Banking, finance, and taxes

Wells Fargo Sets Record Company Earnings, but Small Drop in Book Value

Published:

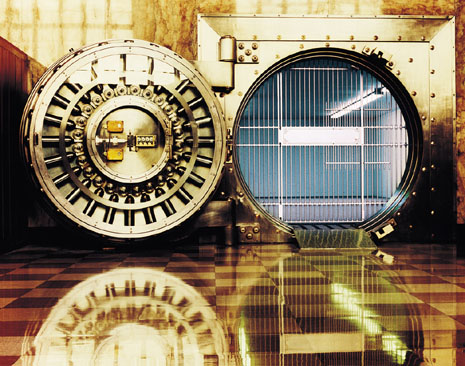

Wells Fargo & Company (NYSE: WFC) has released its second-quarter earnings report and the market likes what it sees so far. Earnings rose almost 20% with a record net income of $5.5 billion, or $0.98 in earnings per share. Revenues were up marginally to $21.4 billion. The consensus estimates from Thomson Reuters were $0.93 per share and $21.2 billion in sales. Source: Thinkstock

Source: Thinkstock

While rival J.P. Morgan Chase & Co. (NYSE: JPM) posted a stronger earnings growth, Wells Fargo shares closed at $41.89 on Thursday and are trading up more than its rival bank after the report with gains of 1.6% to $42.57. This remains our safest bank of 2013 for depositors, but we would still caution that this was up almost 25% so far in 2013 and shares were up about 34% from its 52-week lows.

Here were some additional key metrics that shareholders (and depositors) will care about:

One thing we would point out here is that Wells Fargo saw its book value per share actually decline by one cent in the second quarter to $28.26 per share, versus $28.27 per share in the first quarter of 2013.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.