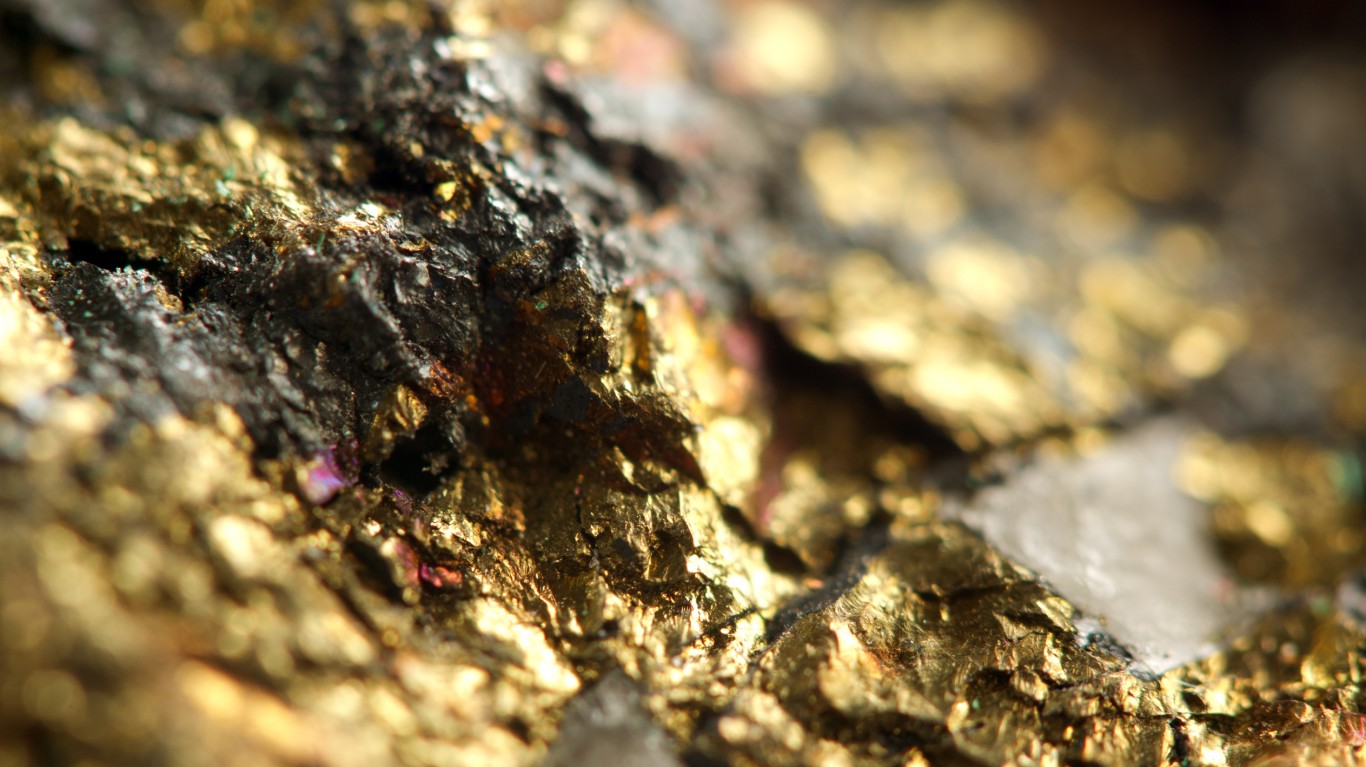

VanEck Gold Miners ETF

NYSE ARCA: GDX

$33.76

Closing price April 12, 2024

Stock prices are very overextended, and it is not a question of if a large correction comes but when. So it makes sense for more conservative investors to pivot to a safer stance. Here are five steps...

Published:

Investors with any sense of stock market history are well aware that’s it’s not a question of if but when a big market correction comes. One prescient analyst says it makes sense to take...

Published:

With a confluence of negative factors mounting, it makes sense for investors to take some simple, but smart steps to soften the blow if we do get a sizable market correction. Veteran investors know...

Published:

Short sellers appear dubious about gold, with most expecting seeing prices for the yellow metal improving.

Published:

Short interest in gold-mining stocks tumbled in the two-week period that ended November 30.

Published:

In the two-week reporting period that ended November 13, short interest decreased on three of five gold-mining stocks.

Published:

Bitcoin is within a few percent of closing at an all-time high. Will it make it? If it does, will the high last longer than a week?

Published:

Short interest in gold-mining stocks and gold ETFs was mixed in the two-week reporting period ended October 30.

Published:

Barrick and Kinross, two of the world's largest gold miners, have reported third-quarter results that topped even robust expectations.

Published:

Short interest in gold mining stocks and gold ETFs was mixed in the two-week reporting period ended October 15. Short sellers made big reductions in some of the gold stocks.

Published:

Short sellers pulled out of most gold stocks and exchange-traded funds in the two-week reporting period through September 30.

Published:

Short sellers were pulling out of gold mining stocks and gold ETFs in the two-week reporting period that ended September 15.

Published:

Short interest in gold mining stocks and gold ETFs was mixed in the reporting period that ended August 31. Short sellers generally reduced their positions in the miners and raised their positions in...

Published:

Warren Buffett's addition of nearly 21 million shares in a gold-mining stock raised more than a few eyebrows when it was revealed two weeks ago. But there's significant potential value in these...

Published:

With one exception, gold-mining stocks and gold ETFs made modest price moves in the two-week short interest reporting period that ended August 14. Short interest nearly doubled in one gold miner.

Published: