Investing

Detailed Google Earnings Preview (GOOG, MMI, YHOO, AOL)

Published:

Last Updated:

Google Inc. (NASDAQ: GOOG) is set to report earnings after the close of trading today and this will set up how the investing world is willing to value content and online advertising for the next quarter. Always remember that revenues to be used ar ex-TAC to remove traffic acquisitions costs. This is also effectively the first real call since the announced acquisition of Motorola Mobility Holdings, Inc. (NYSE: MMI).

Google Inc. (NASDAQ: GOOG) is set to report earnings after the close of trading today and this will set up how the investing world is willing to value content and online advertising for the next quarter. Always remember that revenues to be used ar ex-TAC to remove traffic acquisitions costs. This is also effectively the first real call since the announced acquisition of Motorola Mobility Holdings, Inc. (NYSE: MMI).

Thomson Reuters has estimates of $8.74 EPS and $7.21 billion in revenue; next quarter estimates are $10.02 EPS and $8.1 billion in revenue but keep in mind that Google does not offer guidance.

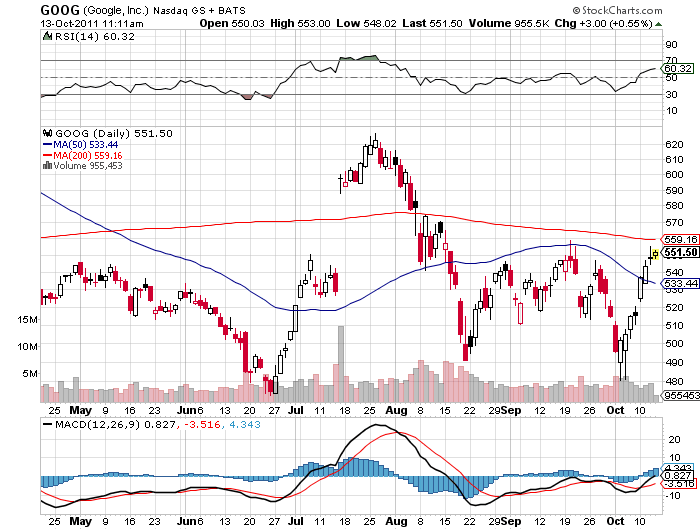

Google is important because of many reasons, but we recently featured it as one of twelve stocks which has more implied upside than Apple Inc. (NASDAQ: AAPL). Shares are up even more and now the stock is flirting with a $550 price against a 52-week range of $473.02 to $642.96. Analysts still have a consensus price target of $719.33 for the stock, a price that is more than $75 higher than its 52-week high. Google peaked around $620 in July.

We still use monthly options for pricing expected moves, and the closest puts and calls imply an expected move of up to about $20 to $22 in either direction. You already know that Google’s chart has been literally all over the map as you can see here from the Stockcharts.com chart. This peaked above $620 in July and bottomed around $490 in August and as recently as last week. Now the stock is looking overbought and is approaching what was serious resistance in mid-September.

We still use monthly options for pricing expected moves, and the closest puts and calls imply an expected move of up to about $20 to $22 in either direction. You already know that Google’s chart has been literally all over the map as you can see here from the Stockcharts.com chart. This peaked above $620 in July and bottomed around $490 in August and as recently as last week. Now the stock is looking overbought and is approaching what was serious resistance in mid-September.

The current price is nestled exactly between the key long-term moving averages we track. The 50-day moving average is down at $533.44 and the key 200-day moving average is up at $559.16.

With AOL Inc. (NYSE: AOL) and Yahoo! Inc. (NASDAQ: YHOO) as a merger rumor, a rumor which might have more problems than not, we believe that investors will take at least some secondary or tertiary looks at both content companies after the Google earnings.

JON C. OGG

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.