Technology

Despite Qualcomm Price Target Cut, One Analyst Still Sees Over 50% Upside

Published:

Last Updated:

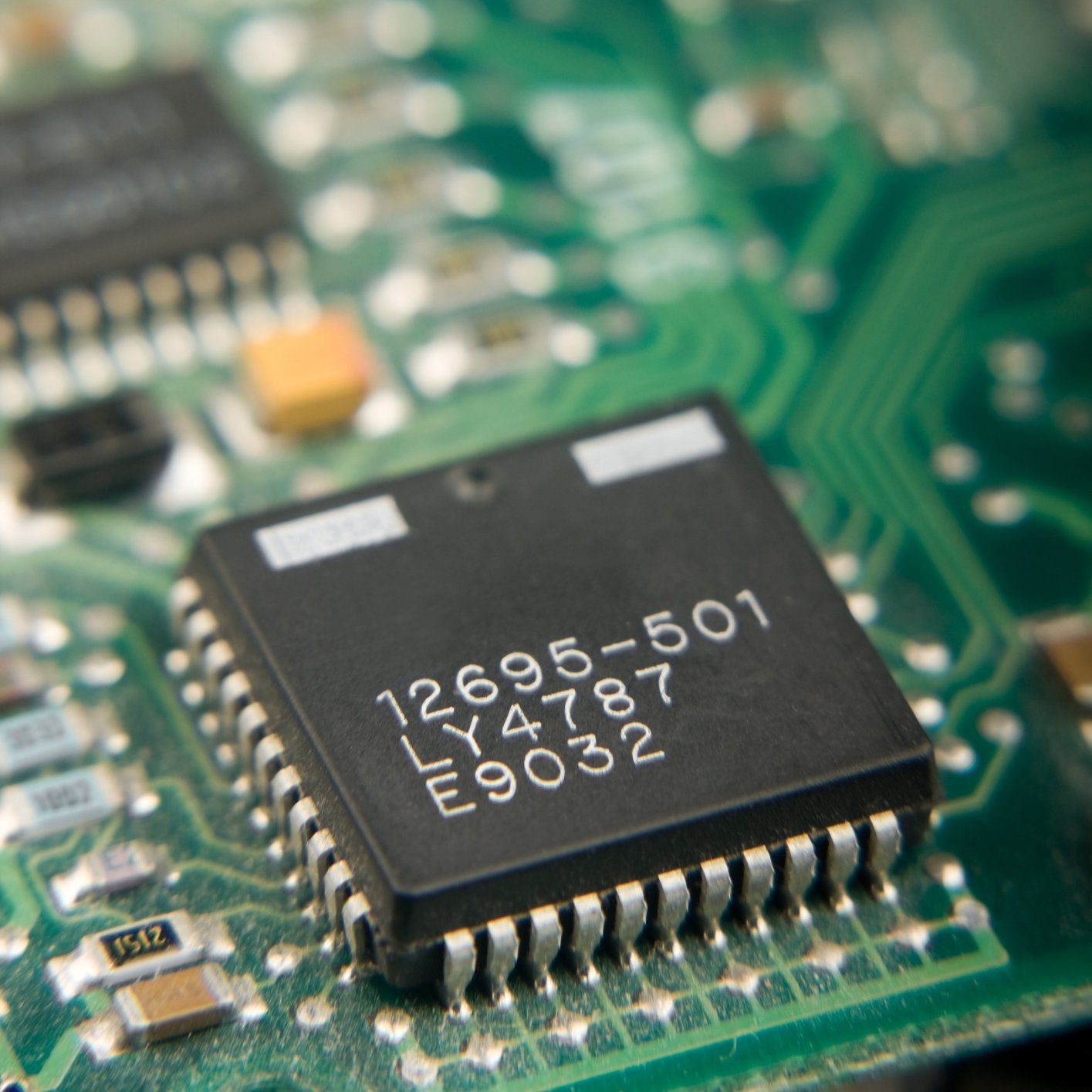

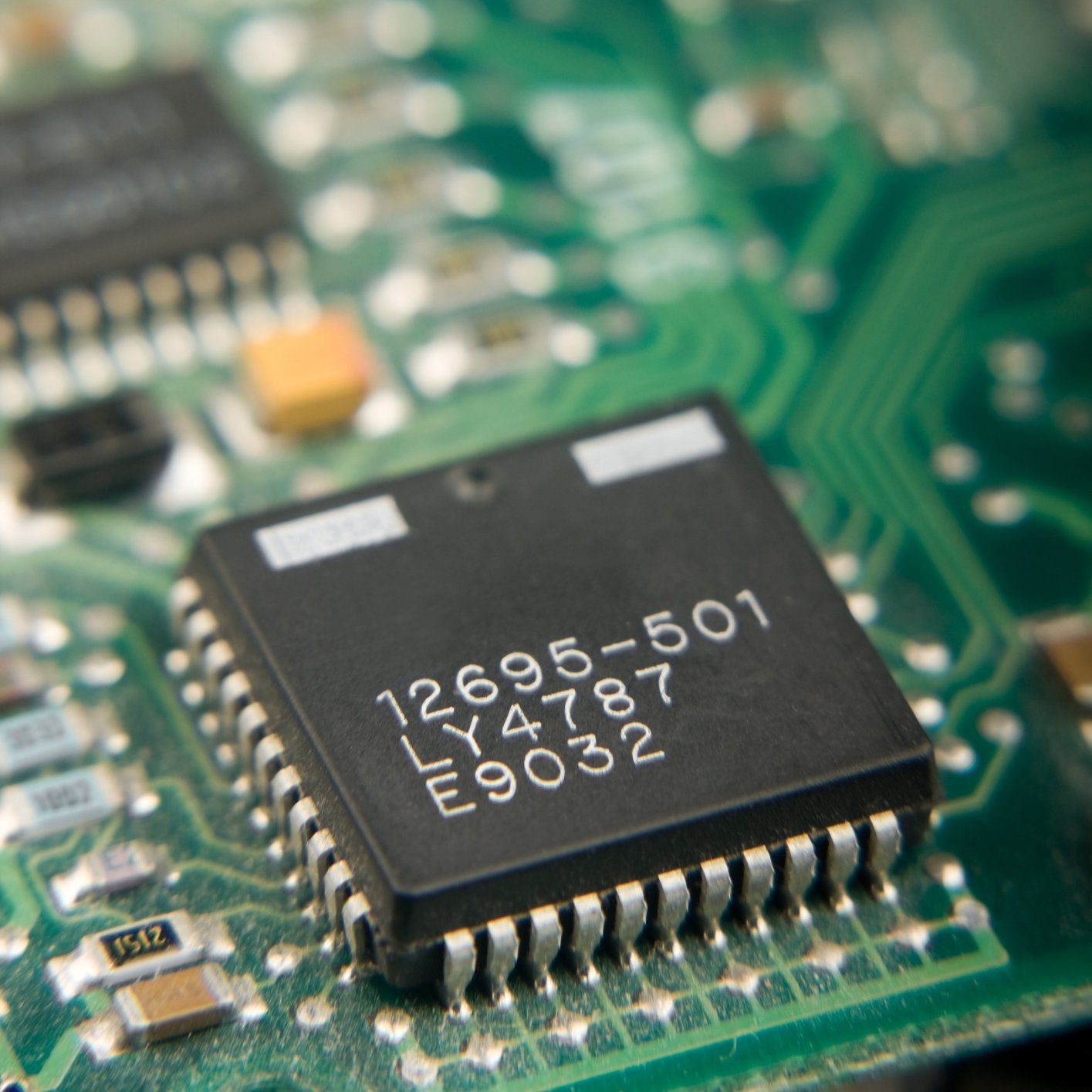

Qualcomm Inc. (NASDAQ: QCOM) recently formed a partnership with TDK to develop, integrate and market RF products, complementing its already dominant position in modems and system on a chip (SoC) apps processors. The RF360 Holdings joint venture between the two companies will develop RF front-end modules and RF filters into fully integrated systems for mobile devices and other uses.

While Qualcomm participates in portions of the RF business, such as power amplifiers, the JV with TDK will enable development of products that can compete with industry leaders including Quorvo, Skyworks, Murata, and Avago.

As a result of these recent moves and market fluctuations, the independent research firm Argus weighed in on this semiconductor giant.

According to Argus:

Qualcomm shares remain under pressure. Late in 2015, the European Commission (EC) filed two Statements of Objections (SO) related to the company’s licensing practices and rates. While these headlines constitute non-operating events, the market chose to ignore positive news on the licensing front which is material to operations. Since announcing licensing agreements with formerly non-compliant companies Xiaomi and Huizhou TCL Mobile Communication in December, Qualcomm has announced additional licensing signings with Haier (a leading consumer electronics and home appliance brand) and with handset maker Tianyu.

[ims_survey]

The firm believes that these signings, reached within Qualcomm’s agreement with Chinese antitrust authorities, should enable the company to receive currently due and retroactive royalty and licensing payments.

Argus continued:

Given current challenges, including customer losses, mix issues, and a (now diminishing) number of qualifying devices evading royalty payments, Qualcomm faces continued tough revenue and EPS trends in fiscal 2016, particularly in the first half of the fiscal year. We look for revenue and EPS to recover in the second half, based on technology leadership at QCT and very robust growth in total addressable market and reported devices that will drive returns at QTL.

Argus has a Buy rating for the company and lowered the target price to $70 from $80. This implies an upside of roughly 47% and with the dividend of 4.17% added in, the upside is over 50%. This makes a difference here that Argus was previously the highest analyst target in the Thomson Reuters universe.

Shares of Qualcomm were last trading up 3.3% at $47.62, with a consensus analyst price target of $62.00 and a 52-week trading range of $45.33 to $74.09.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.