On a crazy earnings week when the market roller-coaster returned, and a warning from Carl Icahn raised some eyebrows, insider buying firmed some. Much of April has been plagued by very slow insider transactions, as the silent period has closed windows for executives and institutional holders to buy and sell shares. That window is starting to open and we saw some massive buys this week.

We cover insider buying every week at 24/7 Wall St., and we like to remind readers that while insider buying is usually a very positive sign, it is not in of itself a reason to run out and buy a stock. Sometimes insiders and 10% owners have stock purchase plans set up at intervals to add to their holdings. That aside, it still remains a positive indicator.

Here are some of the companies that reported notable insider buying this past week.

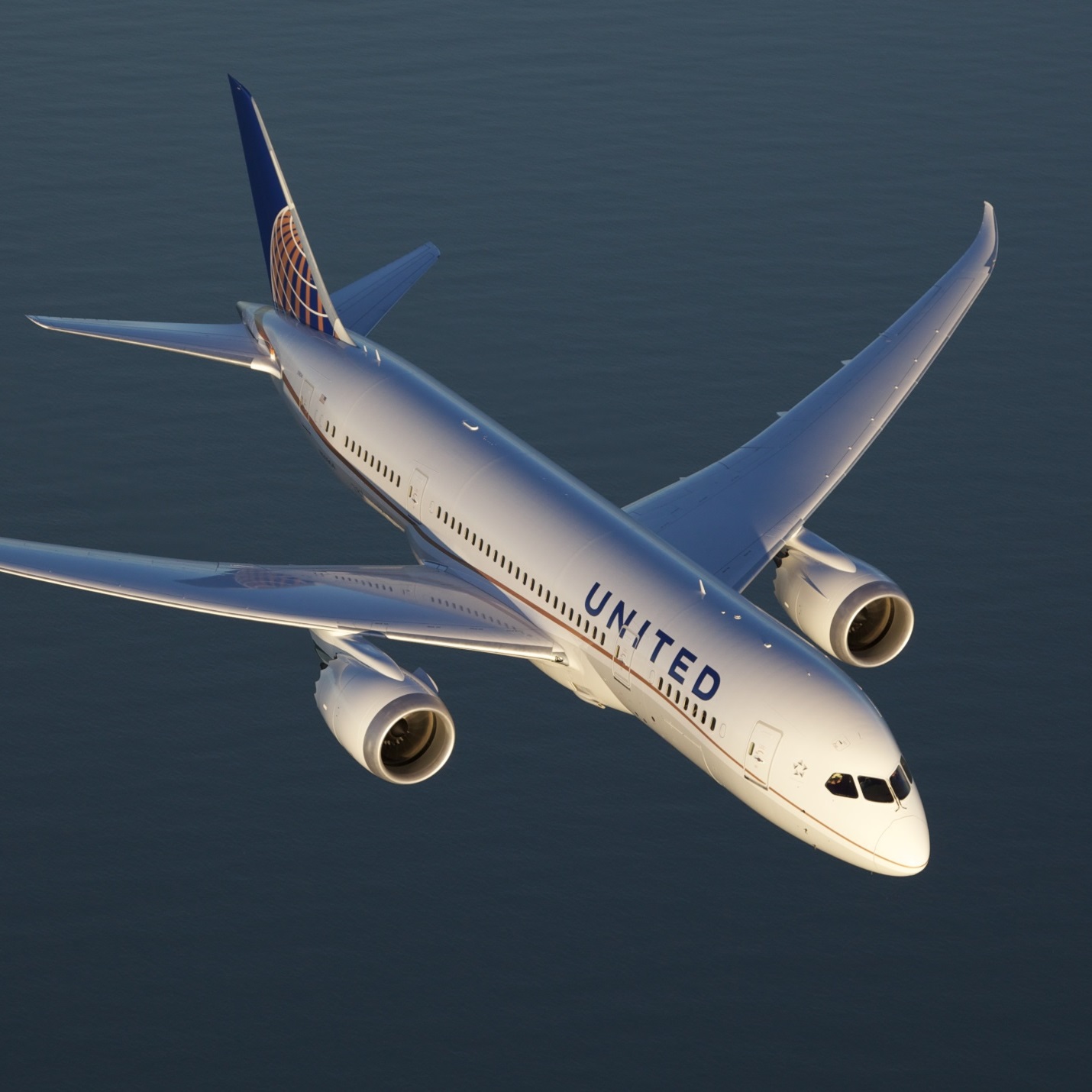

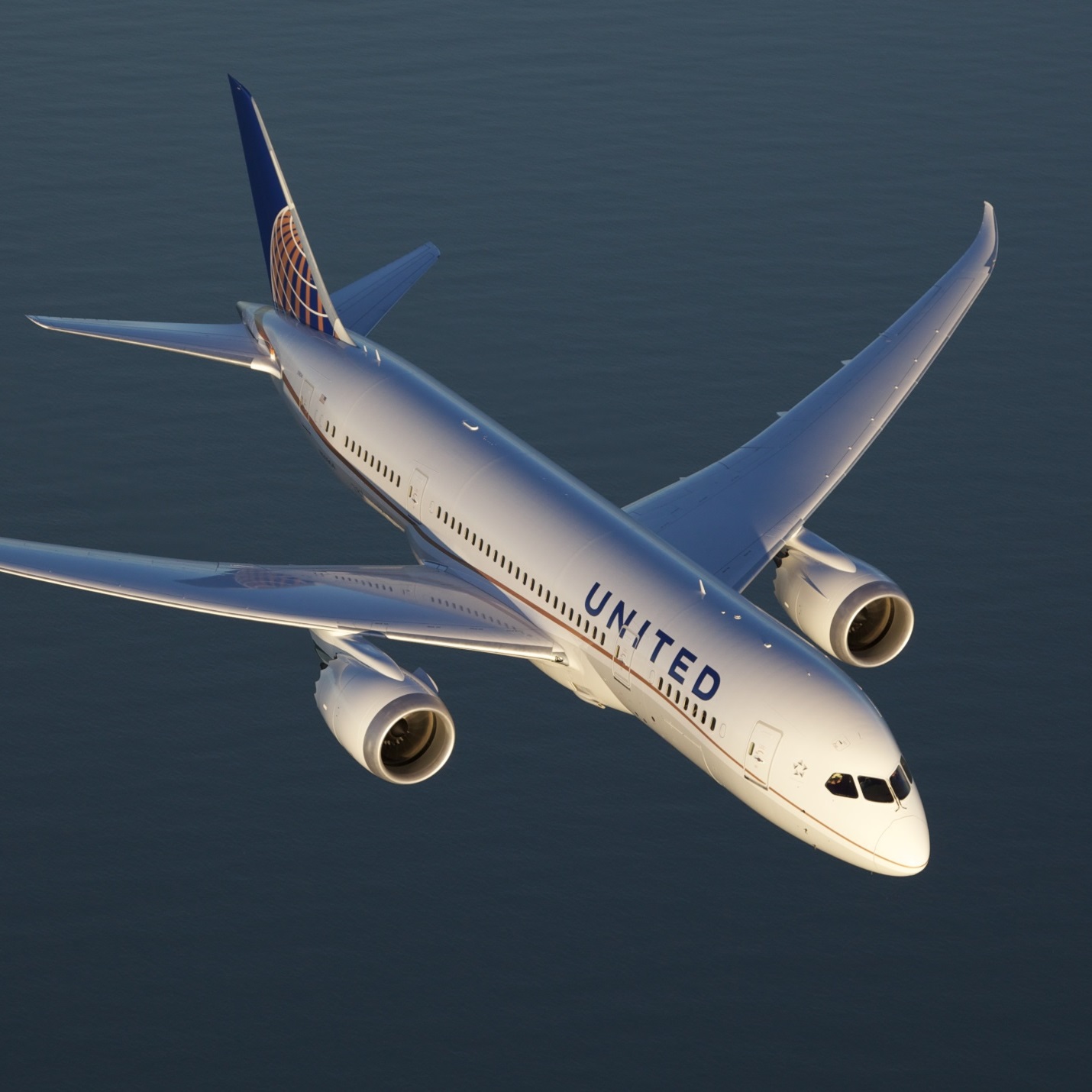

United Continental Holdings Inc. (NYSE: UAL) has finally resolved some issues with activist investors and the buying was heavy this week. A director at the firm Par Investments bought a massive 1,905,000 shares of the stock at prices between $50.76 and $54.04 a share. The total for the huge purchase came to a stunning $100 million. In addition, the chief executive officer purchased 19,800 shares at $50.53, at a cost of just over $1 million. Also buying shares were the chief operating officer, chief financial officer, three directors and an executive vice president, who bought 22,000 shares at prices that ranged from $48.38 to $49.90. The total for that buy came in at $1 million. And it appears to be better timed as shares closed on Friday at $45.83.

Mattress Firm Holding Corp. (NASDAQ: MFRM) hits our screens again, and the same company continues to add shares to its position. Berkshire Partners, which is a 10% owner of the company, bought an additional 165,000 shares at prices between $41.08 and $41.50. The total for this purchase came in right at $7 million. The stock closed Friday at $39.02, so the timing again looks early, but the firm has been scale buying stock for weeks now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.