By Gene Munster and Will Thompson of Loup Ventures

- Apple continues to push the boundary of consumer tech by refining and improving their products with today’s updates to the iPhone and Apple Watch. These improvements drive customer loyalty that creates revenue predictability and should result in higher ASPs, supporting annual cash from operations of $85B+ per year that can be invested in the business and returned to investors.

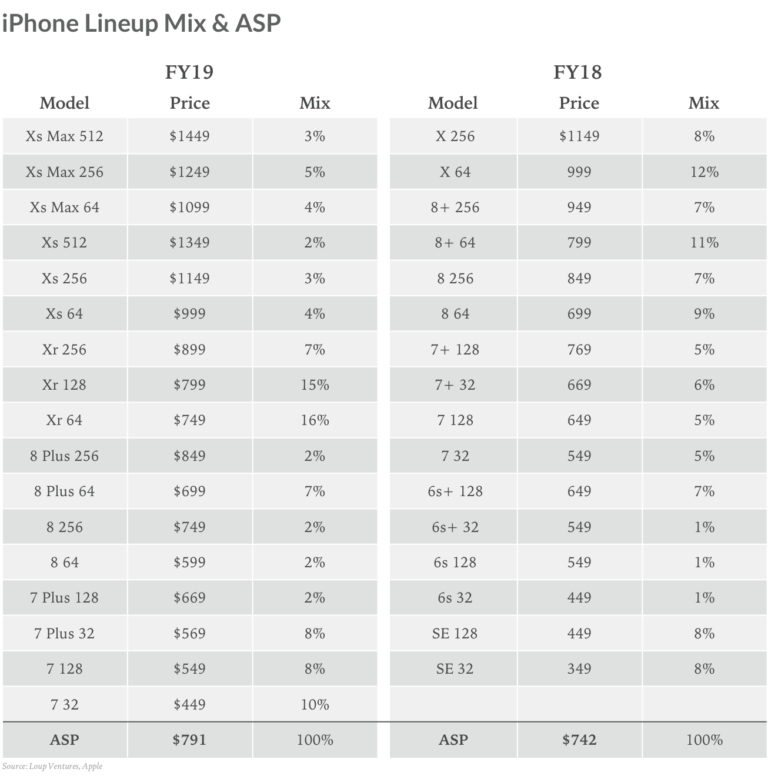

- Once again, Apple has shown their mastery of pricing tiers. Factoring in nine new phones with price points above the FY18 ASP ($745) makes it highly likely that ASPs will trend up.

- The iPhone lineup now ranges from $449 to $1,449, with an unweighted average of $765. This is up 20% from last year when the unweighted average was $636, with the lineup ranging from $349 to $1,099.

- Apple is also building an insurmountable lead in the wearables space for two reasons. First, WatchKit makes it easier for developers to build on Watch. Second, Apple is aggressively advancing hardware, including display, processor, and sensors (most recently adding ECG and fall monitoring).

- We estimate that wearables represent ~5% of revenue today, but is growing quickly, up 60% in Jun-18 compared to 50% growth in Mar-18.

- While we were disappointed by the AR use cases showcased at today’s event, we are still optimistic about the AR opportunity and feel Apple has the best AR platform available today.

[in-text-ad]

The Mix Reveals the ASP Story

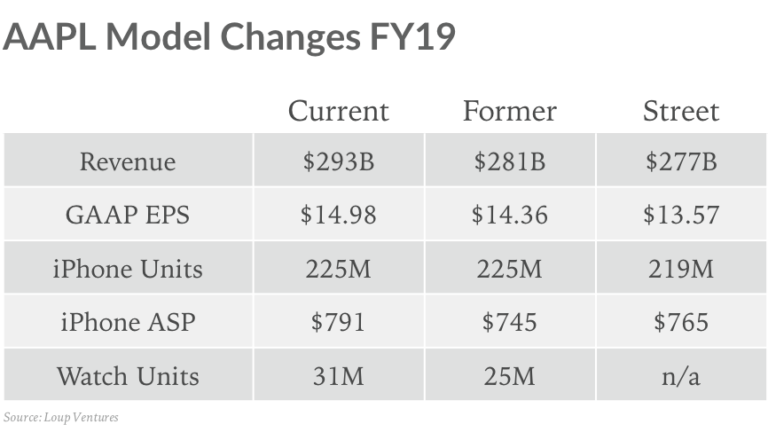

Our biggest near-term takeaway from the event was that ASPs are moving higher. We are raising our estimates, expecting a 7% ASP increase next year from $745 to $791. Given the mix, it’s hard to see ASPs next year below $800 (vs. $745 this year). The table below compares our product mix assumptions.

To illustrate our conservatism, our model anticipates 38% of new unit sales come from the Xr line, the lowest-priced of the new phones. This compares to our assumptions of 12% of units from Xs Max and 9% from Xs. From a high level, our modeling methodology is consistent with past years in that we’re expecting the newest SKUs (Xs Max, Xs, and Xr) to account for 59% of new iPhone sales, compared to last year when we estimated the newest SKUs (8 and X) accounted for 54% of new sales.

Changes to the Model

Link to updated model here.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.