Investing

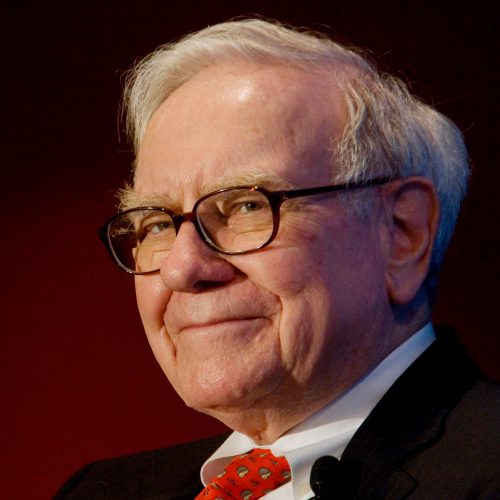

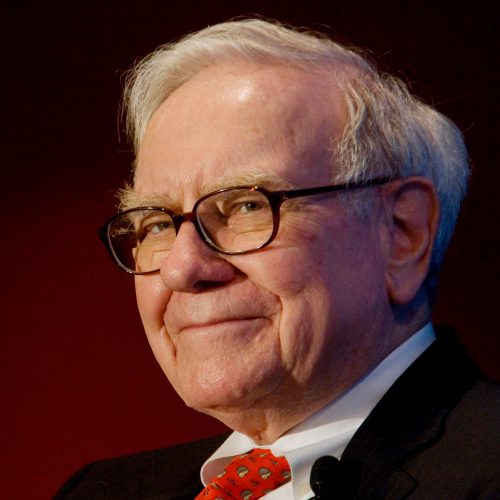

Major Changes in Warren Buffett Holdings as Berkshire Announces Earnings

Published:

Last Updated:

Berkshire Hathaway Inc. (NYSE: BRK-B) announced earnings. Operating earnings were $4.607 billion, in the second quarter up from $3.890 billion in the same period last year. The report showed an increase of the value of investments to $380 million from $236 million in the year ago quarter.

24/7 Wall St. recently looked at the changes in Buffett’s portfolio in the last reported quarter, in an article entitled Major Changes Seen in Warren Buffett and Berkshire Hathaway Stock Holdings — Including Apple.

Goldman Group Inc. (NYSE: GS) was the same stake of 10.959 million shares, but this had been as high as 12.631 million shares prior to the end of 2015.

Graham Holdings Co. (NYSE: GHC) remains the same tiny stake in what is just the remains of Washington Post breakup. It was 107,575 shares.

The total public stock holdings from the full 13F-HR filing do not include the full dollars held in preferred shares. This would otherwise include preferred shares of Dow Chemical Co. (NYSE: DOW) in 2009 and Bank of America Corp. (NYSE: BAC) from back in 2011. It also no longer includes Precision Castparts, now that Buffett’s acquisition of that company has been completed.

American Express Co. (NYSE: AXP) has been listed as the same 151.6 million shares for years now, and it was worth $9.31 billion at the end of March. Buffett has now held on to American Express shares so long he probably worries about the capital gains tax he would pay versus how much Amex shares have fallen from their highs.

Apple Inc. (NASDAQ: AAPL) was listed as a NEW POSITION, with 9,811,747 shares worth some $1.069 billion at the end of the first quarter. Apple’s stock price has fallen since, and it is worth noting that a $1 billion stake in Apple is larger than most of the portfolio managers place for their first purchase. Still, this was a stake taken by one of Buffett’s portfolio managers rather than Buffett himself. While added after the disclosure, here are 11 crucial things to consider about Team Buffett’s stake in Apple.

Coca-Cola Co. (NYSE: KO) was the same stake of 400 million shares, and the value was listed as $18.55 billion. This has remained static for many years and dates back to when he started buying Coca-Cola in the 1980s. Buffett’s cost basis must be nearing zero, if you include the dividends.

International Business Machines Corp. (NYSE: IBM) was again a larger stake as Buffett himself keeps averaging his cost basis lower. The latest stake is 81.232 million shares, worth some $12.3 billion on March 31. Despite a handy bounce from the lows, IBM has remained a serious thorn in Mr. Buffett’s side – particularly as this stake was his own choosing.

This stake has been raised and raised, but it had been kept static at 81.03 million shares as of December 31. This IBM stake was about 79.5 million shares as of the end of last June, and the end of 2014 position was 76.971 million IBM shares.

Wells Fargo & Co. (NYSE: WFC) was the same stake of 479.704 million shares, versus the end of 2015. That stake was grown in the fourth quarter from 470.29 million shares at the end of September. Buffett has grown his stake through time, but at a slower rate in the past year or more.

Increasingly closer to being a 10% holder, Buffett may be at the point that it is harder to grow that stake without more regulatory and more governance issues. The value of the Wells Fargo stake at the end of March was $23.2 billion. History has shown that Buffett would like to just keep buying and buying this stock.

Other key holdings, which are nearly 40 more top stocks, have been tallied below in detail.

Kraft Heinz Co. (NYSE: KHC) was listed as 325,634,818 shares, identical to the stake at the end of 2015. This stake is from the 3 Capital deal and was worth some $25.58 billion at the end of March, but it has been suggested it may be coming down ahead after June.

Phillips 66 (NYSE: PSX) the same 75.55 million shares in March, but Buffett’s stake is now over 10%, which makes it harder to add or sell shares without regulatory filings. The new value was $6.5 billion. This stake previously had been classified as an elimination in 2015 and then was shown after Buffett got the stake classified with the SEC as confidential.

AT&T Inc. (NYSE: T) was no longer listed as a stake held by Berkshire Hathaway, after having been diminished previously. It really tied back to a stake of DirecTV before the AT&T-DirecTV merger with a stake of 59.32 million shares initially. As of the end of 2015, AT&T’s stake was down by 12.74 million shares to 46.577 million shares.

Kinder Morgan Inc. (NYSE: KMI) was the same stake of 26,533,525 that it was at the end of 2015. This one bounced handily and was selected by one of Buffett’s portfolio managers rather than on his own. This was an admitted stance from Mr. Buffett.

Axalta Coating Systems Ltd. (NYSE: AXTA) was the same stake of 23.324 million shares, after having been listed as a new position of 20 million shares.

Bank of New York Mellon Corp. (NYSE: BK) was 20.112 million, roughly the same as the prior quarter, but versus 24.6 million shares in the past.

Charter Communications Inc. (NASDAQ: CHTR) was a slightly larger stake at 10.326 million shares, up from 10.281 million at the end of 2015. It previously had been 8.51 million shares, and having been viewed even lower prior to that. Charter was made a new stake in 2014.

Costco Wholesale Corp. (NASDAQ: COST) was the same stake at 4,333,363 shares.

DaVita Inc. (NYSE: DVA) was a larger stake of 20.827 million shares. This is up from 38.565 million shares in 2015. This DaVita stake was raised on and off in prior quarters, but Buffett already had entered into a standstill agreement not to buy more than 25% of the company.

Deere & Co. (NYSE: DE) was a slightly larger stake of 23.28 million shares. This was listed as 22.884 million shares at the end of 2015, after some 5.83 million shares had been added at the end of last year. It had been lowered to 17.052 million shares previously, and 17.31 million shares that had been there in June and previously.

General Electric Corp. (NYSE: GE) was the same stake of 10.585 million shares. This stake was raised in 2014 and had been telegraphed before because of the warrants.

General Motors Co. (NYSE: GM) was a the same stake of 50 million shares, but this previously had been raised from 41 million shares.

Johnson & Johnson (NYSE: JNJ) was the same tiny stake of only 327,100 shares, but Buffett watchers know this is a leftover bit from a much larger stake in years past.

Lee Enterprises Inc. (NYSE: LEE) was the same tiny stake of only 88,863 shares.

Liberty Media Corp. (NASDAQ: LMCA) and Liberty Global PLC (NASDAQ: LBTYA) are both again listed as Buffett and Berkshire Holdings. These are counted as Class A and Class C shares, so we will leave this stakes simplified just like that.

M&T Bank Corp. (NYSE: MTB) was the same position at 5.38 million shares — same as always.

MasterCard Inc. (NYSE: MA) was listed as 4.934 million shares, worth some $466 million, but this was 5,229,756 shares at the end of 2015.

Media General Inc. (NYSE: MEG) was the same-sized stake at 3.471 million shares at the end of 2015. Just keep in mind that this was down from what had been a static position of 4.64 million shares.

Mondelez International Inc. (NASDAQ: MDLZ) is the same position again at 578,000 shares. This stake remains handily lower than in the past, dating back to the Kraft breakup.

Moody’s Corp. (NYSE: MCO) was the same position of 24.669 million shares yet again, but this stake is still lower than in years past.

NOW Inc. (NYSE: DNOW) was the same stake of 1.825 million shares.

Procter & Gamble Co. (NYSE: PG) is finally reflected as the lower stake of only 315,400 shares. This had previously been listed as almost 52.8 million shares in the prior formal 13F report. We expected it to be part of the Duracell swap, and P&G also previously had been lowered in 2012 after a peak of 96.3 million shares.

Restaurant Brands International Inc. (NYSE: QSR) was the same stake at 8.438 million shares, but it was a new stake in late 2014. The reality is that this is much larger if you consider the preferred shares:

On December 12, 2014, we acquired Class A 9% Cumulative Compounding Perpetual Preferred Shares of RBI having a stated value of $3 billion and common stock of RBI for an aggregate cost of $3 billion. RBI, domiciled in Canada, is the ultimate parent company of Burger King and Tim Hortons. As of the acquisition date, our combined investment in RBI possessed approximately 14.4% of the voting interests of RBI. The RBI Preferred is entitled to dividends on a cumulative basis of 9% per annum plus an additional amount that is intended to produce an after-tax yield to Berkshire as if the dividends were paid by a U.S.-based company.

Sanofi (NYSE: SNY) was the same position at 3.905 million shares.

Suncor Energy Inc. (NYSE: SU) was the same 30 million share stake, but this used to be a smaller stake at 22.35 million last June. The stake had been increased in late 2014, and it had grown each quarter from the 13 million shares in March of 2014.

Torchmark Corp. (NYSE: TMK) the same stake at 6.353 million shares.

Twenty-First Century Fox Inc. (NASDAQ: FOXA) was the same stake of 8.951 million shares at the end of 2015. Its stake had previously been raised from 6.228 million shares in prior reports, versus 4.747 million shares at the end of 2014

U.S. Bancorp (NYSE: USB) was the same position of 85.06 million shares in March, versus 2015, but that stake had been raised slightly in June versus the 83.77 million shares at the end of March. That has grown from 80.09 million shares at the end of 2014.

USG Corp. (NYSE: USG) was the same stake at just over 39 million shares, but this had been raised prior to the end of 2014.

United Parcel Service Inc. (NYSE: UPS) was the same tiny position at 59,400 shares. The UPS stake is way down from 2012.

VeriSign Inc. (NASDAQ: VRSN) was a tad larger at 13.044 million shares, up from a stake that had been static at 12.985 million shares. This one had previously grown in 2014.

Verisk Analytics Inc. (NASDAQ: VRSK) was the same position at 1,563,434 shares, but that is lower than in prior quarters.

Verizon Communications Inc. (NYSE: VZ) was the same stake at 15 million shares at the end of March, but that had been raised a year earlier.

Visa Inc. (NYSE: V) was a raised stake of 10.239 million shares at the end of March, up from 9.885 million shares, but the Visa stake had risen throughout 2014.

WABCO Holdings Inc. (NYSE: WBC) is again slightly lower at 3.237 million shares. It was previously listed as 3.331 million shares, down from 3.559 million shares at the end of September and down from 3.78 million shares previously. At one point the stake was over 4 million shares.

Wal-Mart Stores Inc. (NYSE: WMT) was a stake that was decreased by 949,430 to some 55,235,863 shares, worth $3.78 billion at the end of March. That stake was 56.185 million shares at the end of 2015, the same versus September. This stake had previously been lowered as well, from 60.385 million shares at the end of June and after having been raised prior to 2015.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.