Freddie Mac Issues Outlook for 2015 and 2016

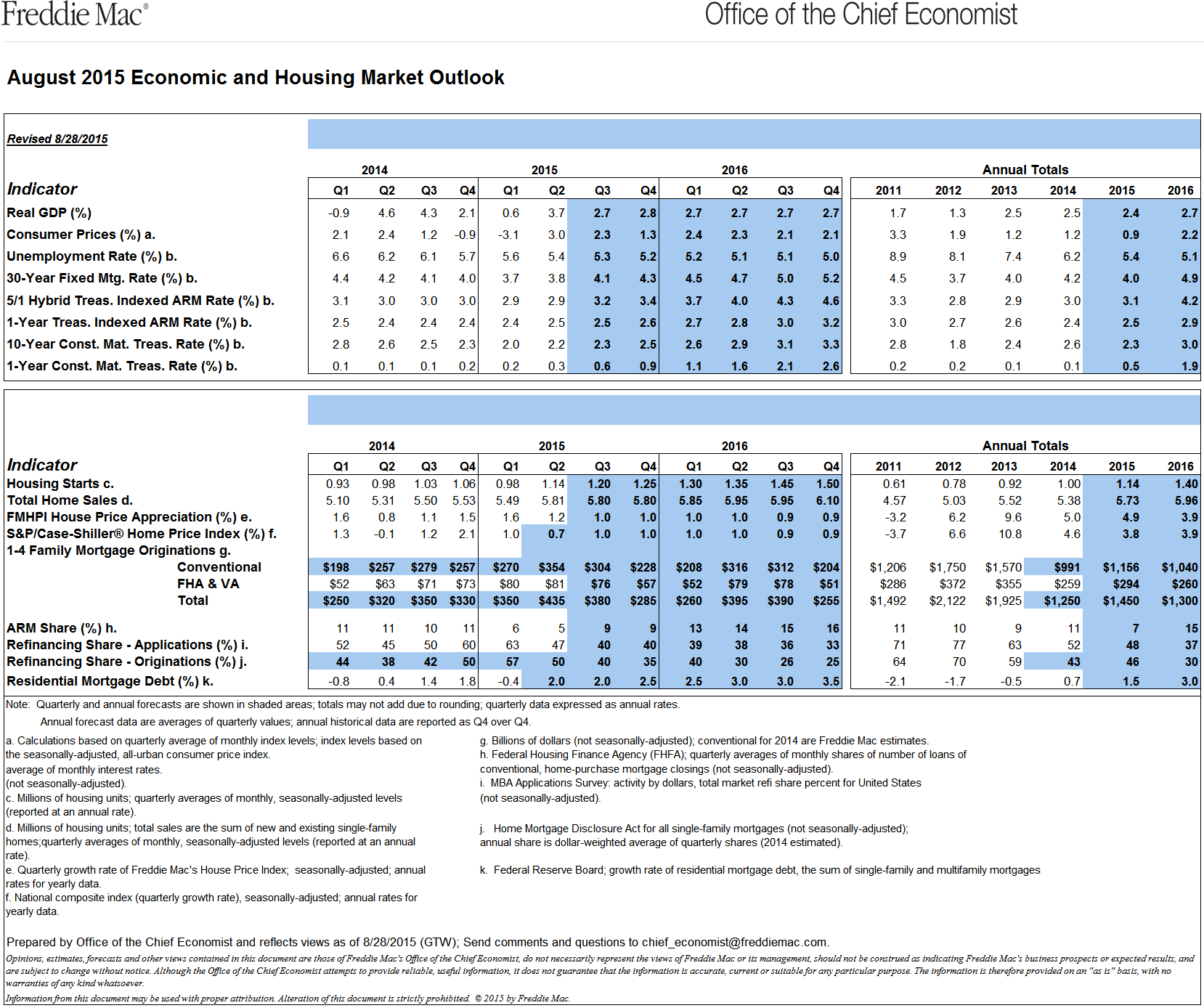

August 31, 2015 by Jon C. Ogg Freddie Mac has now released its monthly Insight & Outlook for August of 2015. While the group is saying that there is no single statistic pegging when a housing market is overvalued or likely to fall, the real goodies are highlighted in some of the basic statistics and forecasts. Included is an infographic on Freddie Mac’s economic and housing market projections for the rest of 2015 and for 2016.

Freddie Mac has now released its monthly Insight & Outlook for August of 2015. While the group is saying that there is no single statistic pegging when a housing market is overvalued or likely to fall, the real goodies are highlighted in some of the basic statistics and forecasts. Included is an infographic on Freddie Mac’s economic and housing market projections for the rest of 2015 and for 2016.

Refinance activity is driving much of the mortgage market right now. They noted:

- Due to stronger-than-expected refinance activity and home sales, estimate of 2015 mortgage originations have been increased to $1.45 trillion and 2016 originations to $1.3 trillion.

- Increased projection of 2015 home sales to 5.73 million units, which would be the best year since 2007.

- Revised 2015 refinance share up to 46% of all single-family mortgage originations.

Here were some of the second quarter refinance highlights for 2015:

- Cash-out refinances increased from 27% of refinances in the first quarter of this year to 34 percent in the second quarter. A year ago, the cash-out share was 22 percent. During the housing boom, the cash-out share peaked at 89 percent in the third quarter of 2006.

- An increasing share of refinancing borrowers chose to shorten their loan terms. Of borrowers who paid off a 30-year fixed-rate loan in the second quarter, 40 percent chose a 15-or 20-year loan, compared to 39 percent in the first quarter.

Freddie Mac compared actual losses on low down payment loans to losses on 20% down payment loans over the 10-year period 2003-2013. This includes the housing crisis, as follows:

- 30-year fixed rate loans with 3% down payments were 17% riskier than 20% down payment loans over that period. They did note that it was “only” that much riskier.

- 7/1 ARMs were 155% riskier than 30-year fixed rate mortgages over the same period.

- 5/1 ARMs were 5-times as risky than 30-year fixed rate mortgages over the same period.

- On affordability, Freddie Mac said that there is a surprising amount of disagreement among the various measures of overvaluation. The same metro area may be tagged as overvalued by one metric and undervalued by another measure.

An image of a table has been provided from Freddie Mac, along with 2015 and 2015 outlooks in economic readings and on housing statistics:

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.