Despite Lower Oil Prices, Texas Manufacturing Remains Relatively Strong

November 24, 2014 by Jon C. Ogg If there is one state that comes to mind that may be worrying about lower oil prices, Texas has to be at or at least close to the top of the list. Fresh regional economic data on manufacturing output from the Dallas Federal Reserve may at least somewhat curb that fear. Still, there are signs that growth slowed in the region. The actual commentary from survey respondents was also quite mixed.

If there is one state that comes to mind that may be worrying about lower oil prices, Texas has to be at or at least close to the top of the list. Fresh regional economic data on manufacturing output from the Dallas Federal Reserve may at least somewhat curb that fear. Still, there are signs that growth slowed in the region. The actual commentary from survey respondents was also quite mixed.

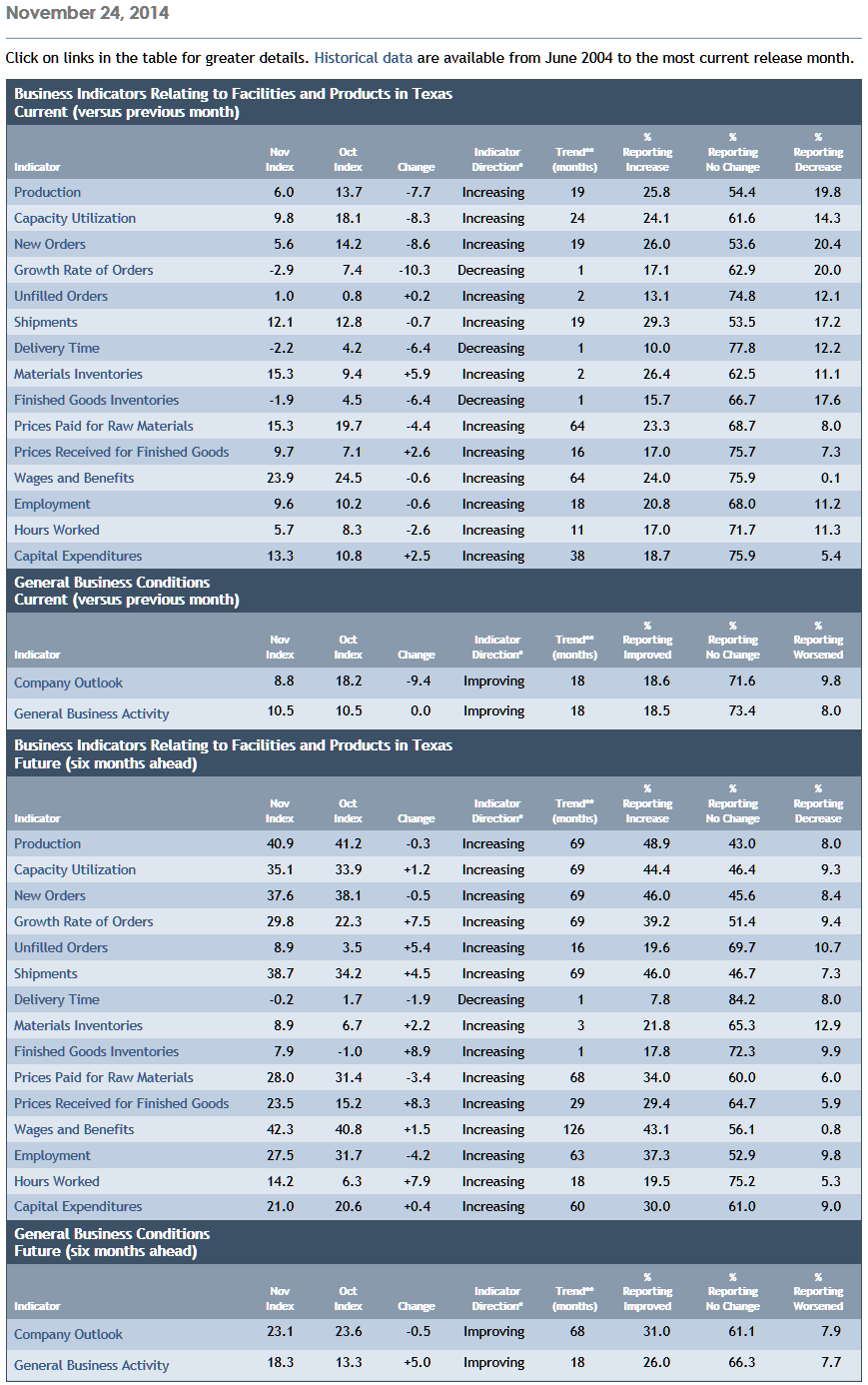

The Dallas Fed Manufacturing survey for the month of November showed that the general Business Activity Index was flat at 10.5 versus the same reading in October. Bloomberg had been calling for the consensus reading to drop down to 9.0 in its forecast. Still, the key production index fell to 6.0 in November from 13.7 in October. This is still growth as the reading was above 0, but it echoes other readings in that it signals slower growth.

The capacity utilization index saw its growth nearly cut in half – down to 9.8 from 18.1. The new orders index saw its growth more than halved, down to 5.6 from 14.2. The shipments index was roughly unchanged at 12.1, but that may represent a fulfillment of old orders.

Perceptions of broader business conditions remained positive this month, while certain outlooks were less optimistic than they had been in October. The company outlook index dropped from 18.2 to 8.8, as a smaller number of firms noted an improved outlook in November.

Labor market indicators reflected continued employment growth and longer work weeks. The November employment index posted a sixth robust reading, coming in at 9.6. Of firms hiring and firing, 21% of firms reported net hiring and 11% reported net layoffs. The hours worked index slipped from 8.3 to 5.7, which indicated a smaller increase in hours worked than last month — and which could ease the need to hire.

Upward pressures on wages and prices were mixed. The raw materials prices index fell from 19.7 to 15.3, its lowest reading in seven months. The finished goods prices index edged up from 7.1 to 9.7.

ALSO READ: How Funds & ETFs Will Hold Kinder Morgan After Mergers

Monday’s regional release was fairly close to live data, and it did include the massive drop in the price of oil we have seen. The Dallas Fed collected this data for the Texas Manufacturing Outlook Survey from November 10 to 19, and 108 Texas manufacturers responded to the Fed survey.

The table above shows the full report in a table for a clearer picture of November’s results versus October.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.