Broadcom, Maybe Saved by Apple, Still Among the Best Values in Chip Stocks

September 20, 2013 by Jon C. Ogg

The boost on Friday is on reports of Apple Inc. (NASDAQ: AAPL) using Broadcom’s processing chips in the new iPhone 5 refresh cycle. The note signals a possible end to worries that Apple may in-house all of its chip efforts. It also comes after Broadcom made an acquisition and gave guidance that frankly sent its shares into a “value analysis” category. Growth investors almost never want to see their stocks there. After all, growth investors want growth, rather than battered stocks that look cheap because their growth metrics have petered out.

As far as Broadcom’s new valuations, the consensus estimates from Thomson Reuters are $2.65 earnings per share (EPS) and $8.36 billion in sales in 2013. That puts the stock at less than 11 times earnings and less than two times revenue. For 2014, those consensus estimates are $2.73 EPS and $9.01 billion in sales, which still signals growth. It implies 10 times next year’s earnings and only 1.8 times next year’s sales.

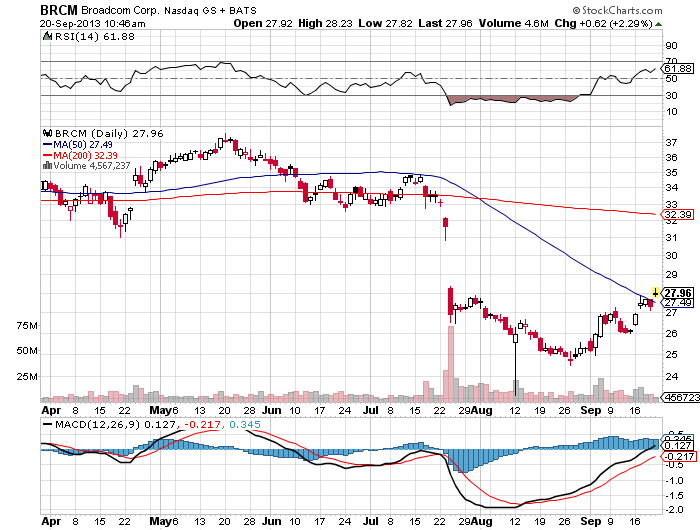

In mid-morning trading, Broadcom shares were up 2.3% at $27.95, and the 52-week range is $23.25 to $37.85. Broadcom has a market cap of $16.2 billion, and the consensus price target from Wall Street analysts is $33.15.

There is still growth and value to be had in Broadcom, but investors are fickle here because of bad misses in the recent past driving its growth rates and stock price lower.

Broadcom’s turnaround might just be getting started. We have included a chart below showing its 50-day and 200-day moving average from Stockcharts.com for your review. Stay tuned.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.