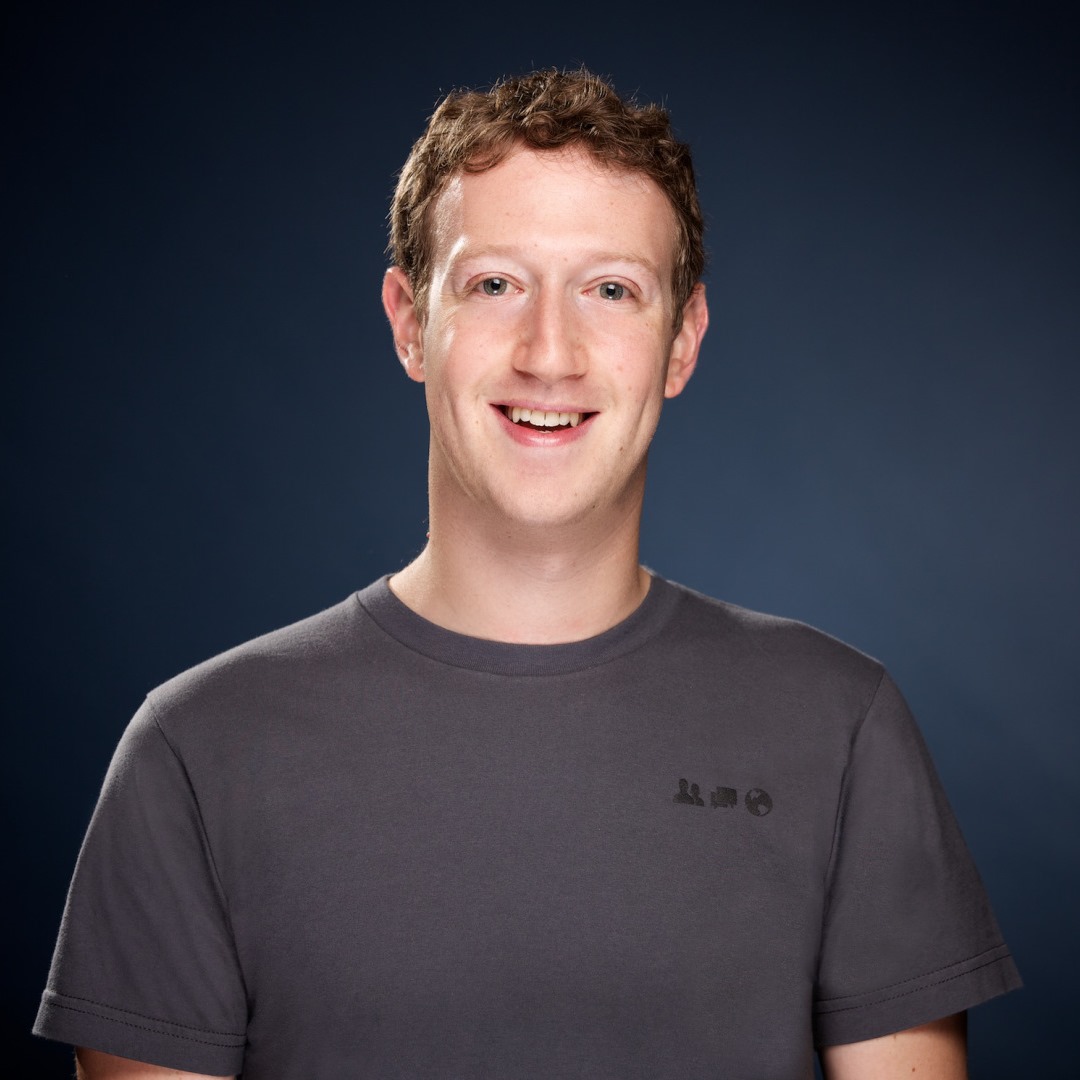

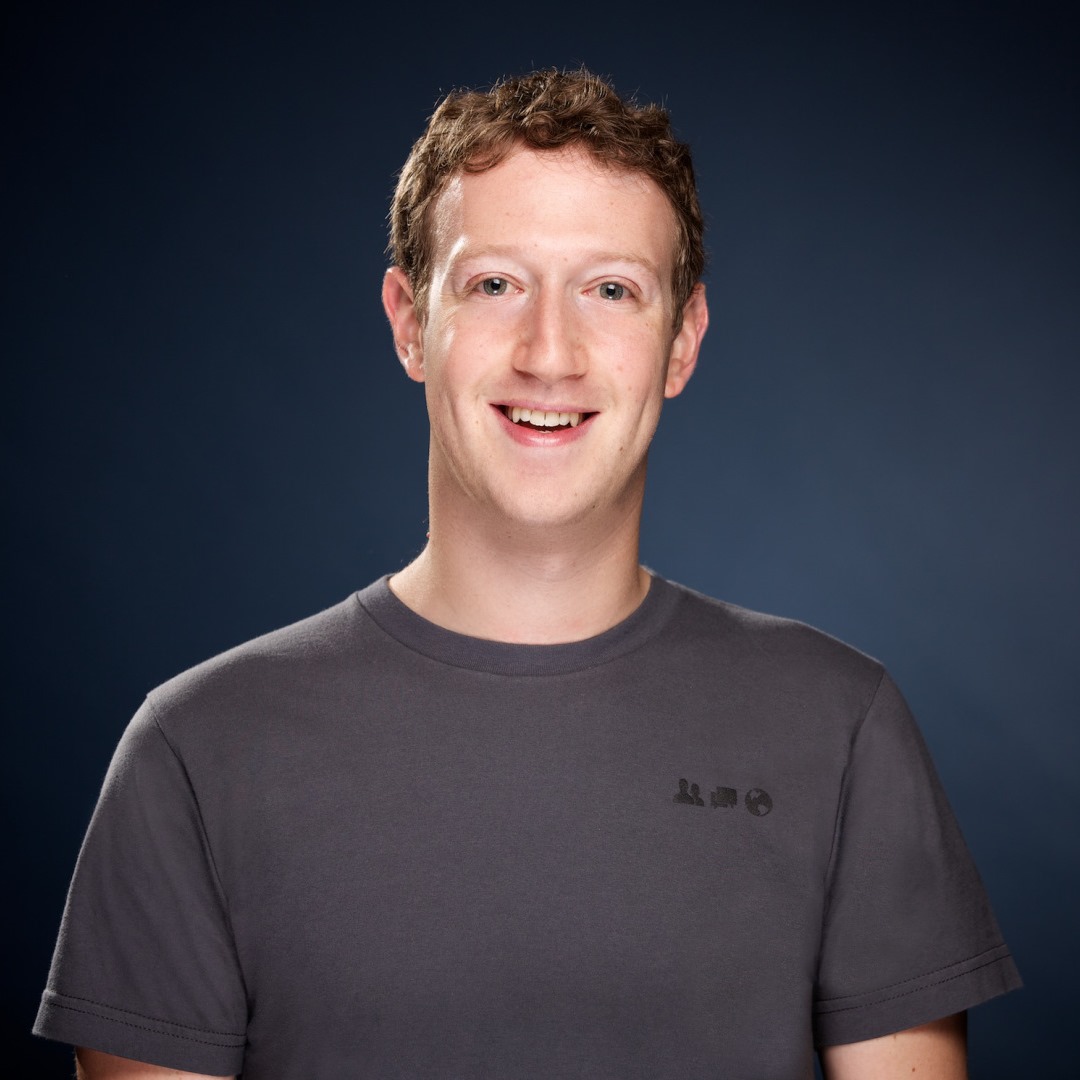

When Facebook Inc. (NASDAQ: FB) holds its annual shareholders’ meeting Thursday, June 1, one item some stockholders will be pushing is stripping Mark Zuckerberg of his role as Chairman of the Board of Directors. As the saying goes, good luck with that.

Zuckerberg holds a majority of Facebook’s voting stock and unless he votes to fire himself, there’s no way that he can be replaced. The company’s plan is to create a new class of shares that would allow Zuckerberg to extend his control of Facebook even though he plans to give away 99% of his financial stake in the company.

The actual proposition that Facebook shareholders will be voting on calls for the board to adopt a policy to require that its chairman be an independent member of the board. The proposition is designated as Proposal Seven in Facebook’s proxy statement and has been endorsed by Institutional Shareholder Services (ISS), a well-respected firm that consults with institutional investors on governance-related risks in publicly traded companies.

The proposal was put forward by SumOfUs, a self-described international consumer watchdog, that has supported petitions demanding that Amazon stopping advertising at alt-right website Breitbart.com.

ISS has assigned a corporate governance score of 10 to Facebook, indicating the highest level of risk according to SumOfUs. In a letter to shareholders, SumOfUs cites the ISS report:

ISS has identified a number of governance issues which suggest that shareholders would benefit from more independent board oversight in the form of an independent chair. The company has a multi-class capital structure which is not in the best interests of all shareholders. The board is not substantially independent, and there is no formal nominating committee. An independent chairman would serve as a more effective counterbalance to the current leadership structure and provide unaffiliated shareholders with a stronger form of independent board oversight and leadership. As such, a vote for this proposal is warranted.

Under the company’s plan to create new Class C shares, holders of Facebook’s Class A and Class B shares would receive two Class C shares for each of the other shares they hold. Class C shares would trade publicly under a new ticker symbol. The economic effect is a three-for-one stock split, but the change would solidify Zuckerberg’s hold on more than 50% of shareholder voting power. The plan to create new Class C shares is being challenged in court and is set for trial in September.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.