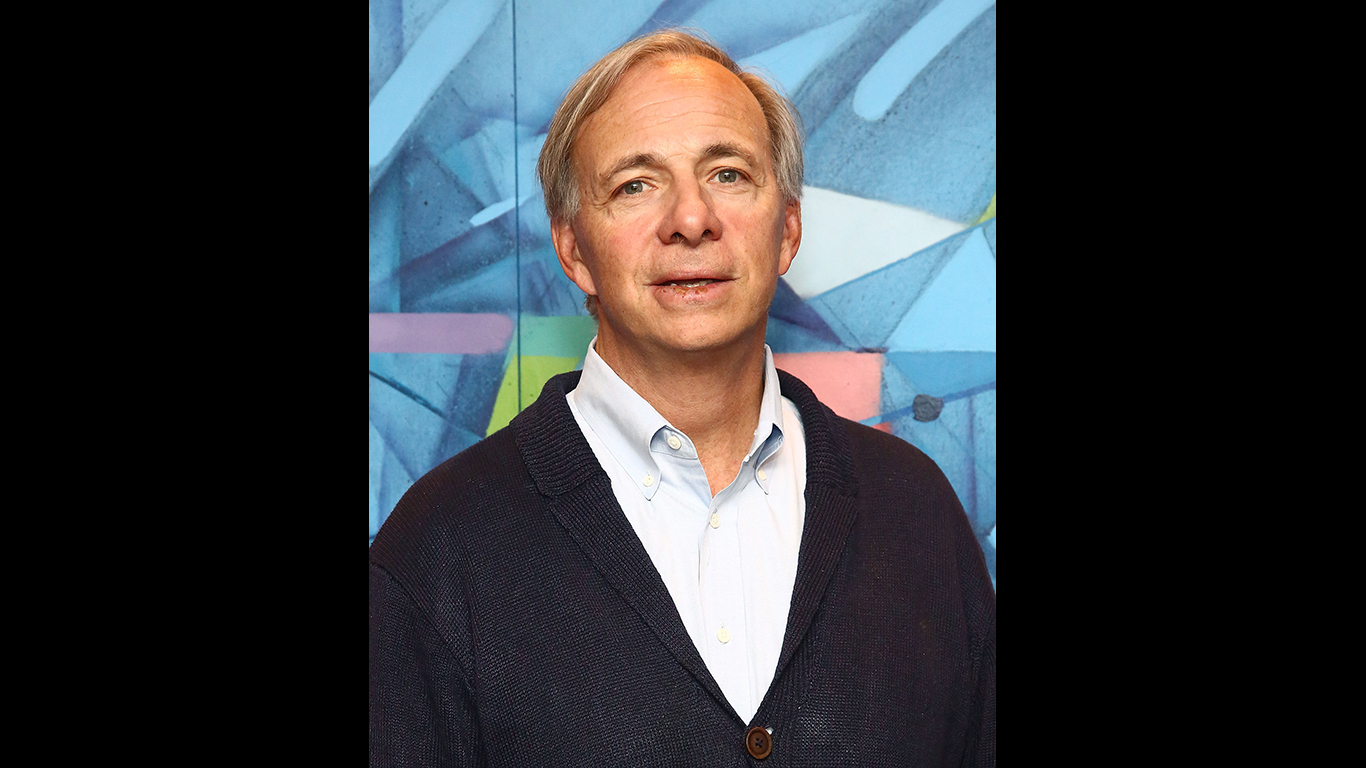

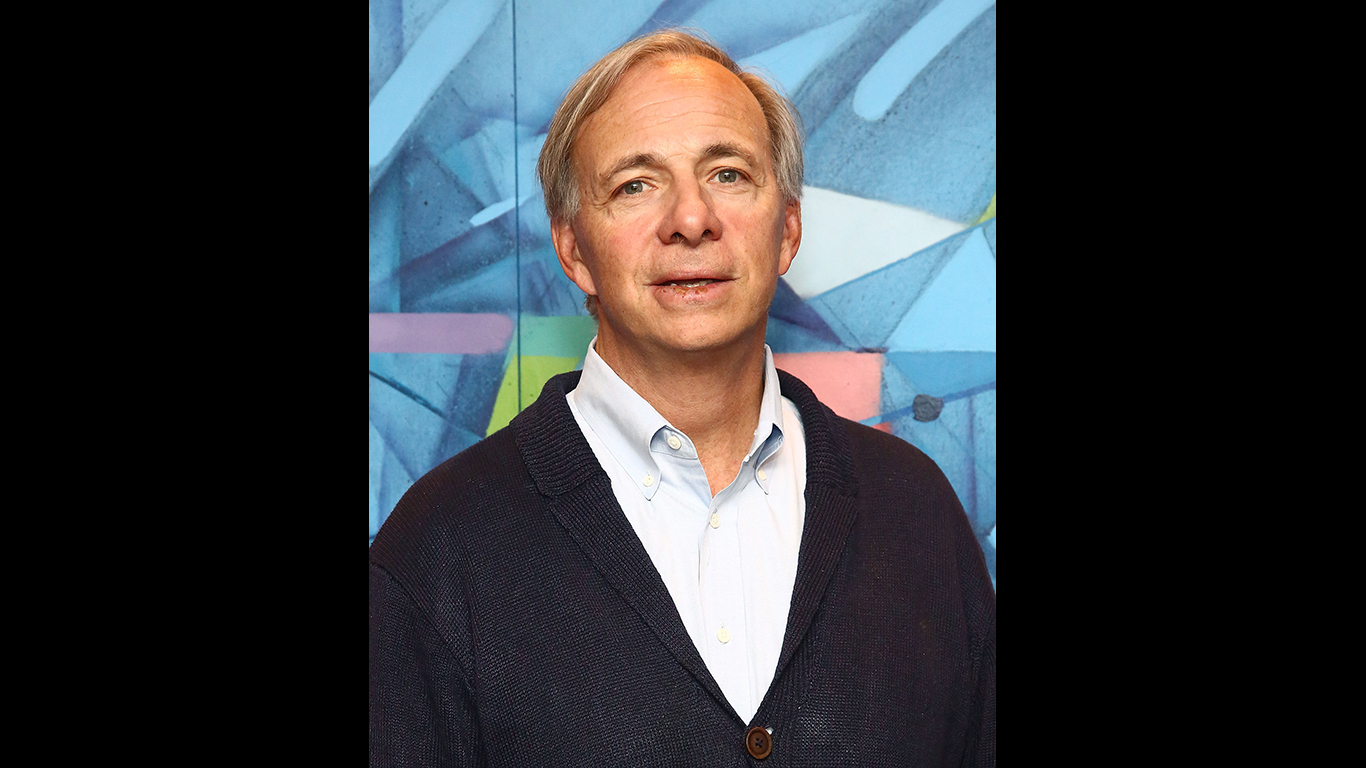

Ray Dalio, who founded the world’s largest hedge fund in 1975 earned $1.26 billion last year. This makes Dalio the richest hedge fund chief in the world and adds to the growing legend about how he built a company which manages $160 billion in assets.

[in-text-ad]

Dalio’s fortune has been put at over $16 billion recently, which Bloomberg claims makes him the 65th richest man in the world. Before he founded Bridgewater trade commodities and futures. He started his firm in a New York apartment.

Dalio has become a major public face of the hedge fund industry. After quietly running Bridgewater for decades, his management style began to fascinate the financial services industry and the press.

Dalio still runs Bridgewater, although he is no longer CEO,, according to what he calls 300 “Principles”. He published these in a book in 2011. The book has been both No.1 on The New York Times bestseller list and has been No.1 on Amazon’s Business Book of the year. However, the contents of the book, and how Dalio runs Bridgewater has been controversial

Dalio has most meetings at Bridgewater videotaped so that virtually anyone at the company can review, and critique them. Employees are encouraged to confront one another about weaknesses and challenge one another’s assumptions, in public. What is labeled as “radical transparency” has come across as cruelty in some circles. However, the firm’s results have been so extraordinary that other companies have started to adopt the practices.

Dalio has also used Bridgewater’s success to become a prominent face of the global finance industry. He is regularly a featured speaker at the annual Davos conferences which draw CEOs and country leaders from all over the world. He pronouncements about the future of the world’s economy are regular grist for the press. Dalio’s opinions on the dangers of income inequality are at the center of that debate of its effects on the world’s financial future. Late last year, Dalio said, “I worry about the next downturn, which isn’t imminent but also isn’t many years away. If you go out two or three years from now, there is significant risk of a downturn at a time that we have a political and social polarization. That is very similar to the late-1930s period.” He added later that “capitalism does not work for the majority of the world’s people.” While it may be considered an alarmist comment, his place at the center of the financial world gives his point of view heft.

Dalio’s dystopian view of the world aside, Bridgewater is so big, and regularly successful, that it is not hard to imagine he could make many more billions of dollars in his lifetime. That would extend a run at the top of his industry which is already unprecedented

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.