Banking, finance, and taxes

J.P. Morgan Buyback, BofA Upgrades, Saving Banks from Elizabeth Warren

Published:

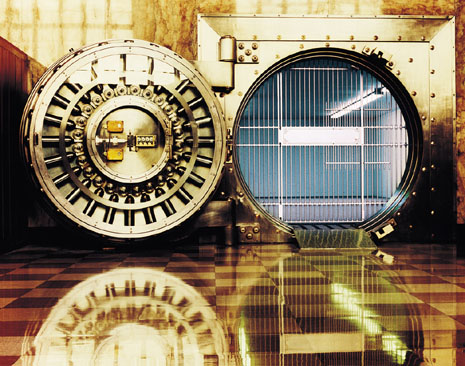

The bank sector suddenly finds itself in a state of flux, and as Yogi Berra might say, “It’s like deja vu all over again.” On the trading day after the presidential election, banks were not very well received. The election of Elizabeth Warren over incumbent Scott Brown for one of the two Senator seats from Massachusetts was about as bad as it could be for the banks. Warren is considered by Wall St. as wanting to go way beyond Dodd-Frank. Whether this ultimately will be the case is another matter, but the headline risk for suits, regulatory action and ongoing criticism of the banks is enough to spook investors. Source: Thinkstock

Source: Thinkstock

But … not so fast. We have two different drivers for the banks this morning, and there is a chance now that much of Wednesday’s losses could be regained.

J.P. Morgan Chase & Co. (NYSE: JPM) is up 1.8% after news of an SEC mortgage settlement, but the big news is that Jamie Dimon has received approval from regulators to rekindle its share buyback program. We were expecting this, but not until 2013.

Bank of America Corp. (NYSE: BAC) is seeing some serious snap back of its losses. This morning the stock was resumed with a Buy rating at Goldman Sachs this morning, and we had already seen that ISI Group had raised shares to Buy from Hold this morning.

Maybe the sentiment is that Elizabeth Warren will not be effective in making her case against bank attacks ahead. Bank of America shares are up more than 3% at $9.54, but we would note that the stock was at $9.94 at the close on the day of the presidential election. J.P. Morgan shares are up 1.7% at $41.18 so far on Thursday, and its shares were up at $42.88 on the close before the presidential election.

JON C. OGG

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.