Amazon.com Inc.’s (NASDAQ: AMZN) Prime Day is all about rounding up new subscribers to the company’s Amazon Prime $99 per year ($10.99 monthly) free two-day delivery service that comes with streaming video and music as free throw-ins.

Last summer Amazon held its first Prime Day promotion, and brick-and-mortar retailers like Wal-Mart Stores Inc. (NYSE: WMT) and Target countered with sale pricing and free shipping offers of their own. This year, Wal-Mart removed its $50 minimum purchase amount and is offering free shipping on all online orders for the week.

The company already has offered a free one-month trial of its ShippingPass service, Wal-Mart’s latest answer to Prime. ShippingPass now offers free two-day shipping for $49 a year, but does not include the other perks of a Prime membership. J.C. Penney and Kohl’s are also promoting added savings for shoppers Tuesday, but neither is really much of a threat to the success of Prime Day.

Prime Day sales pricing is only open to Amazon’s Prime members, but the company offers a 30-day free trial of the service, and those who sign up for that are counted as subscribers as well.

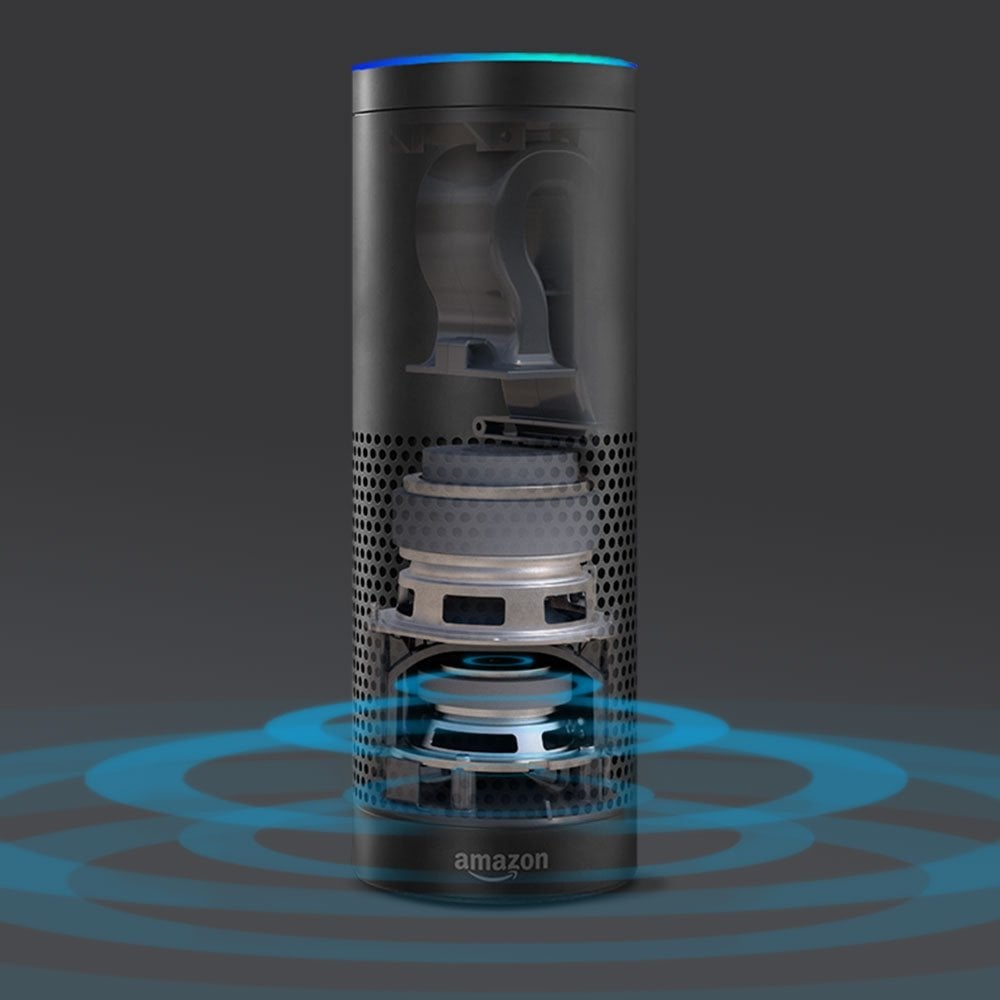

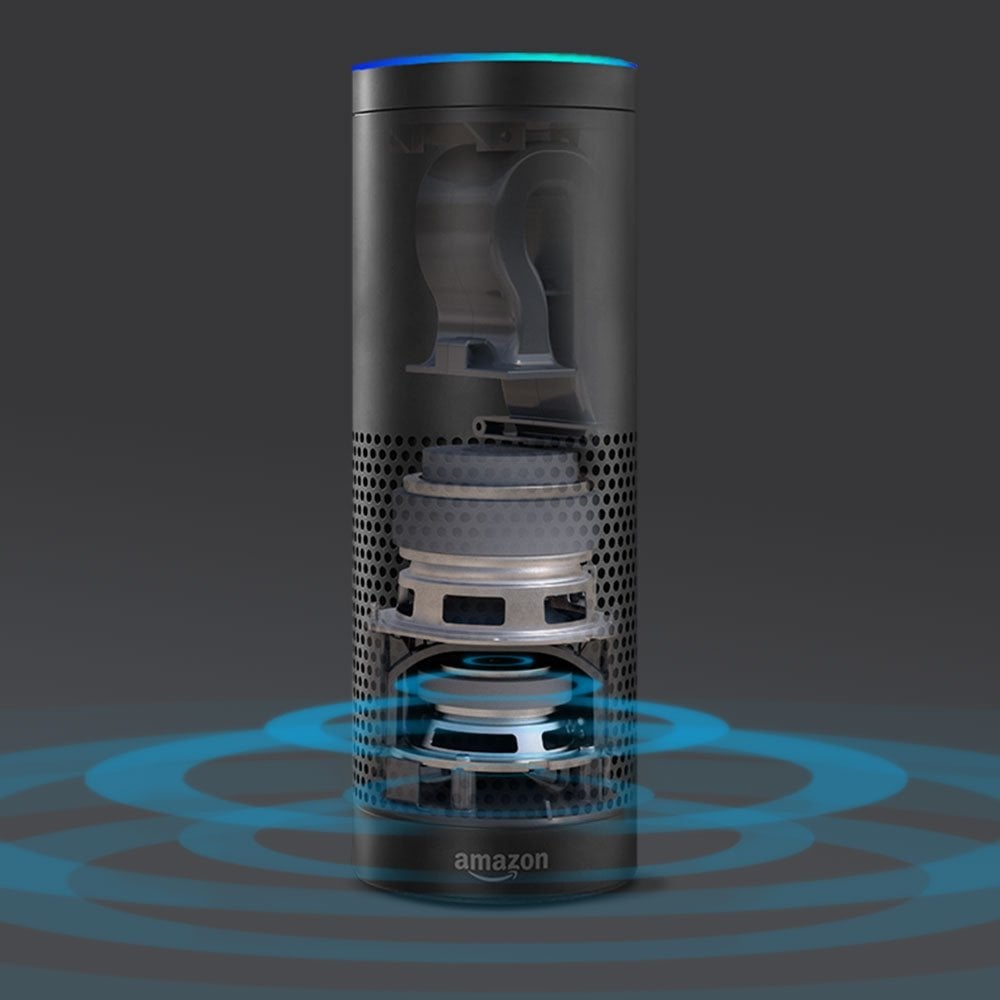

Some of Amazon’s promotions for Prime Day: $50 off on the Amazon Echo, a savings of 28% from the full price of $179.99; up to 33% off a Fire tablet; and an Xbox One 1TB console for $299, including a $50 gift card plus a couple of games and a wireless controller (regular price $468.98).

Last year, Amazon reported that Prime Day recorded sales equal to 97% of 2014’s Black Friday sales and 60% of that year’s Cyber Monday sales.

Although Amazon does not report the number of subscribers to its Prime service, a January estimate by research firm Consumer Intelligence Research Partners (CIRP) put the U.S. subscriber base at 54 million. Piper Jaffray analyst Gene Munster reckons Prime will count 60 million to 70 million subscribers by the end of the year.

About 73% of trial subscribers to Amazon Prime sign up for a full one-year subscription, according to an estimate from CIRP. And 91% of first-year subscribers sign up for a second year, while 95% of second-year subscribers renew for a third year.

Amazon added about 14 million new Prime subscribers in 2015, representing about $1.4 billion in revenue from new subscribers alone. If 91% renew for a second year, that represents about $1.3 billion in revenue. And all that is on top of a base that started at about 40 million subscribers.

And why is this a big deal? Because Prime members spend about twice as much at Amazon as non-Prime shoppers, $1,100 on average compared with $600.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.