Source: Thinkstock

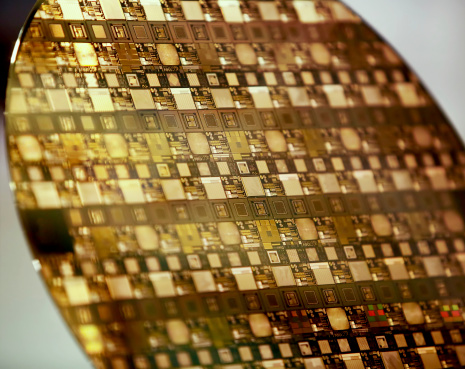

One of the main factors involved with Micron turning down the deal in July was the fear that the U.S. regulatory committee would block this deal. Previously some U.S. senators had pointed out that the chips used in some U.S. weapons systems were produced by Micron and that this deal could pose a threat to national security.

Weiguo, in his trip to the U.S., will not only meet with the Micron board but he will also meet with policy experts in Washington. He is expected to return to Beijing next week.

Despite this impasse, Tsinghua Unigroup has stated that it will continue to pursue Micron. If the company cannot acquire Micron then according to some reports, Tsinghua Unigroup may attempt to form a partnership involving Chinese DRAM/NAND manufacturing. This partnership might not face as much opposition from regulators while allowing for Micron to grow its Chinese sales base.

Analysts took the opportunity to update their calls on Micron after the deal was rebuffed:

- Jefferies reiterated a Buy rating with a $33 price target.

- Argus has a Buy rating but lowered its price target to $26 from $32.

- Deutsche Bank reiterated a Buy rating with a $28 price target.

- Piper Jaffray reiterated a Buy rating with a $25 price target.

Over the course of 2015 Micron shares have dipped over 50%, making it an ideal target for an acquisition at a discount. In the past month shares are down nearly 20% but in just the past week shares are up about 10%.

If Tsinghua Unigroup were to acquire Micron this would be the largest foreign deal by a Chinese company and a pivotal move forward in the Chinese chip industry.

Shares of Micron were up 3.1% at $16.45 on Monday afternoon. The stock has a consensus analyst price target of $26.76 and a 52-week trading range of $13.50 to $36.59.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.