Technology

Fiber to the Premises Is Back: 4 Top Stocks to Buy Now

Published:

Last Updated:

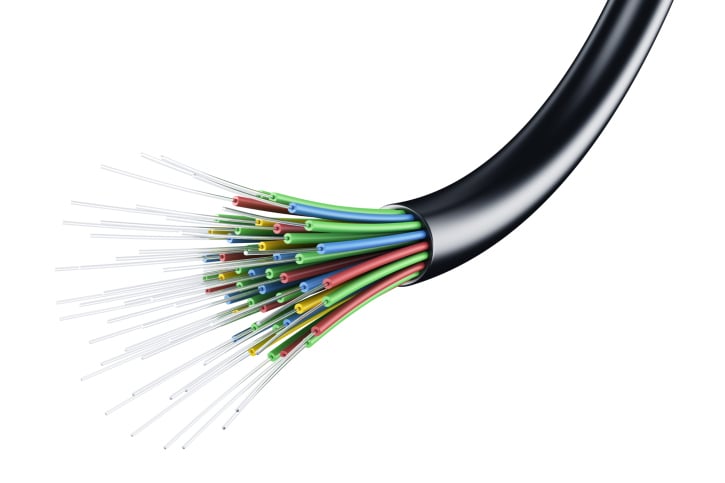

During the late 1990s and well into the new century, one of the biggest buzzword phrases was “fiber to the premises,” or FTTP. The stated goal of many carriers and providers was getting fiber right up and into houses. Verizon Communications Inc. (NYSE: VZ) was somewhat successful in rolling out its FiOS initiative in 2005. While it never became ubiquitous due to cost and logistics, many customers have it and have lauded the outstanding video quality and Internet speeds. Source: Thinkstock

Source: Thinkstock

A new research report from Jefferies says that FTTP is back in vogue, in large part due to the tremendous demand. The analysts point out that over the past year, the number of 1 Gbps broadband service announcements has been incredible, with 55 among significant operators in the United States. Jefferies makes the case that Google Fiber started this ramp-up in broadband activity when it announced its Kansas City roll-out in March 2011.

The Jefferies report includes a list of stocks that stand to benefit from this upswing in FTTP deployment. We screened the list for the top stocks that will benefit that make the most sense to investors. The four we chose are ADTRAN Inc. (NASDAQ: ADTN), Calix Inc. (NASDAQ: CALX), Cisco Systems Inc. (NASDAQ: CSCO) and Corning Inc. (NYSE: GLW).

ADTRAN

This leading global provider of networking and communications equipment provides products that enable voice, data, video and Internet communications across a variety of network infrastructures. While the company missed first-quarter earnings, it has continued to roll out services to new accounts. Its ProCloud is a cloud-management service for Wi-Fi and switches. It features fully redundant infrastructure with guaranteed 99.99% uptime, 24/7 proactive monitoring and ongoing maintenance and hardware replacement.

ADTRAN investors are paid a 1.9% dividend. The Jefferies team has a rating of Hold for the stock and a $16.75 price target. The Thomson/First Call consensus price target is $17.34. Shares closed Wednesday at $16.31.

ALSO READ: Credit Suisse Adds New Stocks to Buy to Top Picks List

Calix

Calix is the Jefferies team favorite play on the FTTP trend. The company provides broadband communications access systems and software for fiber and copper-based network architectures that enable communications service providers to connect to their residential and business subscribers in North America. The company’s Unified Access portfolio of broadband communications access software, systems and services enables communications service providers worldwide to transform their networks and become the broadband provider of choice to their subscribers.

The Jefferies price target is a very large $11, and the consensus target is $9.90. Calix closed most recently at $7.41 per share.

Cisco Systems

This Silicon Valley giant seems like a pretty obvious choice, but may be among the best for investors. Cisco recently won an important contract for the Verizon build-out of the company’s next-generation 100G metro network. While Cisco’s optical business is small as a part of total revenue, this win is seen by Wall Street as a significant endorsement of the investments Cisco has made into its optics business. This will be the business that could be instrumental in an increasing FTTP deployment and build out.

ALSO READ: Why These 4 Biotech Stocks Could Be the Next Buyout Targets

Cisco is trading at a low 13.3 estimated 2015 earnings and boasts an outstanding 7.44 free cash flow yield. The networking giant also seems to have fought through numerous headwinds, including up and down demand from telecom carriers, weakness in emerging markets and threats to its very lucrative switching business. Analysts feel all of these are going away. The company also stands to benefit from a better corporate spending environment in Europe, as well as continued growth here at home.

Cisco investors are paid a solid 2.9% dividend. Jefferies rates the stock at a Hold, with a $27.25 price target. The consensus target is higher at $30.27. The stock closed Wednesday a $28.97.

Corning

This company was a huge player in the fiber build-outs in the 1990s and may be ready to ramp back up for the FTTP deployments. Corning is one of the world’s leading innovators in materials science. For more than 160 years, Corning has applied its unparalleled expertise in specialty glass, ceramics and optical physics.

Corning’s products enable diverse industries such as consumer electronics, telecommunications, transportation and life sciences. They include damage-resistant cover glass for smartphones and tablets; precision glass for advanced displays; optical fiber, wireless technologies and connectivity solutions for high-speed communications networks; trusted products that accelerate drug discovery and manufacturing; and emissions-control products for cars, trucks and off-road vehicles.

Corning investors are paid a 2.28% dividend. The Jefferies analysts rate the stock at Hold, with a $21 price target. The consensus target is $23.97. Shares closed Wednesday at $21.06.

ALSO READ: UBS Says to Buy the Big 3 Land Drillers Now

With fiber deployments allowing 1GB Internet speeds, demand should skyrocket as consumers start to know friends that have these superfast services. These top vendors will be right in the line for contracts as a result.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.