way toward FDA approval of their drugs. If they are indeed approved, the stocks could move substantially higher.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.