All the top Wall Street firms we follow here at 24/7 Wall St. keep a list for their institutional and retail clients of high-conviction stock picks. Generally, these are companies they like on a longer term basis and those stocks with big upside to the assigned target price. With the quarter winding down, and the second half right around the bend, many firms have tweaked their lists of top stocks to buy to account for continued changes in 2021, and one analyst has added some outstanding stocks we feel could have outsized upside.

[in-text-ad]

In a recent Jefferies research report, the analysts make a huge move in reworking the firm’s Franchise Picks list. Three new stocks (see below) were added to the list, while three (Haemonetics, Kennametal, Procter & Gamble) were removed. We have covered the Franchise Picks list for years but have rarely seen larger portfolio changes. Remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Here are the three new additions to the Jefferies Franchise Picks list.

Parker-Hannifin

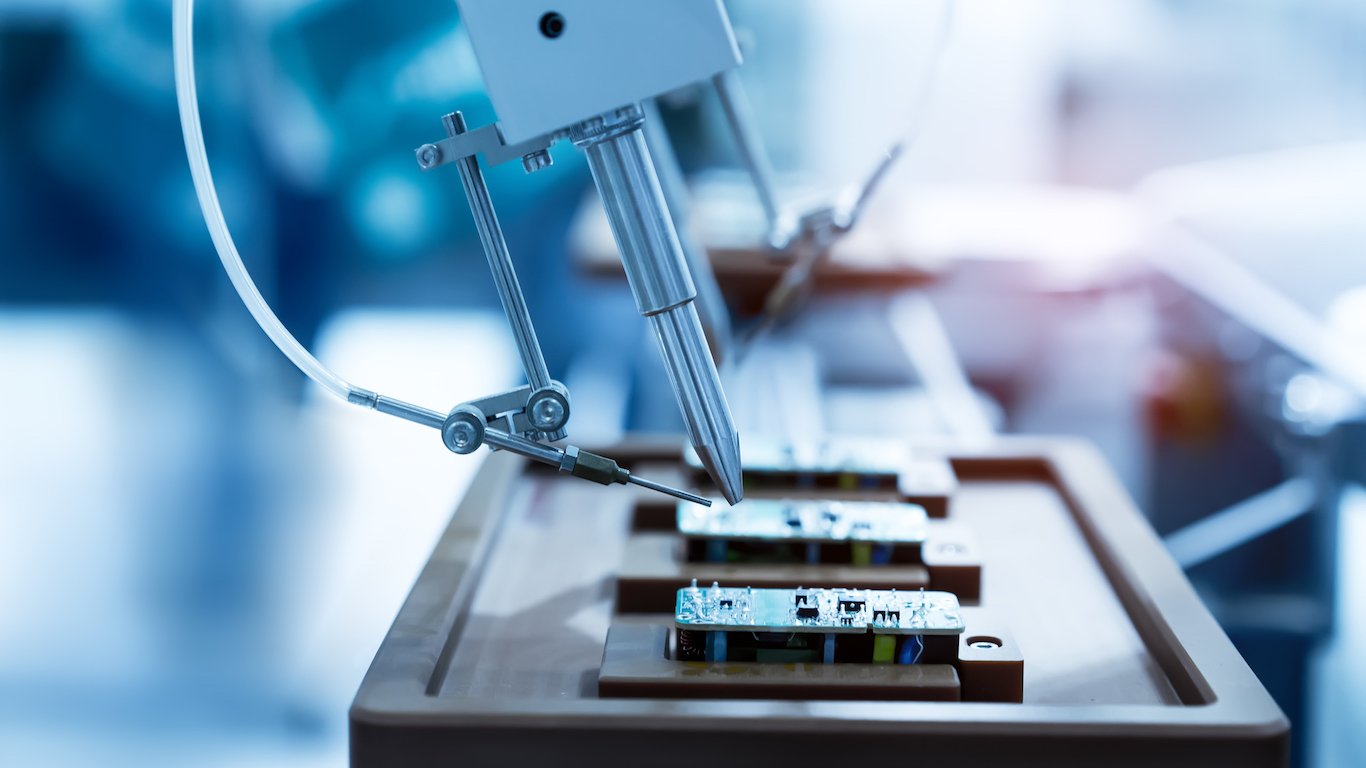

This top industrial company looks poised for a solid 2021 and beyond. Parker-Hannifin Inc. (NYSE: PH) manufactures and sells motion and control technologies and systems for various mobile, industrial and aerospace markets worldwide.

The Diversified Industrial segment provides pneumatic, fluidic and electromechanical components and systems, as well as filters, systems and diagnostics solutions to monitor and remove contaminants from fuel, air, oil, water and other liquids and gases.

The Aerospace Systems segment offers flight control, hydraulic, fuel, fluid conveyance and engine systems and components for commercial and military airframe and engine programs. It also provides electronics thermal management heat rejection systems and single-phase and two-phase heat collection systems for radar, inverse synthetic aperture radar and power electronics.

The analysts said this:

We believe the company will be an outsized beneficiary in the reopening (and acceleration) of the manufacturing economy into what we believe will be a multi-year period of strong top line growth and margin expansion. Aided by recent spikes in commodity prices, which are easily passed-through for PH, we see upside to consensus for fiscal 2022 and 2023 estimates as we are the Street high for both periods.

Shareholders receive a 1.35% dividend. Jefferies has a $375 price objective for the shares, and the consensus price target is $357.12. Wednesday’s last Parker-Hannifin stock trade hit the tape at $305.40.

STARR Surgical

This is an outstanding idea for aggressive growth investors looking for health care exposure. STARR Surgical Co. (NASDAQ: STAA) designs, develops, manufactures, markets and sells implantable lenses for the eye, as well as companion delivery systems to deliver the lenses into the eye.

STARR Surgical provides Visian implantable Collamer lens (ICL) product family to treat visual disorders, such as myopia, hyperopia, astigmatism and presbyopia. Hyperopic ICL treats far-sightedness. It also offers preloaded silicone intraocular lenses, as well as preloaded injectors for use in cataract surgery. In addition, the company sells injector parts and other related instruments and devices. STAAR Surgical markets its products to health care providers, including ophthalmic surgeons, vision and surgical centers, hospitals, government facilities and distributors.

[in-text-ad]

Jefferies is very positive:

Our conviction in STAA shares is based on our proprietary surveys of both refractive surgeons (n=50) and consumers (n=750), along with our bottom’s up total addressable market analysis. Collectively, the data suggests that the EVO Visian ICL could replace the current gold standard LASIK as the lead US refractive surgical option within 3-5 year post launch (expected late 2021). Our sum-of-the-parts analysis supports ~$90-$110 for the myopia opportunities alone, suggesting the current valuation bakes in minimal contribution from Viva in presbyopia markets.

The $150 Jefferies price target is well above the $138 consensus figure. Wednesday’s closing share price was $140.00.

Take-Two Interactive

This top video game producer also has cashed in with some super-hot titles. Take-Two Interactive Software Inc. (NASDAQ: TTWO) develops, publishes and markets interactive entertainment solutions for consumers worldwide. The company offers its products under the Rockstar Games and 2K labels, as well as under Private Division and Social Point labels.

Take-Two develops and publishes action/adventure products under the Grand Theft Auto, Max Payne, Midnight Club, and Red Dead Redemption names through developing sequels, and it offers downloadable episodes, content and virtual currency, as well as releasing titles for smartphones and tablets. The company also develops brands in other genres, including the LA Noire, Bully and Manhunt franchises.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.