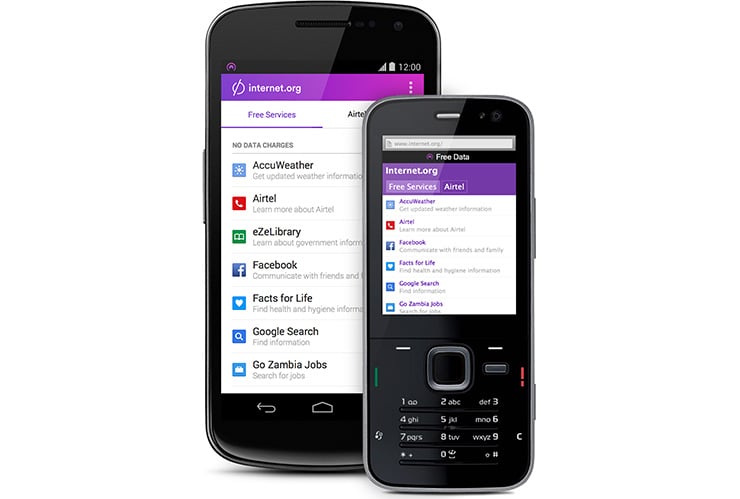

Facebook Inc. (NASDAQ: FB) got two more solid thumbs-up this past week from key analysts covering the stock. Cantor Fitzgerald called Facebook a top pick when it reiterated its Buy rating. Merrill Lynch featured Facebook among a catalyst-driven set of calls as well. Source: Internet.org

Source: Internet.org

Youssef Squali of Cantor Fitzgerald also raised his price target to $100 from $92 on Wednesday. Two of the driving forces were a relatively attractive value of the equity and the company’s top position and mass reach with advertisers that can offer personalized marketing on a broad scale.

The Cantor Fitzgerald call also talked up Facebook’s ownership of WhatsApp, Instagram, Oculus and Messenger. These can all be future drivers and revenue-enhancing tools for the company. In fact, it was expected that Instagram may directly and indirectly add $2.5 billion to sales in this year alone.

Cantor further sees Facebook leading the transition of marketing and ad spending as it is expected that Internet ad spending is expected to pass television ad and marketing by 2020. Part of this is being driven by video use on Facebook expanding, bringing on faster video advertising at the same time. Squali’s $100 price target may not be the best target out there, but it is above the consensus target.

ALSO READ: 6 Analyst Stocks Picked to Double

Facebook remains the king of social media and is the top media pick at Merrill Lynch. Given Instagram, Premium video and Graph Search capabilities, some analysts feel that the company can drive revenue growth even without a huge increase in advertising placement.

The Merrill Lynch analysts point to the fact that Facebook remains the top beneficiary of the adoption of mobile Internet trends, with total U.S. Internet time spent on Facebook and Messenger up 19.6% in May. Other key metrics continue to drive interest. A big help here is that no viable challengers seem to be anywhere in sight. Merrill Lynch pointed to positive monthly data use, easier growth comparisons and positive data on ad revenue drivers as the top catalysts.

Facebook also recently announced a willingness to share ad revenue to acquire premium content, a totally new avenue for the company — and to take content away from Google’s YouTube by offering contributors 55% of the revenue from ads that appear alongside videos. This is yet another step forward for the company as it builds a hedge to the social media train that at some point may hit critical mass.

The Merrill Lynch team raised its price target on the stock to $105 from $95, higher than the $97.33 consensus price target at the time.

ALSO READ: The Worst American Companies to Work For

Facebook shares closed at $87.29 on Thursday, within a 52-week trading range of $62.21 to $89.40. It has taken a long time and was painful for part of the way, but Facebook’s debacle around its initial public offering sure seems like it is now water under the bridge. The successful move to mobile was just one large part of the driving force behind Facebook’s gain.

Facebook’s average (mean) target is $97.76, and its median analyst price target is $97.50. The absolute highest price target is the $120.00 target from Piper Jaffray.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.