Health and Healthcare

Does Eiger BioPharmaceuticals Really Have 400% Upside?

Published:

Last Updated:

Liana Moussatos of Wedbush Securities assumed coverage of Eiger BioPharmaceuticals Inc. (NASDAQ: EIGR) with an Outperform rating. The old price target of $28 was also ratcheted up to $34. What is so unusual is that the prior closing price was $6.75. What is almost as unusual is that other analysts on Wall Street also have massive upside targets for this speculative stock.

Before we get into the guts of the call, understand that Eiger BioPharma is incredibly speculative. Its market cap is not quite $60 million at this time. Also, the $7.10 post-analyst call price compares with a 52-week trading range of $6.10 to $20.63.

Eiger is not for investors who need dividends. The company has no revenues, and it is not expected to have any revenues until 2019. Eiger is also among the companies likely to need more capital in the quarters ahead. After it ended the first quarter with about $49 million in cash and equivalents, Wedbush feels that this is enough capital out to mid-2018.

As far as the start of what could drive so much upside, Moussatos said in her report:

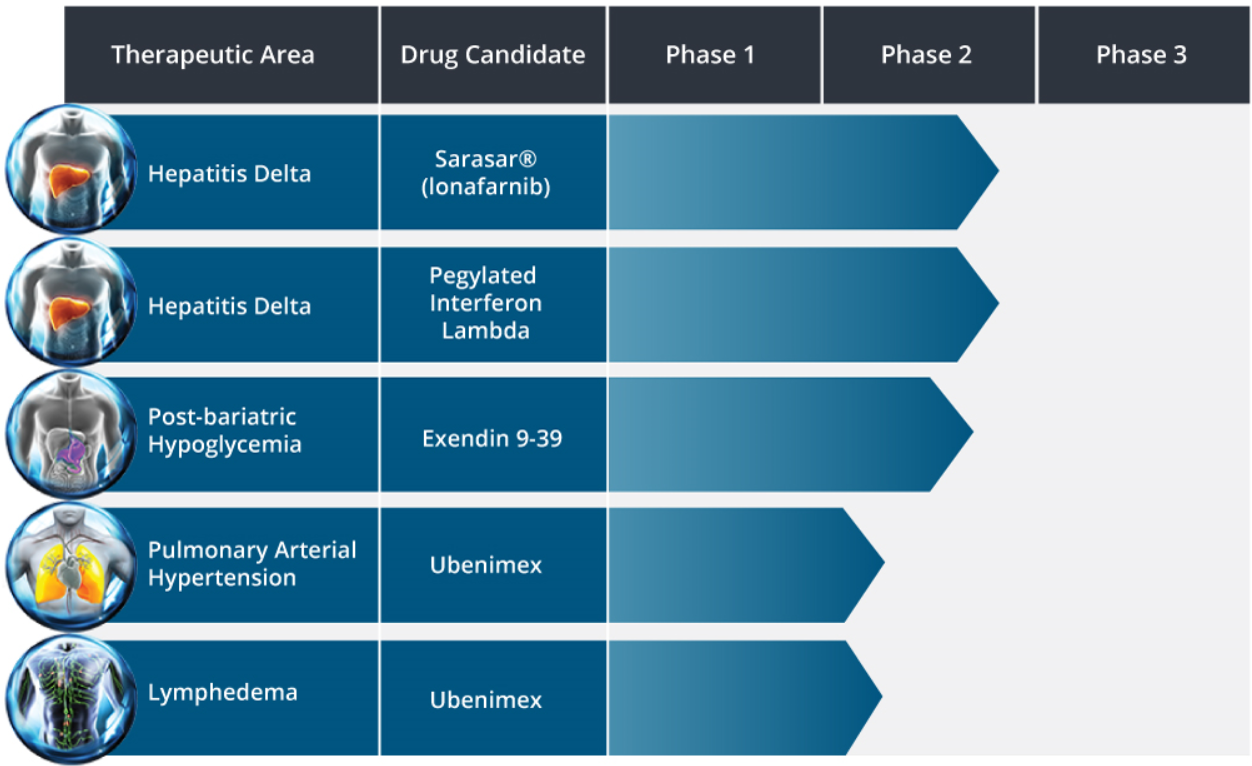

With four drug candidates being tested in four indications and enough cash runway to cover data readouts over the next 12 months, we believe Eiger BioPharmaceuticals is trading at an attractive value and recommend shares to investors.

Investors need to know why an analyst can see 400% upside. One reason is that Eiger BioPharma could be sitting on perhaps more than one blockbuster drug (that is, having more than $1 billion in annual sales). That being said, it might be many years before the blockbuster status is ever seen. And of course there are no assurances that the drug will be that great or that the U.S. Food and Drug Administration will allow it make it to market.

Wedbush’s report said that lonafarnib and pegylated interferon lambda lead the way in targeted hepatitis D virus (HDV) therapy. The lead product candidate is lonafarnib, a prenylation inhibitor with potential to become backbone treatment for HDV. The report said:

Recently in-licensed pegylated interferon lambda (PEG-IFN) is a Type III IFN that is potentially better-tolerated than pegylated interferon alfa-2a (PEG-IFNa2a). Recent results suggest to us these two product candidates especially in combination may provide a chronic and potentially curative regimen for HDV. We project more than $1 billion in WW gross peak annual sales for lonafarnib and more than $600 million for PEG-IFN.

Additional data was represented by Wedbush as follows:

Again, Eiger BioPharma is more speculative than most speculative stocks. Wedbush’s present day fair value is based on a sum-of-parts analysis, and each of those parts was given a value calculated using a 30% annual discount from Wedbush’s net peak annual sales estimate to present day for each product. The firm then applied a 1-10x multiple, depending on stage of development, to reflect risk. Again, highly speculative.

Eiger BioPharma shares have a 52-week trading range of $6.10 to $20.63. Eiger is thinly followed by Wall Street firms, but here are some of the other most recent targets and ratings from other firms:

Oppenheimer’s rating is Outperform with a $34 target price. The firm noted on June 13:

Positive data were presented at the ADA from 19 of 20 patients in the Ph2 multiple-ascending dose (MAD) study evaluating subcutaneous (SC) exendin 9-39 in post-bariatric surgical patients who experience dangerously low, postprandial hypoglycemia known as post-bariatric hypoglycemia (PBH). Interim results from 11 of 20 patients (up to 3 days of dosing) were recently reported. A liquid and a lyophilized formulation of SC exendin 9-39 were evaluated in this MAD study. Results show dose-dependent improvements in postprandial hyperinsulinemic hypoglycemia and substantial reductions in the associated symptoms. Treatment showed prevention of neuroglycopenia, with no need for rescue at doses ≥ 18mg. The liquid exendin 9-39 formulation appears to have several benefits over the lyophilized version.

Jefferies has a Buy rating and a $27 target price. The firm said on June 14:

EIGR and Stanford presented ph.II MAD data at ADA for exendin 9-39 in PBH — the cut included new SC lyophilized and some SC liquid ormulation data. Generally, the results show a dose response and are consistent with ADA 2016 results, though small patient numbers may impact interpretation some. With a 3Q update on the liquid form, there should be enough data to start a LT ph.II. With the add’l newsflow in 2H17/1H18, we see EIGR as attractive at current levels.

Piper Jaffray has an Overweight rating and an even higher target price of $36. The firm said on June 12:

Eiger presented Phase II multiple ascending dose on Exendin (9-39) in 19 patients who received previous Roux-en-Y Gastric Bypass (RYGB) at the American Diabetes Association (ADA) conference over the weekend. Novel liquid subcu Exendin was comparable to the lyophilized formulation in terms of efficacy with potentially enhanced pharmacokinetics (PK) to enable less frequent and/or lower dosing. Eiger will start a Phase II study of this formulation in 4Q:17. Sarasar (lonafarnib) in Hepatitis Delta Virus (HDV) remains the lead candidate with a 48-week LOWR HDV-5 study start soon. We look forward to Phase II LIMT IFN-lambda data at AASLD and FDA discussion regarding registrational path in 4Q:17. Ubenemix Phase II read-outs are expected in early’18. Eiger ended 1Q:17 with cash of $49 million, including a $15 million Oxford term loan, funding the company into mid’18.

Eiger BioPharma was founded in 2008 and is now the post-merger surviving name of Celladon. As of December 31, 2016, Eiger had a total of 20 full-time employees in the United States, 13 of whom were primarily engaged in research and development activities, and seven of whom were engaged in general management and administration. Eiger’s 10-K report said that eight employees have either an M.D. or a Ph.D. Its research and development expenses were $33.0 million in 2016, $8.1 million in 2015 and just $0.6 million in 2014.

See Eiger BioPharma’s drug candidate pipeline below:

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.