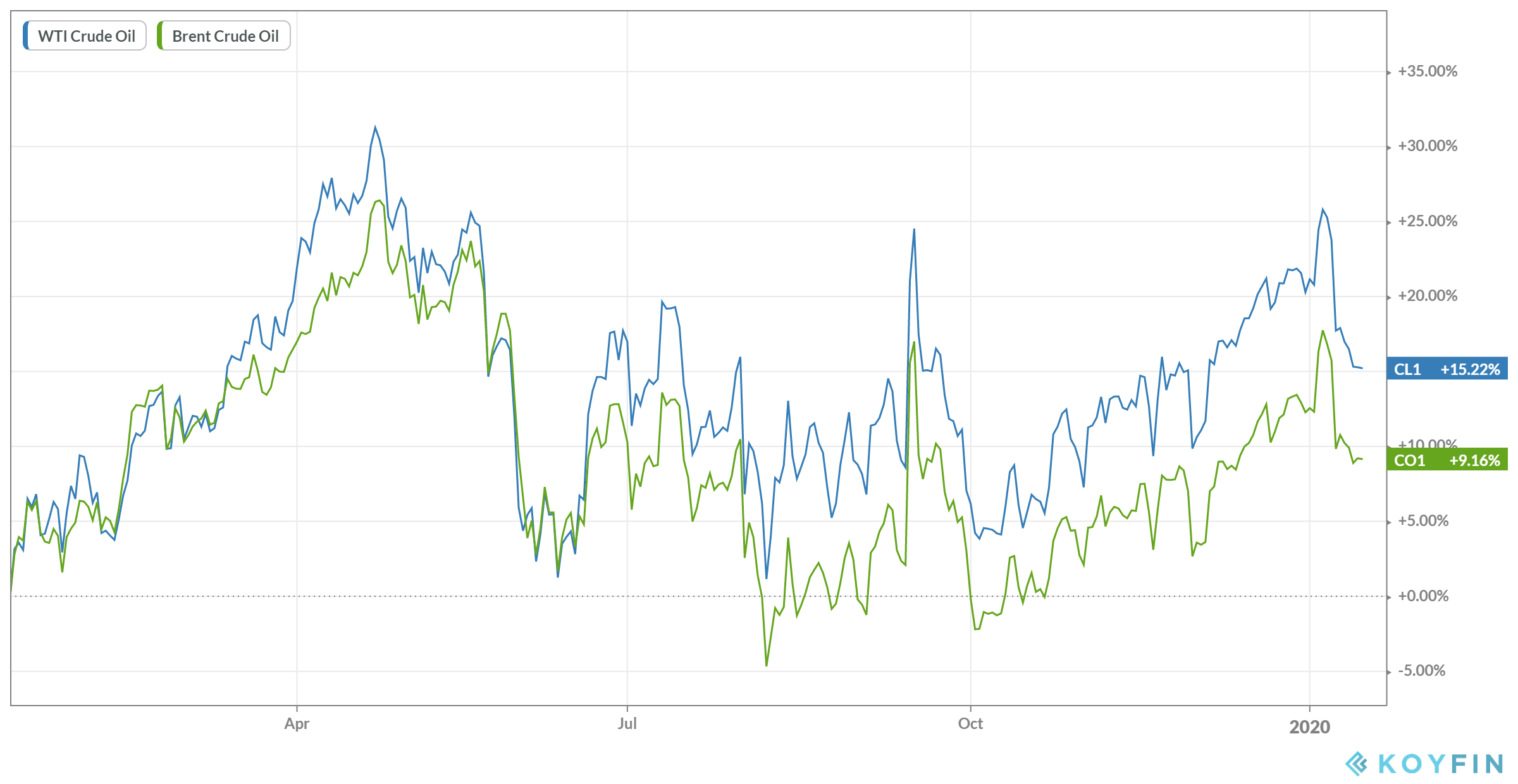

The U.S. drone attack that killed Iranian Lieutenant General Qasem Soleimani sent shivers through global oil markets earlier this month. Crude prices had been climbing all through December following the agreement among members of the OPEC+ coalition to restrain production further. Prices spiked following Soleimani’s death, but have since returned to levels roughly the same as at this time last year.

The revised OPEC+ agreement sliced an additional 500,000 barrels from daily output, leaving daily output 1.7 million barrels a day below its level in October 2018. Saudi Arabia said it will voluntarily cut an additional 400,000 barrels a day from its production, bringing the total reduction to 2.1 million barrels a day.

In its Monthly Oil Market Report for January, the International Energy Agency (IEA) commented on the volatile situation in Iraq. The country’s “strategic importance” to global oil supplies has grown as production has doubled to 4 million barrels a day since 2010, according to the IEA. Iraq’s importance has been magnified by the reduction of exports from Iran, which now total just 300,000 barrels a day, and the collapse of Venezuelan production.

The IEA commented: “In the medium term heightened security concerns might make it more difficult for Iraq to build production capacity. In turn, this could make it more difficult to ensure there is [sufficient] spare production capacity to meet rising global demand in the second half of this decade.”

Global supply fell by 780,000 barrels a day in December to 100.7 million barrels, a decrease of 1.3 million year over year. OPEC supplies have declined by 2.4 million barrels a day since December 2018, while the IEA expands the call on the cartel’s supply to fall from 29.44 million barrels a day in December to 28.5 million over the first half of 2020.

Global demand growth increased from 955,000 barrels a day in October 2018 to 101.1 million barrels in this past October. Demand grew by 800,000 barrels a day in China and 500,000 barrels a day in India in November, while overall U.S. demand is flat for 2019.

The IEA forecasts global demand growth to rise by 1.2 million barrels a day in 2020 as a result of continuing low prices, higher expected GDP growth, and smoother trade relations. The OPEC+ countries need to cut another 300,000 barrels a day of production to meet their agreed output quota while non-OPEC production rises by 2.1 million barrels a day.

The agency added

Today’s market where non-OPEC production is rising strongly and OECD stocks are 9 [million barrels] above the five-year average, provides a solid base from which to react to any escalation in geopolitical tension. As a back-up resource, the value of strategic [stockpiles] has once again been confirmed. … At the start of 2020 the oil market has again faced a period of geopolitical turmoil at the same time as a significant sector is adjusting to a major change to its operating environment. That we have such a well-supplied and increasingly globalised market will help us to face these challenges.

The following charts show the price and percentage changes for WTI crude (labeled CL1) and Brent crude (CO1) over the past 12 months.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.