Cars and Drivers

Electric Cars, Buses Are Slowly Taking Over the Transportation Market

Published:

Last Updated:

It may be difficult to visualize, but sales of passenger electric vehicles (EVs), like cars, sport utility vehicles and crossovers, have doubled in just two years. Between 2016 and 2017, EV sales rose by just 10% to 1.1 million. Then sales jumped to 2 million in 2018. By 2030, sales of passenger EVs are forecast to rise to 28 million and by 2040, sales will double again to 56 million.

[in-text-ad]

The data was published Wednesday by BloombergNEF (BNEF) in its Electric Vehicle Outlook 2019 report and represents a modest increase of three percentage points compared with last year’s forecast. What’s not so modest is that by 2040 BNEF expects passenger EVs to account for 57% of all passenger vehicle sales worldwide. Sales of conventional, fossil-fueled vehicles drop from around 85 million in 2018 to 42 million in 2040.

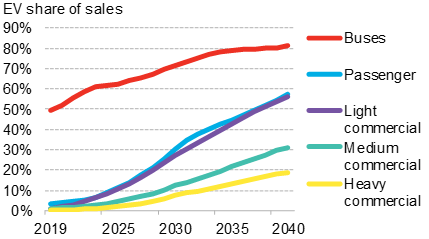

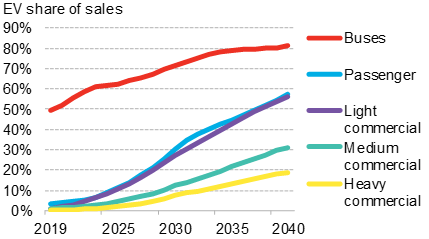

Electrically powered buses were forecast last year to account for 80% of sales by 2040, and that percentage increased only slightly in this year’s report to 81%.

New this year are projections that the light commercial segment will reach 56% of sales in China, the United States and Europe by 2040, and that electrified medium commercial vehicles will account for 31% of their market at the same time. Electrified heavy commercial vehicle sales are projected to rise to 19% of all heavy truck sales by 2040, but BNEF expects the heavy truck segment to include hydrogen and fuel-cell-powered choices as well for the global long-haul trucking fleet.

The following chart shows the projected EV share of annual vehicle sales out through 2040.

BNEF’s head of advanced transport, Colin McKerracher, said, “Our conclusions are stark for fossil fuel use in road transport. Electrification will still take time because the global fleet changes over slowly but, once it gets rolling in the 2020s, it starts to spread to many other areas of road transport. We see a real possibility that global sales of conventional passenger cars have already passed their peak.”

The estimated decline in fossil fuel demand for transport nearly doubled in just one year, according to BNEF, from an estimated 2040 drop of 7.3 million barrels a day to a decline of 13.7 million barrels a day. As EV sales rise, they replace less fuel-efficient gas- and diesel-powered vehicles, and new fossil-fuel vehicles continue a steady pace of improving mileage ratings. It’s a double whammy for the oil industry that is on the brink of supplying 100 million barrels of oil a day in 2019.

Cheaper batteries are forecast to drive down the cost of EVs over the next 20 years, says BNEF, which expects to make EVs cheaper than fossil-fueled cars by the mid- to late-2020s.

While fossil fuel burning will drop, demand for electricity will jump. BNEF estimates that EVs will add about 6.8% to global electricity consumption by 2040 and demand for lithium-ion batteries will rise by more than 11 times, from 151 gigawatt-hours this year to 1,748 in 2030.

Vehicle emissions are projected to continue rising until 2030 as more fossil-fueled vehicles are added to the global fleet. Emissions are forecast to fall in the decade between 2030 to 2040, but only to levels similar to 2018.

China, the world’s biggest market for EVs, will account for 48% of all EV sales in 2025, but the country’s share drops to 26% by 2040 as other markets catch up. European sales will top U.S. sales sometime in the next decade, while sales in emerging markets (excluding China) will remain low.

Overall, more than 360,000 EVs were sold last year in the United States and 1.71 million were sold globally. The U.S. total is 80% higher than in 2017, and the global total is 40% higher year over year. These are America’s most eco-friendly vehicles.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.