Special Report

11 Reasons Mortgage Interest Rates Could Increase

Published:

Last Updated:

The American dream of homeownership could become less affordable in the near future. For those lucky enough to afford a home, the purchase is an important milestone. Most Americans will never make a more expensive purchase, and most buyers must borrow money to afford a house — which means applying for a mortgage.

The frequently lengthy process of applying for a mortgage and buying a home involves numerous steps, including verifying financial and employment status, spending habits, hiring a lawyer, inspectors, and so on. One key factor is the interest rate on the loan. This rate determines the cost of the mortgage, that is the monthly payments and the years it would take to pay it off. Low mortgage rates tend to encourage home buying, while higher rates may discourage some buyers.

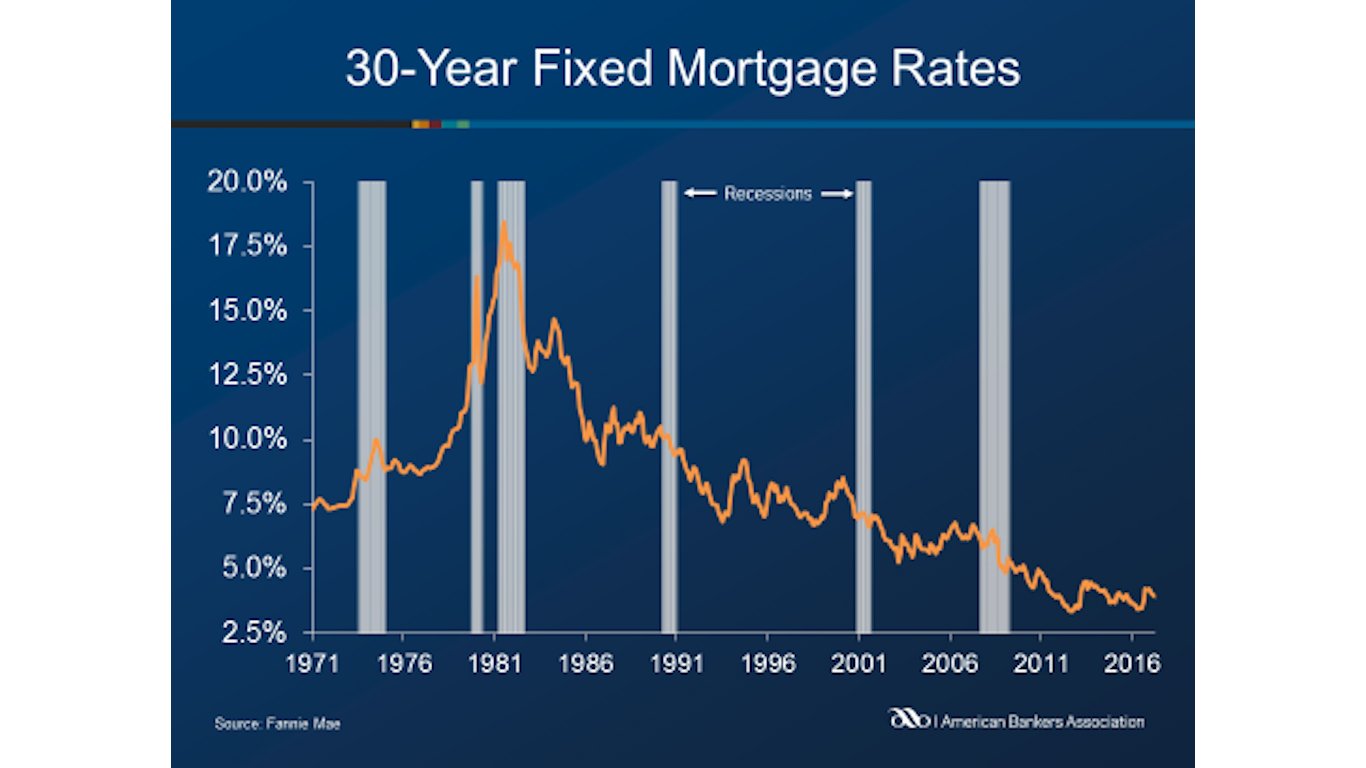

While prospective homebuyers should make their own decisions based on their own circumstances, they should consider that the Federal Reserve has been raising rates and confirmed more rate hikes are on tap in 2017 and 2018. With the Fed raising its benchmark interest rate, banks will likely follow suit and mortgage rates will also rise. Still, although interest rates are off all-time lows, they remain extremely cheap by historical standards.

The question is: should homebuyers act soon?

Source: American Bankers Association

Source: American Bankers Association

Click image to enlarge

Click here to see 11 reasons mortgage interest rates could increase.

Click here to see our detailed findings.

1. Fed policy

The Fed is arguably the most powerful economic institution in the world, as its decisions direct the course of the world’s largest economy. One of these critical decisions is where to set the federal funds rate, commonly referred to as the Fed’s benchmark interest rate. Average fixed mortgage interest rates track closely with longer-term Treasury yields. The fixed rate is almost always slightly higher, because mortgage-backed securities are relatively risky. Adjustable-rate mortgages (ARMS), by contrast, rise and fall with short-term rates.

[in-text-ad]

2. Recovery is speeding up

Mortgage debt as a percentage of Fed assets skyrocketed after the recession. The Fed now holds over $4.4 trillion in debt instruments, up from around $800 billion before the recession. Of that, $2.5 trillion is Treasury debt and almost $1.8 trillion is in mortgage-backed securities. The Federal Reserve is already indicating it will start gradually shrinking its balance sheet by selling these assets, a move of confidence perceived as another form of tightening that will lead to rate hikes.

3. Unemployment drops

The unemployment rate and other labor market indicators are some of the many economic measures evaluated by rate setters. They are known as lagging indicators, which means companies adjust their hiring and firing behavior after trends of economic strength or weakness are established. Similarly, rising mortgage interest rates send the message that the economy is thriving. Currently, unemployment is very low, at 4.4% as of this May.

4. Consumer confidence rises

You cannot have weak consumer confidence and a growing number of home purchases for very long. Economists and rate setters use the Consumer Confidence Index to approximate the degree of optimism among American consumers. The index is based on spending and savings levels across the nation. At the moment, consumer confidence is not exactly at an all time high, but is still considered strong. Since the recession consumer confidence has trended upwards, albeit with some erratic dips.

5. Inflation

Mortgage interest rates rose dramatically in the ’80s and ’70s, reaching their all time peak of 18.6% in October of 1981, largely due to the pace of inflation. At that time, the high mortgage rate was one way to compensate investors for the high inflation rate. Then Fed Chair Paul Volcker raised rates to curb inflation, as did his successor Alan Greenspan. It is likely that if inflation were to increase, current Chair Janet Yellen would do the same.

Today, inflation is running between 1.5% and 2% — very low levels historically. “That’s one of the main factors leading to low long-term interest rates,” noted Mike Fratantoni, chief economist with the Mortgage Bankers Association.

[in-text-ad]

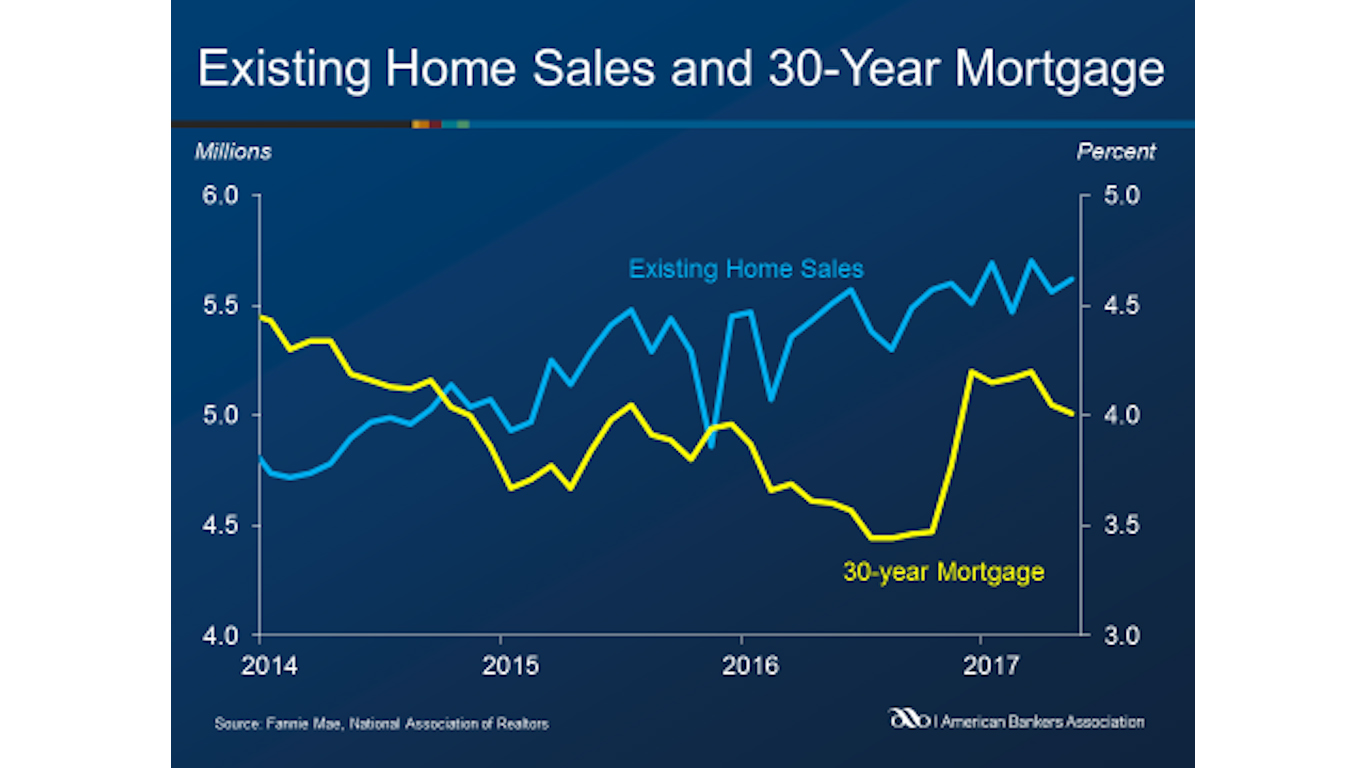

6. Rising existing home sales

Because low mortgage rates encourage home buying, existing home sales tend to increase as rates decline. However, the various moving parts of this equation make predicting the outcome of this interaction quite challenging. For example, existing home sales compete with new home sales, and the difference largely depends on Americans’ appetite for fixer-uppers, whether families can afford all-new homes, and many other issues.

7. Geography

Various aspects of housing markets are extremely localized, and the experience of purchasing a home can differ considerably depending on the location — even within the same town or city. The mortgage interest rate varies remarkably little, however, according to Fratantoni. “One of the benefits of moving to a capital markets system is that funds could flow to wherever demand was highest, and mortgage rates were a sort of equalizer across the country.”

At the same time, different districts and states have different requirements and regulations that can affect the interest rate on mortgages.

8. Your credit score

While mortgage rates generally hover around the average 30-year fixed rate, your own mortgage rate could be higher or lower depending on the underwriter’s determination of your ability to repay the loan. If a bank decides the likelihood of default is high, it will charge a higher interest rate to increase the short-term return on the relatively riskier loan. On the other hand, those perceived as a good bet will be able to shop around for a lower rate.

9. Housing market regulations

Regulation of the U.S. housing market has been a politically charged subject since the subprime mortgage crisis. Proponents of increased regulations sought to curb lenders’ misconducts and protect consumers, while opponents pointed to red tape slowing down lending and borrowing. An example is the Consumer Finance Protection Bureau, which was set up to help protect borrowers. While it has likely succeeded in doing so, it has also made mortgage applications lengthier and more complicated. Lenders must take more steps evaluating applicants, which can cause delays. Such delays can obstruct the timing of a home purchase, which for individual buyers may result in locking in an undesired interest rate.

[in-text-ad]

10. Stock market trends

It is probably obvious to most adults in the United States, but it bears repeating: mortgages are packaged as securities that investors can buy and trade, and therefore are heavily dependent on investors’ decisions on the bond market. There isn’t a demonstrable direct relationship between mortgage rates and the stock and bond markets, but they do respond to one another. For example, because stock and bond markets compete for the same investment money, when the stock market goes up, investors tend to sell off their bonds and buy stocks. If stocks continue on an upward trend, investors may sell longer-yield Treasury bonds in favor of stocks, which can be riskier but tend to have a more swift return. This means interest rates would need to rise to keep up with the reduced return on bond investments. Therefore — at least considering these factors in a vacuum — it is reasonable to expect that waves of Treasury selling to buy stocks might lead to a rise in mortgage interest rates.

11. International trade wars

The U.S. national debt is currently at almost $20 trillion. Foreign central banks and various entities own close to one-third of U.S. national debt. Japan and China each own over $1 trillion. Most analysts do not consider it even a remote likelihood, but because of these relatively high debt levels, anything from international trade wars, changes in foreign central bank rules, or other freak incidents like huge currency sell-offs could lead to Treasury selling by foreign debt holders, which would drive rates higher.

For the record, when the S&P downgraded the U.S. credit rating in 2011, rates did not rise as feared because the United States was still the most attractive market and the U.S. dollar remained the world’s reserve currency.

Detailed Findings:

Mike Fratantoni is chief economist with the Mortgage Bankers Association, a real estate finance industry advocate. In an interview, Fratantoni explained that mortgage interest rate fluctuations are closely related to the level of risk perceived in mortgage-backed securities, which is the instrument investors use to trade blocks of mortgages in capital markets, where the interest rates are ultimately set.

Compared with other types of investments, “an investor in a mortgage-backed security has a lot of uncertainty,” Fratantoni said. “If a borrower refinances that loan [or] if they sell their home, the investor gets the money back earlier, and if rates rise, the investor gets their principal back later.”

Relatedly, mortgage interest rates rose dramatically in the 70s and 80s, reaching their all time peak of 18.5% in October of 1981, largely due to the pace of inflation. At that time, the high mortgage rate was one way to compensate investors for the high inflation rate. Today, inflation is running between 1.5% and 2% — very low levels historically. “That’s one of the main factors leading to low long-term interest rates,” Fratantoni noted.

In an email with 24/7 Wall St., Daren Blomquist, senior vice president with property and real estate data company ATTOM Data Solutions, emphasized the myriad of factors that go into assessing the risk of making a home loan. The complexity of the assessment has increased after stricter underwriting standards were implemented following the subprime mortgage crisis.

Another key factor is whether you will be living in the home. “Investor loans will inherently come with a higher rate than owner-occupied loans because they are higher risk given that the owner is not using the home as shelter,” said Blomquist.

To understand how mortgage interest rates might increase, 24/7 Wall St. reviewed historical mortgage rate fluctuations since the 1970s and government housing market reports. We also consulted experts from the Mortgage Bankers Association and real estate company ATTOM Data Solutions.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.