Can Netflix’s Stock Drop Tempt Apple Buyout Ambitions?

April 4, 2014 by Jon C. Ogg

24/7 Wall St. recently joined in on the idea that Apple Inc. (NASDAQ: AAPL) should acquire Netflix. We valued this as a low probability event at the time, and obviously price matters here. As noted on March 24, “One final issue needs to be brought up — deal proposals of this sort are generally only proposed during really good times and in bull markets.”

So, what about that bull market help? The Dow Jones Industrial Average and S&P 500 have both challenged new all-time highs. Still, the Nasdaq’s previous momentum stocks are currently under real pressure and the prior high-beta momentum stocks are getting trashed. After more than a 4% drop in mid-Friday trading, Netflix’s stock price hasn’t had an up-day worth noting in ages. By a quick look of trading history since the end of February, Netflix shares have risen in only three of the past 25 trading sessions.

Tim Cook seemed happy to have $1 billion in sales from Apple TV last year. Unfortunately, that $1 billion is a drop in the bucket, considering that Apple is expected to post revenue of over $180 billion this year alone. Netflix is expected to report sales of $5.4 billion in 2014 and $6.4 billion in 2015.

Netflix’s drop of more than 4% on Friday has taken its value to almost $20 billion. Netflix was valued around $22.5 billion when we first proposed that Apple acquire it. Be advised, this proposed deal is not as much of a price issue as it is a new growth concept issue for Apple. If Reid Hastings has to start worrying about more competition killing his stock, then Tim Cook might be able to strike a deal.

The fresh competition in media from Amazon.com Inc. (NASDAQ: AMZN) via Fire TV is likely to matter more than anything new, but Google Inc. (NASDAQ: GOOG) cannot be ignored. Larry Page and Sergey Brin are now in total control of Google as well. That means they can do whatever they want, and they may not even need to seek anyone’s approval to do deals of the $20 billion size, when you consider that Google is worth $368 billion or so. Apple is still worth $476 billion.

So, how would it work where Netflix would fit into the Apple empire? Apple could get whatever interest Carl Icahn has to vote for the deal, and Reed Hastings could even surrender his shares to be brought on as Apple’s highest paid employee. Of the top 10 institutional holders, there is a huge overlap: of the top 10 holders, some 25% of the outstanding Netflix shares held are also by firms who are in the top 10 holders of Apple alone.

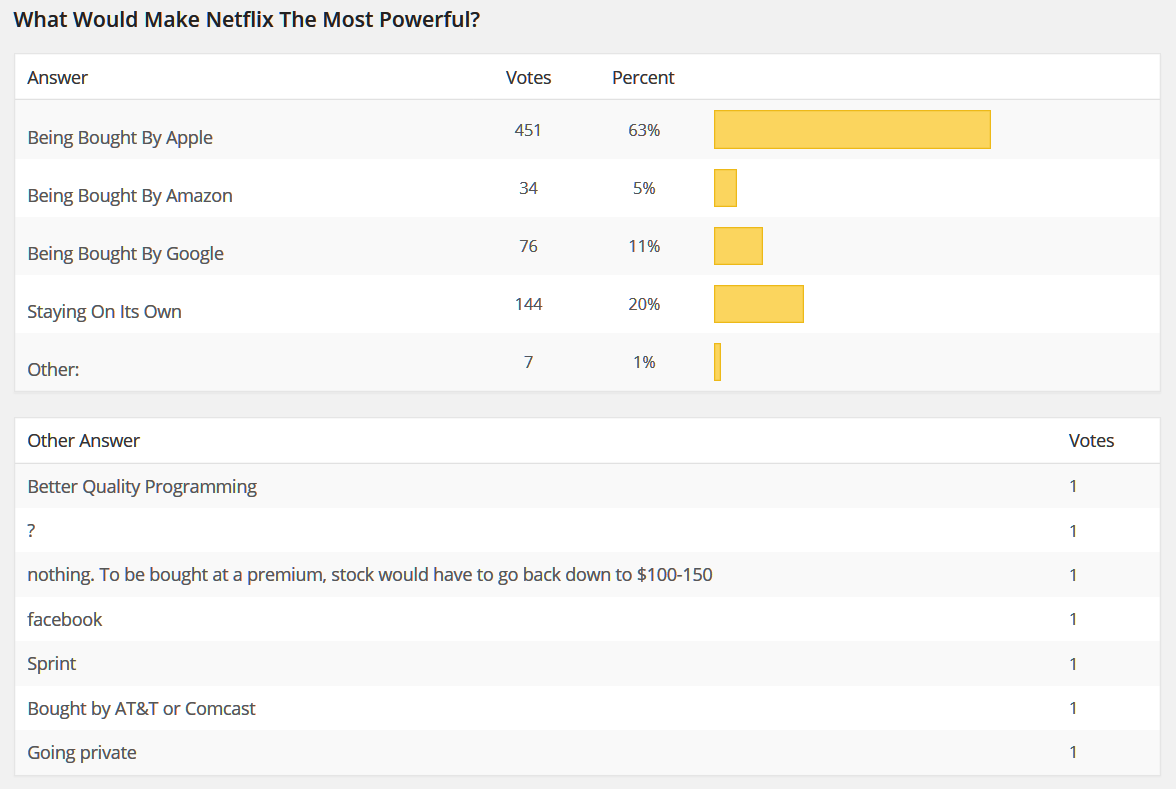

Now, here is the real rub that Tim Cook should not ignore. We generally believe that a poll has to contain 1,000 responses for it to be considered a truly representative poll. Still, 700 — or 712 — starts getting close enough that we would care about its statistics. When we wrote that Apple should buy Netflix, our polling question was simply “What Would Make Netflix the Most Powerful?” Of the 712 answers, some 451 responses (63%) said that “Being Bought by Apple” would be the best strategy. Of the other answers, “Staying on Its Own” was 144 votes, or 20%. Only 5% voted for Amazon and 11% voted in favor of Google.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.