What’s So Hot about Twitter?

November 4, 2013 by Paul Ausick

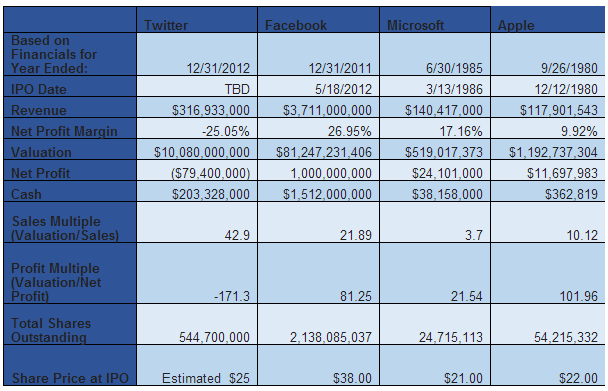

How does that stack up with some other IPOs in the tech world? Financial analysis firm Sageworks Inc. has prepared a handy chart comparing Twitter’s pending IPO with those of Facebook Inc. (NASDAQ: FB), Microsoft Corp. (NASDAQ: MSFT), and Apple Inc. (NASDAQ: AAPL). Apple went public in 1980, Microsoft in 1985, and Facebook just last year. In the following chart, Sageworks uses the number of Class A common shares outstanding to compute Twitter’s valuation.

As Sageworks’ chairman notes, “[Twitter] is still losing money, and at least Facebook was profitable when they went public. Proponents of the stock are talking about the potential of Twitter, but most companies that go public have potential, so this is immaterial to the conversation.” Ouch.

The IPO is set to price on Wednesday night and begin trading on Thursday on the NYSE under the ticker symbol “TWTR.”

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.