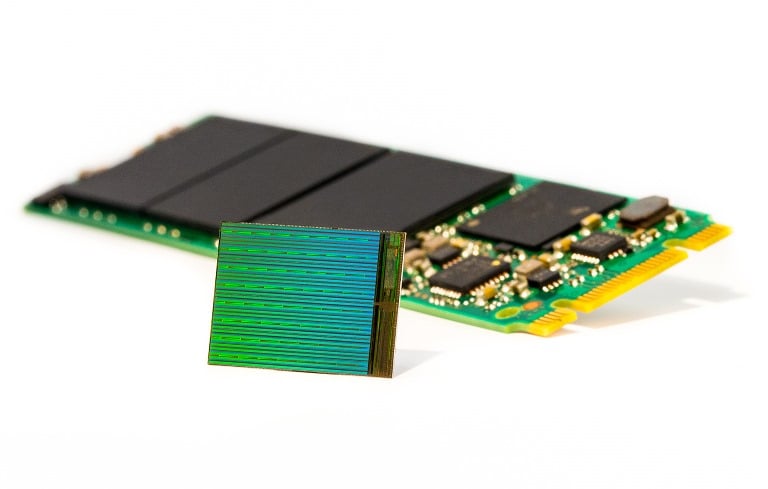

New developments in flash memory may have colossal implications within the semiconductor industry as a whole, especially because it is a collaboration between two giants in the industry. Micron Technology Inc. (NASDAQ: MU) and Intel Corp. (NASDAQ: INTC) announced Thursday the next big step in their collaboration in flash and NAND technology. The companies revealed the world’s highest density flash memory. Source: courtesy of Intel Corp.

Source: courtesy of Intel Corp.

This new 3D NAND technology was jointly developed by both companies. It stacks layers of data storage cells vertically to create storage devices with three times higher capacity than its competitors. Ultimately, this enables more storage in a smaller space, resulting in significant cost savings, low power usage and high performance to a range of mobile consumer devices, as well as the most demanding enterprise deployments.

Considering that Planar NAND flash memory is approaching its practical scaling limits, the implication is posing significant challenges for the memory industry. As a result, 3D NAND technology is poised to make a dramatic impact, aiming for continued performance gains and cost savings, driving more widespread use of flash storage.

ALSO READ: 4 Hot RBC Tech Stock Picks to Buy Now

It is also this collaboration that could keep pressure on SanDisk Corp. (NASDAQ: SNDK) and other companies in the semiconductor industry involved in flash memory. Of course it goes without saying that Micron and Intel will have to deliver better products, but the two companies do have extensive experience and could be disruptive to other companies in the field. SanDisk in particular is feeling the heat Thursday, as it also had its guidance reduced yet again.

Brian Shirley, Vice President of Memory Technology and Solutions at Micron, commented on the potential impact:

Micron and Intel’s collaboration has created an industry-leading solid-state storage technology that offers high density, performance and efficiency and is unmatched by any flash today. This 3D NAND technology has the potential to create fundamental market shifts. The depth of the impact that flash has had to date — from smartphones to flash-optimized supercomputing — is really just scratching the surface of what’s possible.

Shares of Micron were up 1.5% at $26.98 Thursday, in a 52-week trading range of $21.02 to $36.59. The stock has a consensus analyst price target of $41.60.

Intel shares were up 1.2% at $30.26. The consensus price target is $34.70, and the 52-week trading range is $25.29 to $37.90.

Meanwhile, SanDisk shares were down 18% at $65.87 — well under the prior 52-week low of $73.11 before it slashed guidance.

ALSO READ: 5 Top Cloud Storage Tech Stocks to Buy Now

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.