The Money Anxiety Most Americans Face

September 2, 2016 by Douglas A. McIntyreFrom The Fiscal Times

Even as Americans are racking up ever-higher levels of credit card debt and student loans, they’re claiming that paying down what they owe is their top financial priority.

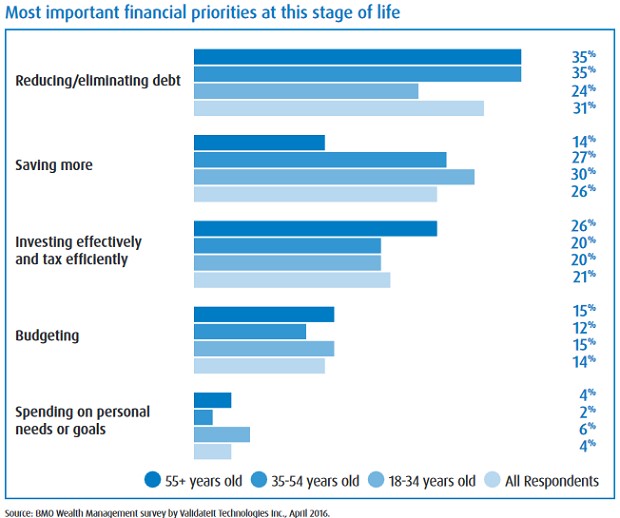

A new survey from BMO Group finds that 31 percent of Americans cite debt repayment as their top financial priority, followed by saving more (26 percent) and investing efficiently (21 percent).

Some respondents admitted to being worried that their debt could hurt their ability to achieve future financial goals. Among those surveyed, 24 percent said they were concerned they had more debt than they could repay, and 14 percent were worried about their ability to maintain a good credit score.

Consumers owe more than $3.6 trillion in debt, thanks to credit card bills, student debt, auto loans and mortgages, according to the Federal Reserve. While a willingness by consumers to borrow money (and banks to lend it) is generally good news for the economy, the growing levels of debt could pose future personal finance problems.

Statistics show that Americans are taking some steps to reduce their debt loads, such as refinancing their mortgages or signing up for income-based repayment plans for federal loans. They’re also chipping away at credit card debt, but not quickly enough.

Americans paid down nearly $27 billion in credit card debt in the first quarter of the year, according to CardHub. While that may sound impressive, it’s the lowest debt repayment for a quarter since 2008, and it’s just a drop in the bucket against the $71 billion collectively charged in the quarter.

Related: Home Prices Hit an All-Time High: Is This Another Bubble?

Related: An Obscure, Outrageous Reason Your Property Taxes Are So High

Related: Junk-rated US Municipalities Shine Brighter With Record Low Rates

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.