More than one-third of the 30 companies included on the Dow Jones industrial average are scheduled to report earnings this week. All told, nearly 500 companies are on the earnings calendar for this week.

In addition to our weekend looks at the Dow stocks reporting this week and at several others with heavily traded shares, here’s a bit more detailed look at five stocks set to report either Tuesday afternoon or Wednesday morning.

[in-text-ad]

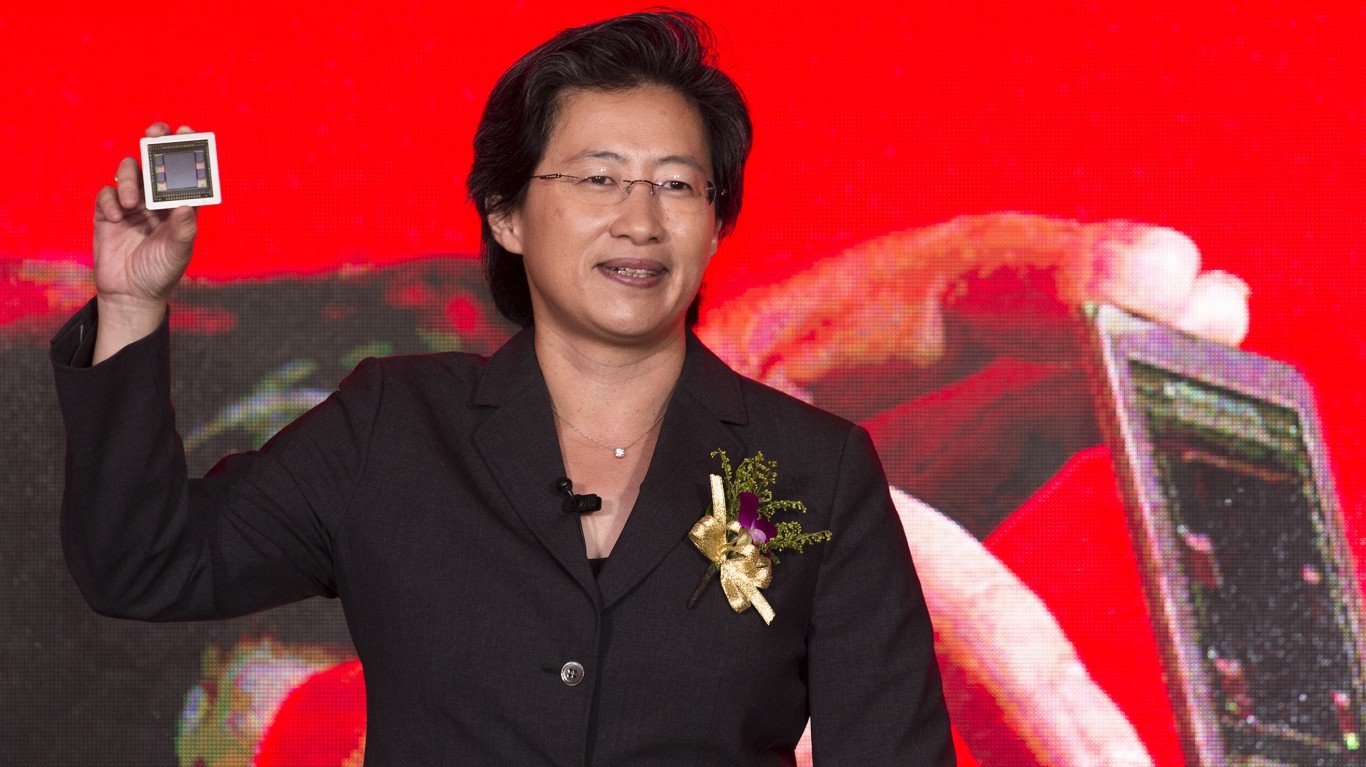

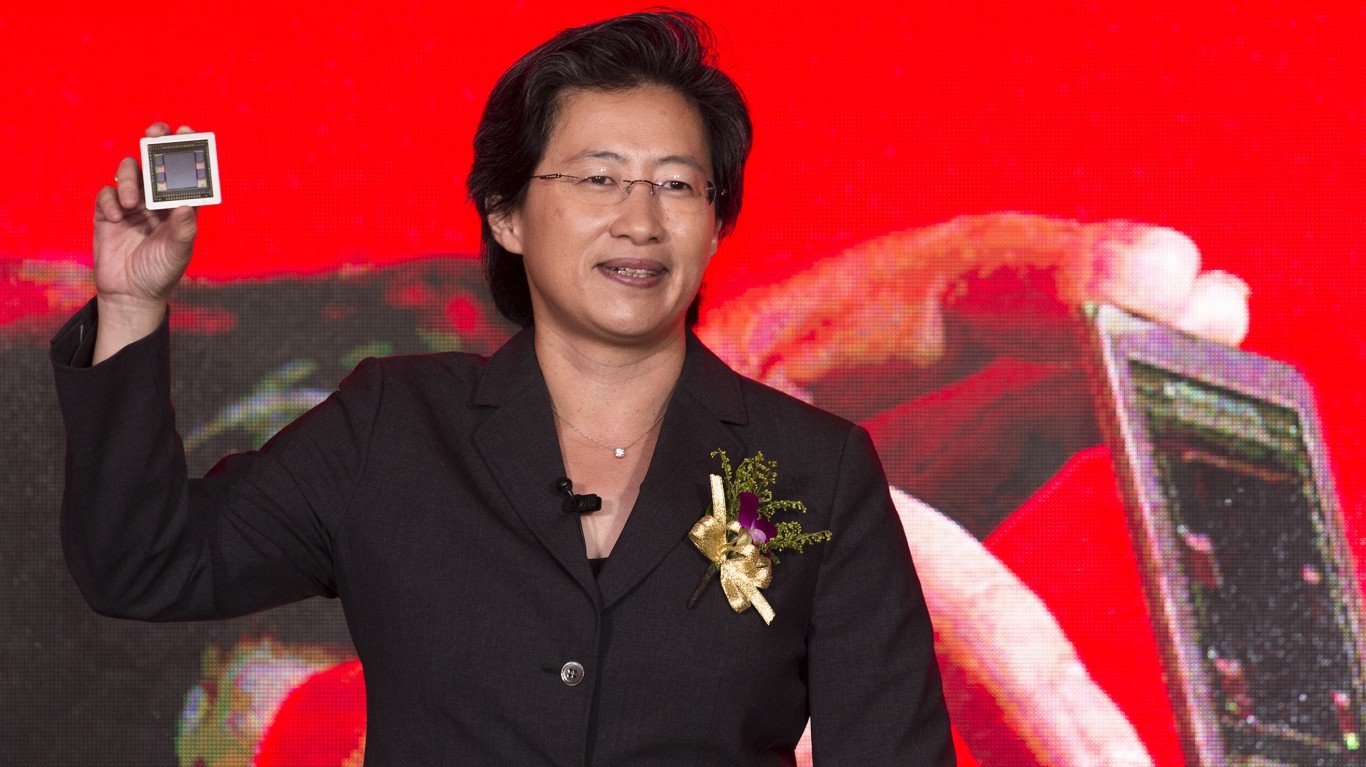

AMD

Advanced Micro Devices Inc. (NASDAQ: AMD) stock doubled last year and has added just over 3% so far in January. The company has taken advantage of Intel’s missteps in manufacturing technology to steal a march on the larger company’s desktop and server business. Add to that AMD’s gains in graphics processors, and it’s not hard to see why the share price soared in 2020.

When AMD reports fourth-quarter results after markets close Tuesday, analysts are expecting earnings per share (EPS) of $0.47 on sales of $3.02 billion. The totals represent year-over-year increases of 47% in EPS and 42% in revenue. EPS for the full year is expected to double to $1.23, and sales are forecast to rise by 42%.

Shares traded up about 3% early Monday morning at around $95.60, above the consensus price target of $93.34 and at around 76 times expected fiscal 2020 earnings. The stock’s multiple to estimated 2021 EPS is about 53. AMD does not pay a dividend.

Microsoft

After the closing bell Tuesday, Microsoft Corp. (NASDAQ: MSFT) is expected to report second-quarter fiscal 2021 results. Microsoft is among the companies that have benefited substantially from the pandemic-induced move to working from home. This has boosted demand for the company’s Azure cloud service and for new computers running the company’s venerable Windows software. All this sets the stage for continuing growth in 2021 as the global economy recovers.

Analysts are forecasting second-quarter EPS of $1.64, up 8.6% year over year, and revenue of $40.2 billion, up 8.9%. For the full fiscal year ending in June, EPS are expected to rise by more than 17% to $6.76 and revenue is forecast to rise by nearly 11% to $158.3 billion. Microsoft stock added about 42.5% in 2020 and trades up about 2.5% so far this year.

At a current price of around $228 per share, the stock trades at about 34 times expected 2021 EPS and 31 times expected 2022 earnings. The current consensus price target on the stock is $243.33, implying an upside of about 2.8%. Microsoft’s dividend yield is 0.99%.

Starbucks

Starbucks Corp. (NASDAQ: SBUX) is scheduled to report first-quarter fiscal 2021 results on Tuesday as well. Despite improving late in the quarter, Starbucks is still tabbed to post lower year-over-year same-store sales, although the company sees a “significant rebound” in its 2021 fiscal year and “outsized growth in fiscal 2022” with adjusted EPS rising by more than 20% in the year.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.