New Dow Stocks Dominating the Dow: Technical Worries

February 3, 2014 by Cgblaine22

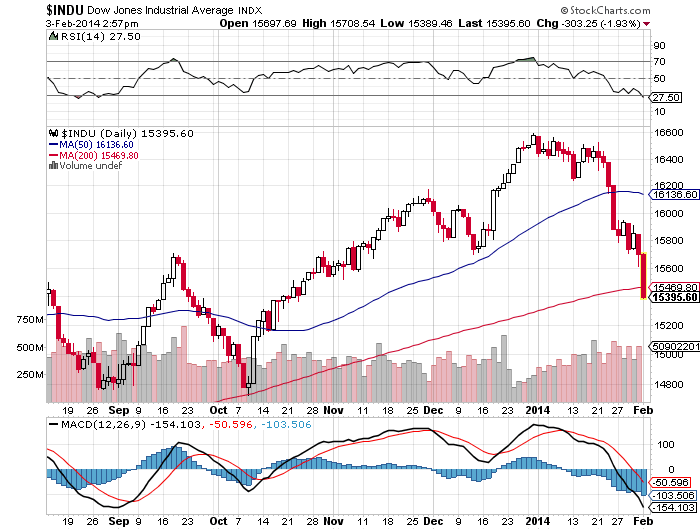

Market technicians, or chart readers for the rest of us, are paying close attention to the current levels of the market. More specifically, the key 200-day moving average has come into play on Monday.

The indexes were at their lowest levels since late October. The NASDAQ Composite Index had tumbled 107 points to 3,997. The Nasdaq hasn’t closed under 4,000 since Nov. 25.

The Dow has been the most volatile of the three major averages this year.

The Dow was trading under its 200-day simple moving average Monday for the first time since Dec. 2012. Its 14-day relative strength index, a measure of momentum, was at 28. A reading below 30 suggests the index has fallen too far too fast, and a rebound may not be far off.

Five Dow stocks appear to be responsible for 100 points of Monday’s decline: IBM Corp. (NYSE: IBM), 3M Corp. (NYSE: MMM), United Technologies (NYSE: UTX); Goldman Sachs Group Inc. (NYSE: GS) and Visa Inc. (NYSE: V).

Goldman Sachs and Visa joined the Dow only last fall. Because these are high priced stocks they are contributing to the added volatility. In 2013, the Dow was up 26.5%, compared with 29.6% for the S&P 500 and 38.3% for the NASDAQ.

The Dow is a price weighted index. So, the higher a stock price of one of its members, the greater the effect on the index. Goldman was trading at around $160, with Visa at about $213. IBM, now at about $173, had been the index highest-price stock for years.

Five stocks — Goldman Sachs, 3M, IBM, Chevron Corp. (NYSE: CVX) and Boeing Co. (NYSE: BA) — are responsible for more than 450 points of the Dow’s 1,150-point loss for the year. Add in Visa, the total reaches 527 points, or 46% of the Dow’s point loss.

Where things get real interesting is that the top 5 of the 30 Dow stocks by weighting account for more than 33% of the entire index. If the weighting was an equal-weight barometer, then that is twice as much as the weightings should be.

Another issue is that the entire bottom half of the index do not even come to a total weighting that matches the top five weighted members. IndexArb.com reports the following weightings:

- Visa 8.81%

- IBM 7.23%

- Goldman Sachs 6.71%

- 3M 5.24%

- Boeing 5.12%

The chart from stockcharts.com represents exactly what the key issue is on the Dow. That 200-day moving average held when tested back in October. That was during the government shutdown. Now we have China, emerging markets, and a much needed stock market correction driving the pressure here.

For the DJIA to hit a 10% correction, that index has to hit 14,929.38. A 10% correction in the S&P 500 Index does not come into play until 1,665.75 – which is almost exactly 1,000 points higher than the crush depth bottom back in March of 2009.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.