Technology

Massive DRAM and 3D NAND Demand Drives 4 Top Tech Stocks

Published:

Last Updated:

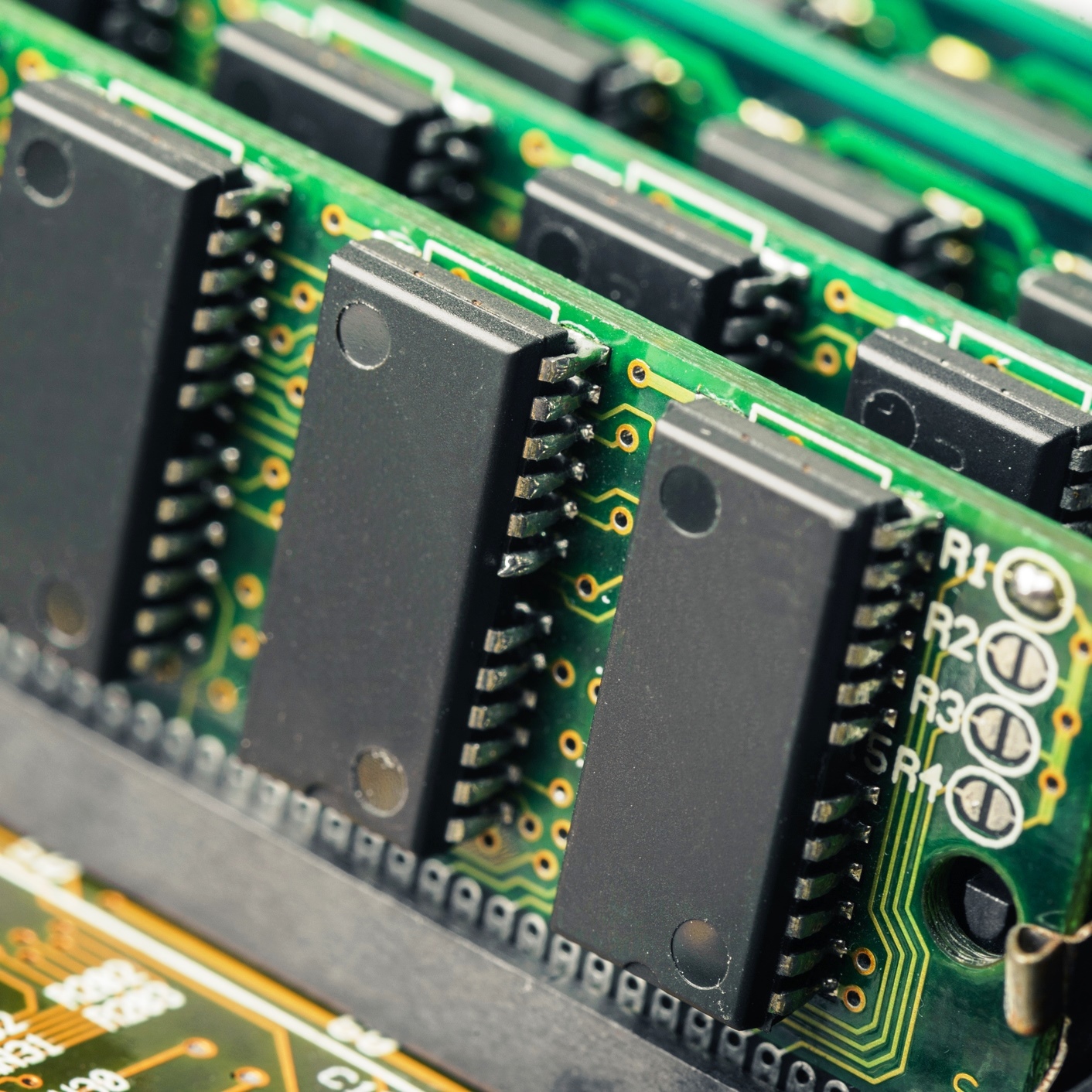

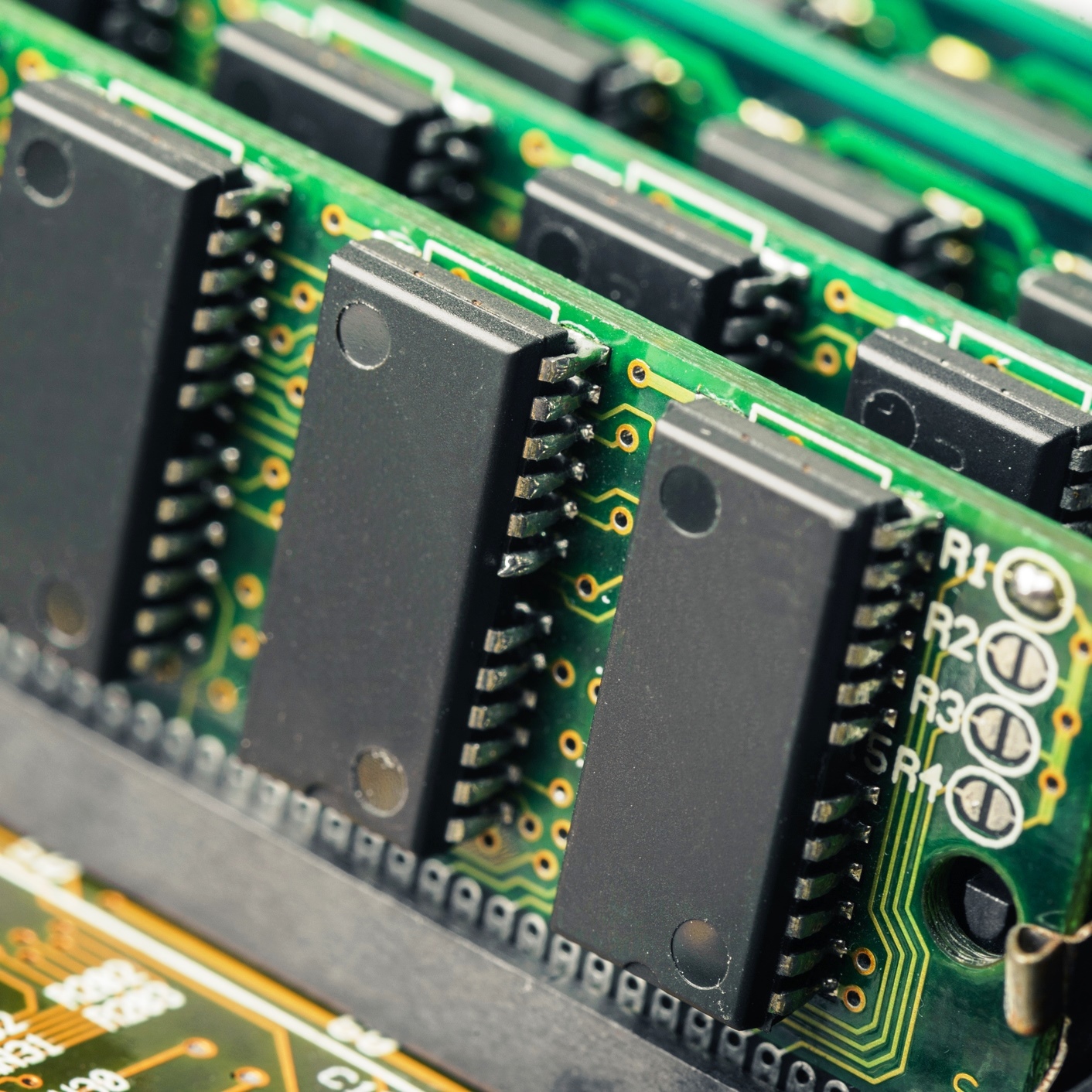

It’s been percolating for a while, and some of the top stocks already reflect the growth, but demand for DRAM and 3D NAND flash memory is continuing at a pace that is even astounding some on Wall Street. Flash memory is electronic (solid-state) non-volatile computer medium that can be electrically erased and reprogrammed. Dynamic random-access memory (DRAM) is a type of random-access memory that stores each bit of data in a separate capacitor within an integrated circuit.

In a new research report, Stifel thinks capital expenditures at big chip companies like Samsung is rising. The report noted:

We believe DRAM pricing has held up better than expected (and bit growth may actually be somewhat higher than previously forecasted) and Samsung is aggressively converting its capacity (both DRAM and older planar NAND capacity) to 18 nanometer. We expect the company to maintain a leadership position at this node for approximately six months before the competition can fully ramp.

This demand and strong pricing bodes well for the top semiconductor capital equipment companies. Stifel has four top stocks rated Buy in which investors can gain exposure to 3D NAND, DRAM and subsystems.

Stifel feels this semiconductor capital equipment leader has the broadest range of exposure to 3D NAND and foundry display. Applied Materials Inc. (NASDAQ: AMAT) is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Applied Material’s technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world.

The analysts are very positive on the stock and see Applied Materials benefiting not only the semiconductor side of the business, but also from larger, higher resolution and flexible screens on the display side of the business. The stock may still be one of the best technology values available for investors today. Some Wall Street analysts see continued FinFET capacity expansion (10nm/14nm/16nm) and transition to 3D NAND, with DRAM spending remaining strong this year.

Semiconductor and Display markets are strong. Many feel there are five top reasons to own the shares: semiconductor capital equipment strength, OLED, investments from China, valuation, and $4 in earnings per share in two years.

Applied Materials investors receive a 1.01% dividend. The Stifel price target for the stock is $42. The Wall Street consensus target price is $41.16. Shares closed last Friday at $39.79.

This remains one of the top chip equipment picks across Wall Street. Lam Research Corp. (NASDAQ: LRCX) designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers plasma etch products that remove materials from the wafer to create the features and patterns of a device.

Many Wall Street analysts have highlighted the company and its peers as having a significant equipment opportunity from the NAND evolution as well. Lam Research also appears well positioned to gain share in the wafer fab equipment market, driven by a strong focus on technology inflection spending over the next few years.

Despite so-so foundry and logic spending over the past year, many on Wall Street think that Lam will also continue to benefit from technology transitions such as FinFET, 3D NAND, multi patterning and advanced packaging in 2016 and beyond. Many analysts believe it is the “cleanest” semi-cap story benefiting from cyclical tailwind, SAM expansion and share gains.

Lam Research reported solid results and an impressive shipment outlook. The posted third-quarter fiscal 2017 non-GAAP earnings blew past the consensus estimate. Earnings were up 16% sequentially and 130.9% year over year.

Shareholders in Lam Research are paid a 1.3% dividend. Stifel has a $170 price target, while the consensus price objective is $136.60. The stock closed trading on Friday at $139.98 per share.

This stock flies somewhat under the radar but offers solid upside. MKS Instruments Inc. (NASDAQ: MKSI) provides instruments, subsystems and process control solutions that measure, control, power, monitor and analyze critical parameters of manufacturing processes in the United States and internationally.

MKS offers pressure measurement and control products used for various pressure ranges and accuracies; materials delivery products, including gas flow measurement products and vacuum valves; automation and control products, such as automation platforms, programmable automation controllers, temperature controllers and software solutions for use in automation, I/O and distributed programmable I/O, gateways and connectivity products; and vacuum products comprising vacuum containment components, effluent management subsystems and custom stainless steel chambers, vessels and pharmaceutical process equipment hardware and housings.

Stifel feels the increase in Applied Material’s display equipment business will have positive implications for MKS as it supplies many key subsystems for Applied’s display tools. In addition, MKS acquired Newport last year and added the company’s iconic Spectra-Physics laser brand to its product lineup.

MKS shareholders receive a 1.0% dividend. The $71 Stifel price target is less than the consensus target of $73. The stock closed Friday at $71 per share.

Shares of this small-cap company could offer large returns for aggressive investors. FormFactor Inc. (NASDAQ: FORM) helps semiconductor manufacturers test the integrated circuits that power consumer mobile devices, as well as computing, automotive and other applications.

The company is one of the world’s leading providers of essential wafer test technologies and expertise, with an extensive portfolio of high-performance probe cards for DRAM, flash and system-on-chip (SoC) devices. Customers use FormFactor’s products and services to lower overall production costs, improve their yields and enable complex next-generation integrated circuits.

Last year the semiconductor probe card manufacturer made a bold bet by shelling out more than $350 million to acquire Cascade Microtech, one of its primary competitors. That move nearly doubled the size of its business and promised to make the company stronger than ever. With earnings right around the corner, shareholders could be looking pretty.

Stifel has set its price target for the stock at $15, and the consensus price objective is $14.79. The shares ended last week at $10.95 apiece.

While these stocks are only suitable for very aggressive, risk-tolerant accounts, the anticipated increase in spending in 2017 could make a solid difference to the top and bottom lines of these well-run companies.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.