After markets closed on Monday, Coupa Software reported solid beats on profit and revenue estimates but said the company planned on continued investment in top-line growth and that it could take a number of years of robust growth in order to recover from the coronavirus pandemic’s impact on the company. Shares traded down about 17% shortly after Tuesday’s opening bell.

Westport Fuel Systems also beat profit and revenue estimates and shares traded up about 2% early Tuesday. CTI BioPharma was expected to report results on Monday but did not do so.

We already have previewed four companies set to report results after markets close Tuesday and before they open again on Wednesday (GoHealth, Jabil, Markforged and SentinelOne) and three more reporting results after Wednesday’s closing bell or first thing Thursday morning (Commercial Metals, Dollar General, and Lennar).

Here is a look at three more companies scheduled to report earnings Thursday morning.

Canadian Solar

Solar module maker Canadian Solar Inc. (NASDAQ: CSIQ) has seen its share price fall by nearly 40% over the past 12 months. The stock’s annual high was posted last April, and its annual low in January. Canadian Solar announced a new 420W module Tuesday morning that the company says is well-suited for residential applications. The company has managed to pull its gross margin up to around 18.6%. Canadian Solar reports quarterly results first thing Thursday morning.

Just seven brokerages cover the stock, and four of those have given Canadian Solar a Hold rating. The other three rate the shares as a Buy or Strong Buy. At the recent price of around $28.30 per share, the upside potential to the consensus price target of $41.00 is 44.91%. At the high target of $55.00, the implied upside is 94.3%.

Analysts are forecasting fourth-quarter revenue of $1.59 billion, which would up 29.4% sequentially and 52.9% higher year over year. Adjusted earnings per share (EPS) are forecast at $0.13, down 70% sequentially but up 18.2% year over year. Estimates for the 2021 fiscal year call for sales of $5.34 billion, up 53.6%, and EPS of $1.09, down 50%.

Shares trade at 26.2 times expected 2021 EPS,17.8 times estimated 2022 earnings of $1.61 and 12.2 times estimated 2024 earnings of $2.36 per share. The stock’s 52-week range is $23.25 to $51.00. Canadian Solar does not pay a dividend. Total shareholder return for the past year is negative 36%.

Hut 8

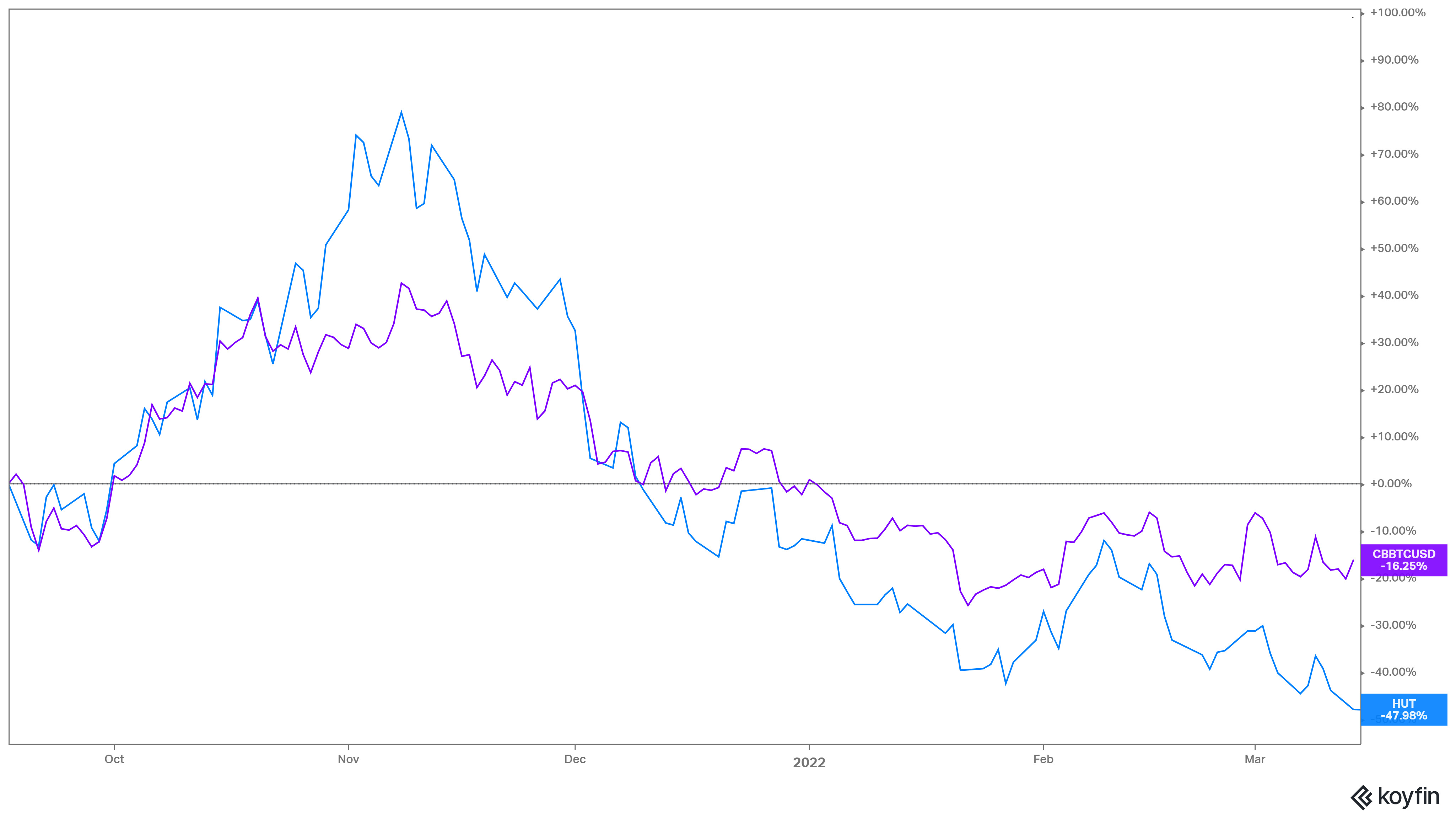

Shares of cryptocurrency mining company Hut 8 Mining Corp. (NASDAQ: HUT) have dropped by nearly 48% since mid-September of 2021. That is about three times larger than the drop in Coindesk’s bitcoin-U.S. dollar index. In the following chart, the blue line is Hut 8’s share price and the purple line is the bitcoin-dollar index.

At the end of February, the company reported that it mined 289 bitcoin in the month and held 6,115 bitcoin on its balance sheet. The company also acquired a Canada-based wireless connectivity company that it plans to use to offer scalable cloud services in direct competition with Microsoft, Amazon and Google. Hut 8 plans to use inactive cloud space to offer infrastructure for Web3 and blockchain-based gaming. The company is set to report earnings early Thursday morning.

Hut 8 has not attracted much attention from analysts, but the four that cover it are solid bulls, with three giving the stock a Buy rating and the other a Strong Buy nod. At a share price of around $4.70, the upside potential based on a median price target of $18.50 is nearly 294%. Based on a high price target of $20, the upside potential on the stock is about 325%.

Fourth-quarter revenue is forecast at $49.45 million, up 24.4% sequentially and 280% higher year over year. Adjusted EPS are forecast at $0.17, up 43.6% sequentially. Additional quarterly data is not available. For the full 2021 fiscal year, EPS are forecast at $0.42 on sales of $139.16 million, up 335%.

Shares trade at 10.8 times expected 2021 EPS, 3.8 times estimated 2022 earnings of $1.23 and 3.3 times estimated 2024 earnings of $1.41 per share. The stock’s 52-week range is $3.15 to $16.57. Hut 8 does not pay a dividend. Total shareholder return for the past year is negative 47.6%.

Li-Cycle

Lithium-ion battery recycler Li-Cycle Holdings Corp. (NYSE: LICY) came public through a SPAC merger that was completed in mid-August of last year. Since then, the shares have declined by more than 23%. The company’s hub-and-spoke design is expanding with new spokes in Arizona, Ohio, Norway and Germany and a hub facility in Rochester, New York, that is expected to be completed next year. Li-Cycle is expected to share its results Thursday morning.

Of eight brokerages covering the stock, six give it a Buy or Strong Buy rating and the other two have a Hold rating. At a share price of around $8.00, the upside potential based on a median price target of $13.50 is nearly 69%. Based on a high price target of $18, the upside potential on the stock is about 125%.

First-quarter revenue is forecast at $7.7 million, up 54% sequentially. Analysts are looking for an adjusted per-share loss of $0.07, better than the prior quarter loss of $0.09 per share. For full fiscal 2022 ending in October, the adjusted loss per share is forecast at $0.28 on sales of $38.90 million, up more than 425%.

Shares trade at 17.4 times estimated 2024 EPS of $0.46. The company is also forecast to post a loss per share of $0.10 in 2023. The stock’s post-IPO range is $3.00 to $14.28. Li-Cycle does not pay a dividend. Total shareholder return for the past year is negative 31.4%.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.