Retail

Shopping at Wal-Mart Now Massively More Affordable Than Target and Peers

Published:

Everyone loves saving money. Be it at grocery stores, gas stations, retail outlets, and on and on. Wal-Mart Stores, Inc. (NYSE: WMT) has made a career of being the cheapest seller or being the best value for consumers for years now. It turns out that the discount by shopping at Wal-Mart, or the premium shopping elsewhere, is approaching the widest levels in years. Source: courtesy of Wal-Mart Stores Inc.

Source: courtesy of Wal-Mart Stores Inc.

Credit Suisse’s Michael Exstein, Charlene Wong, and Anjani Vedula may have maintained their Outperform rating and $95 price target on Wal-Mart, but their report from Tuesday was really a longer-term view on Wal-Mart’s pricing gap to competitors.

The Credit Suisse team believes that there are just no signs at all that Wal-Mart is giving up its relative price advantage to it competition. Credit Suisse has conducted its Monthly Mass Channel Pricing Survey since February 2006. Its finding makes you wonder why the ‘Always Low Prices’ mantra is now listed as ‘Making it easier to save more today, for a better tomorrow.’

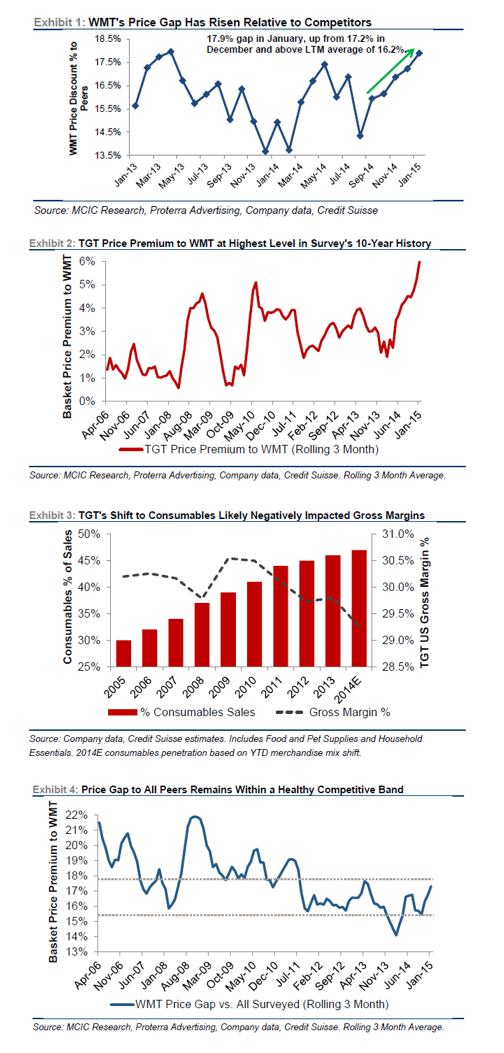

The Credit Suisse report indicated that Wal-Mart had the lowest total basket price for consumables over the past decade. And more recently, the gap between Wal-Mart and its competitors improved for the fifth consecutive month. This rose to 17.9% in January, versus 17.2% in December and versus the one-year average of 16.2%.

Exstein and his team of analysts showed that Wal-Mart may be more competitive on pricing than investors appear to be giving it credit for. Wal-Mart’s price advantage to Target Corp. (NYSE: TGT) was shown to be at the highest level in the survey’s history. The team noted:

As Target increased its consumables merchandise penetration, the company appears to have attempted to offset the margin pressure by being less of a ‘close follower’ to Wal-Mart pricing … Our survey basket price premium at Target expanded to 6.9% in January, above the twelve-month average of 4.2%. Note that our survey does not incorporate the 5% discount given to purchases made with Target’s private label REDcard. These transactions remain the minority of Target’s total sales; REDcard penetration was 20.7% of Target’s US sales as of 2014.

Target’s basket pricing gap with Wal-Mart, according to the Credit Suisse report, has grown over the past decade — even as the company has placed greater emphasis on consumables. In 2005, 30% of Target’s sales were consumables. By 2014, Credit Suisse projected that the share of US consumables sales had risen to 46%.

Another observation was made that after the gross margin dilution, Target was likely becoming less aggressive on Wal-Mart’s pricing gap. Exstein and his team said:

Wal-Mart continues to enjoy a price advantage versus its primary competitors. While the advantage has not grown it remains in a tight four year band. The emphasis is primarily on total basket savings, rather than on single item price points, in part as a result of the more widespread adoption of consumables throughout the US retail system.

ALSO READ: Sears Cannot Afford Wal-Mart’s Pay Raise

At $76.54, Target has a 52-week range of $55.25 to $77.75 and a market cap of $48.8 billion. Target also trades at roughly 16 times next year’s (January 2016) consensus earnings estimate. Target’s dividend yield is now up at 2.7%.

At $85.58, Wal-Mart has a 52-week range of $72.61 to $90.97 and a market cap of $272 billion. Wal-Mart trades at 17 times next year’s (January 2016) consensus earnings estimate. Wal-Mart pays a 2.2% dividend yield to its investors.

We have included some of the graphics below to show the data that Credit Suisse compiled from outside and internal data.

Source: Credit Suisse research

Source: Credit Suisse research

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.