Goldcorp, Inc. (USA)

NYSE: GG

$11.19

Closing price April 17, 2019

Shareholders of gold miner Newmont have approved the company's $10 billion acquisition of Goldcorp. Barring any regulatory hitches, the deal is expected to close this quarter.

Published:

Last Updated:

The brokerage firm Raymond James sees a mixed view of Newmont and Barrick after the deal in a report from March 12, 2019.

Published:

Last Updated:

Investors should understand from the get-go that this gold merger would seem to be unlikely from a shareholder voting and regulatory stance. The reaction in the shares also seems to reflect some...

Published:

Last Updated:

These four gold stocks make good sense for investors looking to add a hedge to their current equity holdings.

Published:

Last Updated:

Monday's announcement of the $10 billion merger between gold mining giants Newmont and Goldcorp naturally leads to the question about what other firms may be on the block.

Published:

Last Updated:

Gold mining giants Newmont and Goldcorp have agreed to a $10 billion merger that will create the world's largest gold mining firm.

Published:

Last Updated:

These five stocks trading under the $10 level could provide investors with some solid upside potential. Plus, after the recent huge sell-offs, these stocks look even better now.

Published:

Last Updated:

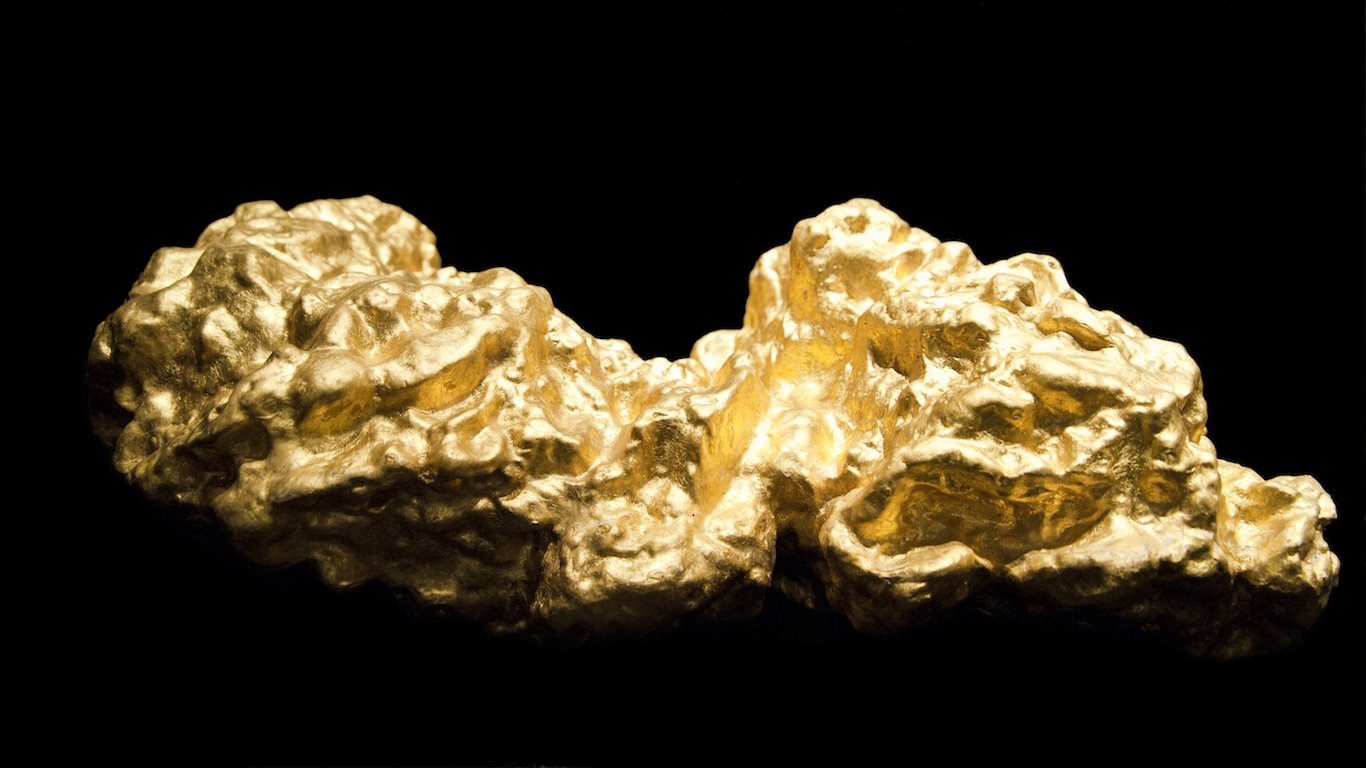

One thing to do now with the end of the year closing in is to take some gains and add a position in gold to help protect against a total market collapse. Gold remains a hard asset that people trust...

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Friday included Goldcorp, Home Depot, JC Penney, Nvidia, PG&E, Qualcomm, Target, Taiwan Semiconductor, Weatherford and Yamana Gold.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Friday included GoldCorp, Gilead, GrubHub, Hilton Worldwide, KKR, Raymond James and Western Digital.

Published:

Last Updated:

One way to always have a degree of protection is to own gold-mining stocks. And now could be an excellent time to buy some protection and add some gold into long-term growth portfolios.

Published:

Last Updated:

Does Monday's announced merger between gold miners Barrick and Randgold presage a rush of consolidation and merger in an industry that has been reeling for a couple of years now?

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Wednesday include AMD, Alphabet, Amazon.com, Best Buy, Dollar General, Ferrari, Goldcorp, Hewlett Packard Enterprise, Square and Tilray.

Published:

Last Updated:

How on earth can analysts and investors maintain a positive view on gold miners? Is there still value in them even if the underlying commodity is in the toilet?

Published:

Last Updated:

RBC remains generally positive on the gold-mining stocks as prices have held despite the rise in U.S. interest rates and gold is seen as a solid way to hedge against market volatility.

Published:

Last Updated: