Top Gainers of the S&P 500 of 2014 and the Second Quarter

July 1, 2014 by Jon C. OggIt seems hard to believe that the second quarter and the first half of 2014 have already come to an end. Such is life, and the five-year bull market has now extended even further. The S&P 500 Index gained 4.7% in the second quarter and is up 6.05% year-to-date. The Dow Jones Industrial Average (DJIA) rose by 2.2% in the second quarter, but it is up by only 1.5% year-to-date. 24/7 Wall St. wanted to take a look at the best and worst stocks of the DJIA and the S&P 500 Index of 2014.

While we have looked at the performance, we also wanted to see what the prospects are going forward on each. Color has been added on each as well.

This group is the best performing S&P 500 stocks, and the best performing DJIA stocks were run in their own piece.

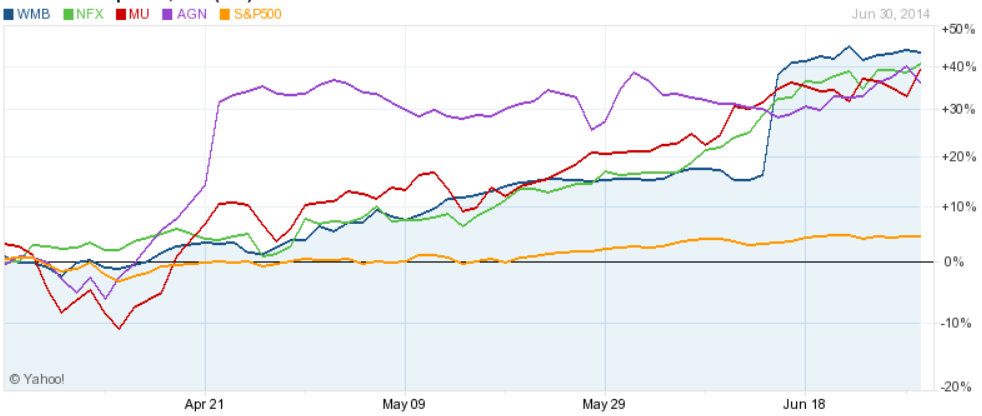

Williams Companies Inc. (NYSE: WMB) led the S&P 500 Index for performers in the second quarter of 2014. Shares rose some 44.7% in the quarter alone, and they are up by 54.8% in the first half. At $58.21, shares have a 52-week range of $32.36 to $59.68. A transformative acquisition seems to have driven the gains here. Investors get a 2.9% dividend yield, and the consensus analyst target price is $60.14.

Newfield Exploration Co. (NYSE: NFX) was the second best stock of the second quarter in the S&P 500 Index. At $44.20, its gain was 40.9% in the second quarter. The stock is up 80.1% year-to-date, which is actually the largest year-to-date gain as of the second half. Newfield’s 52-week range is $22.71 to $44.26, but investors may want to take caution that the Thomson Reuters consensus price target is $43.90 here.

ALSO READ: The Ten Stocks That Will Take the DJIA to 20,000

Micron Technology Inc. (NASDAQ: MU) took the number-three spot for the quarter in the S&P 500 Index. The independent DRAM manufacturing king rose by 39.2% in the second quarter alone, and shares are up 53.1% in the first half. This stock seems to just keep chugging along, and analysts remain very bullish. At $32.95, its 52-week range is $12.31 to $33.05 and the Thomson Reuters consensus price target is $38.40. Micron may have been the third highest gainer in the S&P 500 of the second quarter, but it ranked as the sixth best S&P 500 stock so far in 2014.

Allergan Inc. (NYSE: AGN) is a driving force, but this is because of the pursuit to acquire the company. At $169.22, the gain in the second quarter was 36.4%, and the year-to-date gain has been 52.7%. With it being a merger candidate, there is little reason to add color beyond this point.

Performance was measured by FINVIZ.com, data on each stock (and the chart below) was provided by Yahoo! Finance. The chart is the performance of the second quarter, and it can be enlarged by clicking to expand it.

ALSO READ: Nine Analyst Stock Picks Trading Under $10 With Huge Implied Upside

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.